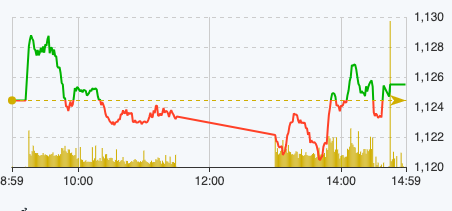

After a few minutes of the market opening with a slight increase, selling pressure gradually increased, causing a tug-of-war situation to appear and the VN-Index fell below the reference level after more than 1 hour of trying to maintain the price.

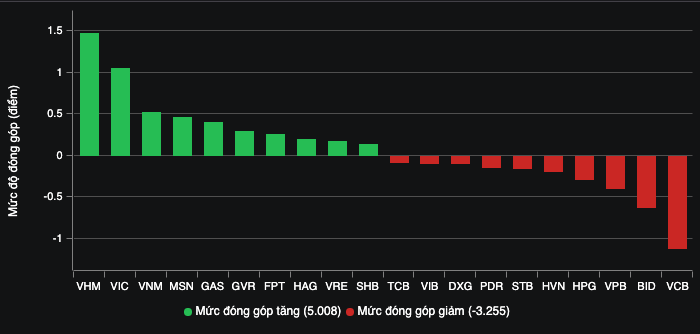

The bright spot is that the large-cap group has made efforts to prevent the market from falling deeply, with VHM, VIC, VNM, and MSN alone adding nearly 4 points to the VN-Index. The banking and securities groups have lost steam, although the number of points lost is not too large.

At the end of the morning session on December 11, VN-Index decreased by 1.06 points, equivalent to 0.09% to 1,123.38 points. The entire floor had only 169 stocks increasing but 310 stocks decreasing. HNX-Index decreased by 0.77 points to 230.43 points. UPCoM-Index decreased by 0.32 points, equivalent to 0.38% to 85.39 points.

VN-Index performance on December 11 (Source: FireAnt).

Entering the afternoon session, the market continuously fluctuated erratically with gloomy trading volume.

At the end of the trading session on December 11, VN-Index increased by 1.06 points, equivalent to 0.09% to 1,125.5 points. The entire floor had 215 stocks increasing, 302 stocks decreasing, and 76 stocks remaining unchanged.

HNX-Index increased by 0.17 points, equivalent to 0.07% to 231.37 points. The entire floor had 73 stocks increasing, 83 stocks decreasing and 81 stocks remaining unchanged. UPCoM-Index decreased by 0.23 points to 85.48 points. The VN30 basket recorded differentiation when 12 stocks increased in price and 14 stocks decreased in price.

The trio of Vingroup stocks including VHM, VIC, and VRE contributed 2.7 points to the general market. With the positive performance of these three, the real estate group successfully reversed the general market trend when the entire industry closed the session up 1.1%.

Of which, VHM increased by 3.4%, VIC increased by 2.56%, VRE increased by 1.28%, CEO increased by 2.14%, ITA increased by 4.93%,... On the contrary, DXG decreased by 3.25%, DIG decreased by 2.68%, NVL decreased by 1.5%, PDR decreased by 3.14%, BCR decreased by 5.93%,...

Cash flow into the securities group helped the stocks of this industry "turn around" in the afternoon session. VND increased by 1.15% and matched 24.1 million units, SHS increased by 1.08% and matched 21.5 million units, SSI increased by 0.31% and matched 20 million units, HCM increased by 3.23% and matched 10.6 million units. Although VIX had the highest matched order with 41.2 million units, it ended the session down slightly by 0.58%.

Red covered most of the banking group stocks, in which STB decreased by 1.24%, VPB decreased by 1.02%, EIB decreased by 0.52%, LPB decreased by 0.92%, MBB decreased by 0.27%, TPB decreased by 0.57%, MSB decreased by 0.77%,...

Stocks that impact the general market.

The total order matching value in today's session reached VND16,710 billion, down 19% compared to the previous session, of which the order matching value on the HoSE floor reached VND14,651 billion, down 18%. In the VN30 group, liquidity reached VND5,961 billion.

Foreign investors continued to net sell with a value of more than 426.3 billion VND, of which this group disbursed 1,107.06 billion VND and sold 1,533 billion VND.

The codes that were sold strongly were VCB 140 billion VND, FUEVFVND 103 billion VND, STB 66 billion VND, VPB 47 billion VND, FRT 17 billion VND,... On the contrary, the codes that were bought mainly were VND 44 billion VND, CEO 37 billion VND, DGC 27 billion VND, VIC 19 billion VND, MSN 15 billion VND,... .

Source

Comment (0)