This is the opinion of financial expert, Dr. Nguyen Tri Hieu, when analyzing the impacts of the US Federal Reserve (Fed) cutting interest rates on September 18.

Positive impact on economic activity

Last September, the Fed decided to cut interest rates by 0.5%, for the first time in 4 years. How does this affect Vietnam's economy, sir?

- The Fed has decided to cut interest rates by 0.5%, thereby signaling a loose monetary policy cycle. At this time, inflation in the US is well controlled, although at over 2% but on a downward trend. The Fed has a reason to reduce interest rates, reduce capital costs for businesses, increase the rate of labor, to support growth.

The Fed’s interest rate cut will impact the Vietnamese economy. First, lower interest rates and a potentially weaker USD will reduce its value against the VND. On the other hand, the VND’s value will increase, stopping the depreciation or, in other words, reducing the pressure on the exchange rate to increase. That is the direct impact.

As for the indirect impact, it can be clearly seen that the difference between VND and USD interest rates is reduced, thereby reducing pressure on the exchange rate. If previously, USD interest rates were high, while VND interest rates were low, there was a phenomenon of low VND value compared to USD value (pressure on the exchange rate).

Second, it is beneficial for foreign trade. Because if the exchange rate is stable, it will help reduce import costs and reduce pressure on VND inflation. In addition, global interest rates tend to decrease, which will stimulate consumption, investment, production and business of enterprises and people, helping the world economy maintain growth momentum and be more sustainable, stimulating demand for goods and services, thereby promoting demand for Vietnam's exports.

Regarding investment activities, the Fed's interest rate reduction helps stabilize interest rates, reduce the cost of debt capital and foreign currency investment of enterprises in Vietnam. The cost of borrowing capital of the Government and FDI enterprises in foreign currency also decreases. This contributes to reducing debt risks and stimulating credit and investment in the coming time. And the stable VND exchange rate will support and encourage investment activities of foreign investors.

Interest rates suitable for Vietnam context

While many central banks have reduced interest rates, why has the State Bank not reduced operating interest rates at this time?

- In Vietnam, facing the prospect of the Fed cutting interest rates in September, the State Bank of Vietnam has reduced the lending interest rate for valuable paper collateral (OMO) for the first time since the end of 2023 from 4.5% to 4.25% on August 5, and the second time to 4% on September 16.

The reduction of the above two interest rates is said to be aimed at supporting liquidity for the banking system after the interest rate hike period to reduce exchange rate pressure. It should be remembered that before the US cut interest rates by 0.5% last September, this country had continuously increased interest rates. In this roadmap, the Fed raised interest rates by 75 basis points 4 times in a row and the last time it raised interest rates was in July 2023. Over the past few months, banks have simultaneously adjusted their deposit interest rates to meet credit demand that is forecast to continue to increase more strongly in the final months of the year.

In fact, the interest rate on the open market channel that the State Bank influences, thereby helping the interbank interest rate level go down (market 2), will support capital costs for banks, thereby indirectly helping banks reduce lending interest rates on (market 1) - the place where financial institutions transact with businesses and residents.

The State Bank of Vietnam has loosened monetary policy earlier than the Fed, and Vietnam's interest rates are already very low, so it is likely that from now until the end of the year, monetary policy will be stable.

The current context also requires taking into account inflation, exchange rates, macroeconomic stability, and stability of the monetary and foreign exchange markets... The State Bank of Vietnam needs to balance the goals of macroeconomic stability and growth in the context of increasing pressure on exchange rates and inflation...

The volatile world situation, increasingly fierce trade competition, unpredictable escalation of political and military conflicts, natural disasters, storms and floods, etc. have pushed up world commodity prices, thereby causing inflationary pressure on Vietnam - which has a very high openness to the world. In recent days, crude oil prices have returned to high levels due to the tense situation in the Middle East.

This is also the sentiment of the Governor of the State Bank when explaining to businesses about the need to reduce lending interest rates recently. Because the State Bank's mission is multi-targeted. Why has the domestic exchange rate recently increased sharply again, while the Fed is reducing the USD interest rate?

- After a cooling period from August and bottoming out in September, the exchange rate between the Vietnamese Dong and the USD has increased again since the beginning of October. The increase in the exchange rate is not only due to the interest rate difference between the USD and VND but also many other factors including supply and demand in the market. The increased demand for USD also pushes the exchange rate up. At the end of the year, the demand for foreign currency for payment by import and FDI enterprises arises.

Exchange rate fluctuations are not alarming. USD prices in the unofficial market have climbed again, while prices at banks remain stable. The Fed may cut interest rates by another 50 basis points by the end of 2024 if economic data continues to improve. This could help ease pressure on the VND. However, it should be noted that any change in Fed policy could create major fluctuations in the Vietnamese foreign exchange market.

Businesses still hope for a reduction in interest rates. Do you think the current interest rates are appropriate?

- Currently, the SBV's operating interest rate is at a relatively low level, at 3 - 4.5% compared to the target inflation of 4 - 4.5%. The real interest rate gap between the operating interest rate and inflation is relatively narrow. Therefore, there is not much room for further monetary easing. I think that the current monetary policy management is suitable for the macroeconomic context, inflation and the endurance of credit institutions.

