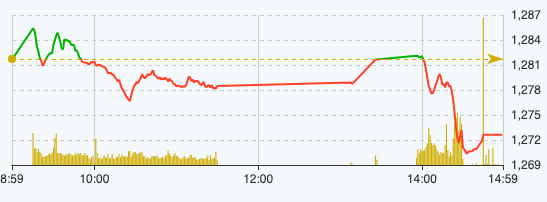

After a short period of opening with a slight increase and fluctuating around the reference level, the market quickly reversed and fluctuated below the reference level due to profit-taking pressure from investors.

The duo PLX and GAS tried to pull the market up with increases of 2.1% and 1.8% respectively, GVR also increased by 1.7% in the morning session. Meanwhile, HDB decreased the most with a loss of 2%, NAB, CTG, SHB, STB, MSB also decreased by 1%.

At the end of the morning session on May 29, VN-Index decreased by 3.25 points, equivalent to 0.25% to 1,278.48 points. The entire floor had 165 stocks increasing and 239 stocks decreasing.

VN-Index performance on May 29 (Source: FireAnt).

Entering the afternoon session, investor sentiment became more negative, widespread selling pressure caused the VN-Index to plummet. Most industry groups were in the red, with only a few industries such as telecommunications, consumer services, and industry remaining green with a narrow increase.

At the end of trading on May 29, VN-Index decreased by 9.09 points, equivalent to 0.71% to 1,272.64 points. The entire floor had 182 stocks increasing, 260 stocks decreasing, and 61 stocks remaining unchanged.

HNX-Index decreased by 1.44 points to 244.15 points. The entire floor had 88 stocks increasing, 95 stocks decreasing and 50 stocks remaining unchanged. UPCoM-Index increased by 0.31 points to 95.92 points.

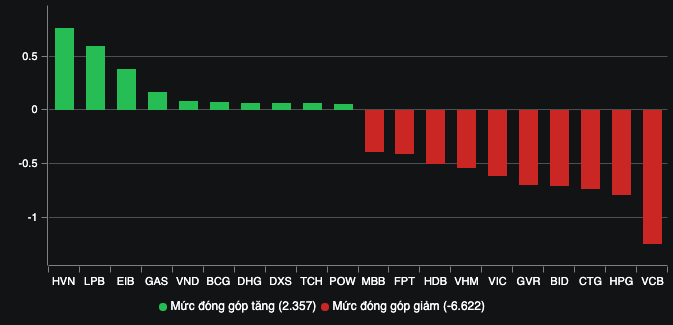

The banking group negatively affected the market when VCB led the market decline by taking away nearly 1.3 points from the general index, the two giants CTG and BID also took away a total of more than 1.4 points. The two codes HDB and MBB were also in the top 10 negatively affecting the market and took away 0.9 points. However, there were still a few positive gainers such as LPB and EIB when contributing a total of nearly 1 point.

After a period of rapid growth, Apec stocks suffered a sell-off of millions of units. Most notably, API dropped to the floor price of VND10,200/share with a sell order of 2.4 million units. APS also dropped to the floor price of 9.09% to VND8,000/share with a sell order of 1.8 million units. IDJ fell 8.75% to VND7,300/share with a sell order of more than 2.24 million units.

It is worth mentioning that recently, these three stocks have continuously had no sellers and a ceiling price buy surplus of up to millions of units before hitting the floor and having a sell surplus of millions of units.

On the positive side, HVN continued to fly high and led the market's growth with a contribution of nearly 0.8 points. At the end of the session on May 29, this code increased by 5.2% to VND28,300/share.

Codes that affect the market.

The total order matching value in today's session was VND28,842 billion, up 14% compared to yesterday, of which the order matching value on the HoSE floor reached VND25,430 billion. In the VN30 group, liquidity reached VND9,270 billion.

Foreign investors continued to net sell for the fourth session with a value of VND 1,656 billion today, of which this group disbursed VND 1,858 billion and sold VND 3,514 billion .

Source: https://www.nguoiduatin.vn/thi-truong-quay-xe-vao-cuoi-phien-co-phieu-hvn-lap-dinh-a665895.html

![[Photo] General Secretary To Lam chairs the third meeting to review the implementation of Resolution No. 18-NQ/TW](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/10f646e55e8e4f3b8c9ae2e35705481d)

![[Photo] General Secretary and President of China Xi Jinping arrives in Hanoi, starting a State visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/9e05688222c3405cb096618cb152bfd1)

![[Photo] Opening of the 44th session of the National Assembly Standing Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/14/03a1687d4f584352a4b7aa6aa0f73792)

Comment (0)