On the basis of balancing economic recovery factors, moderate inflationary pressure and the weakening of the VND against the USD, at some point, the SBV may have more favorable conditions in its management, but the general situation shows that banks will continue to maintain stable lending interest rates at low levels to prioritize credit growth targets. Enterprises and borrowers in general should not expect lending interest rates to decrease further, because the bad debt ratio has been increasing significantly recently and increasing the cost of banks' provisioning.

Credit flows to the right place

Businesses still have difficulty accessing cheap capital and want to have faster and easier access to loans for production and business? What is the solution for both banks and businesses to "win-win"?

- Banks always have strict terms and conditions and businesses that want to borrow must accept to comply. It is necessary to change policies related to credit, especially on mortgaged assets, especially mortgaged assets in the agricultural sector; increase the loan value on mortgaged assets. And especially, it is necessary to promote the role and effectiveness of the Credit Guarantee Fund. It is necessary to exploit funding sources from the State, ministries, branches and from projects to organize more programs to improve the capacity of small and medium enterprises.

The State establishes and develops State-owned financial institutions to implement credit guarantee policies for enterprises. The basic activities of these institutions are to implement policies to guarantee bank loans of small and medium-sized enterprises to encourage enterprises to invest long-term, innovate technology, improve competitiveness and integrate into the international market.

The GDP growth target for the whole year of 2024 is around 7%, with growth in the fourth quarter from 7.5 - 8%. From now until the end of the year, a large amount of capital will be pushed into the economy. In your opinion, will credit growth reach the set target of 15%? How can capital be absorbed and put into production and business life in a timely and effective manner?

- With the economy continuing to recover positively in the second quarter and the first nine months of 2024, plus lending interest rates continuing to be kept stable at low levels, credit growth in 2024 will reach its target. However, in my personal opinion, we do not have to increase credit growth at all costs but must ensure quality.

Currently, Vietnam's credit/GDP ratio is over 125%. International organizations have also warned that Vietnam is one of the countries with the highest credit/GDP ratio in the group of middle-income countries.

We need stimulus policies and better stimulus measures than fiscal policies. In my view, fiscal stimulus policies will include increased government spending, especially public investment. In addition, spending on social programs, such as business development support programs, should also be focused on. Continue to improve the business investment environment, remove difficulties for production and business.

To support economic growth in the coming time, fiscal policy continues to play a key role, expanding with focus and key points, associated with promoting public investment disbursement. Regarding monetary policy, it should be proactive and flexible, increasing the ability to access capital for businesses...

Thank you!

By September 30, credit growth reached 9%. The disbursement figure after 9 months of banks reached about 1.2 million billion VND, about 60%. With less than 3 months left until the end of 2024, about 800,000 billion VND needs to be injected into the economy to achieve the set credit growth target of 15%, opening up opportunities for economic recovery when capital will be disbursed more strongly in key areas, supporting production and business activities for enterprises more effectively.

Dr. Nguyen Tri Hieu

Source: https://kinhtedothi.vn/tin-dung-cuoi-nam-tap-trung-vao-chat-luong-tang-truong.html

![[Photo] Prime Minister Pham Minh Chinh meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/be2f9ad3b17843b9b8f8dee6f2d227e7)

![[Photo] President Luong Cuong and King Philippe of Belgium visit Thang Long Imperial Citadel](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/cb080a6652f84a1291edc3d2ee50f631)

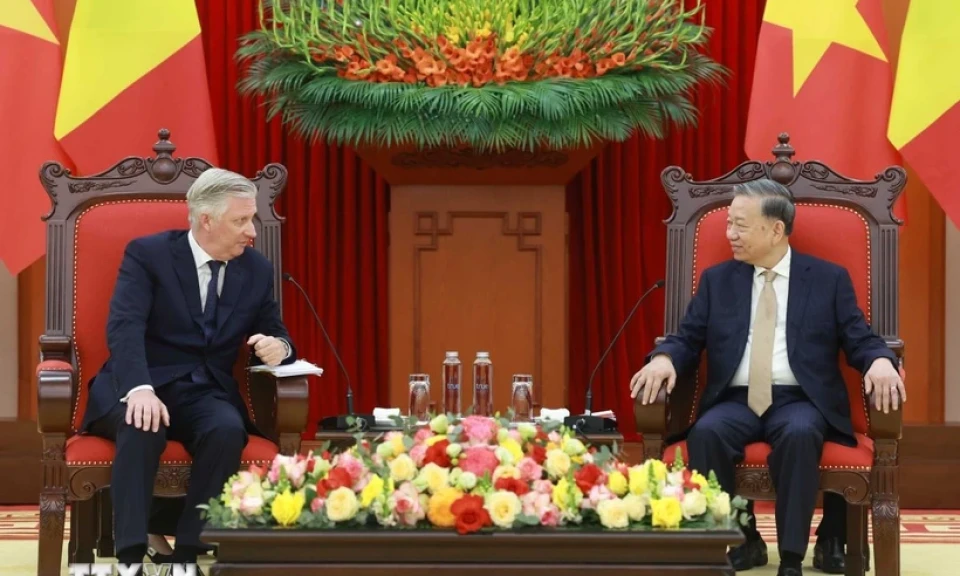

![[Photo] General Secretary To Lam receives King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/e5963137a0c9428dabb93bdb34b86d7c)

![[Photo] Close-up of Vietnam's sniffer dog team searching for earthquake victims in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/d4949a0510ba40af93a15359b5450df2)

![[Photo] Myanmar's capital in disarray after the great earthquake](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/7719e43b61ba40f3ac17f5c3c1f03720)

Comment (0)