Investment Comments

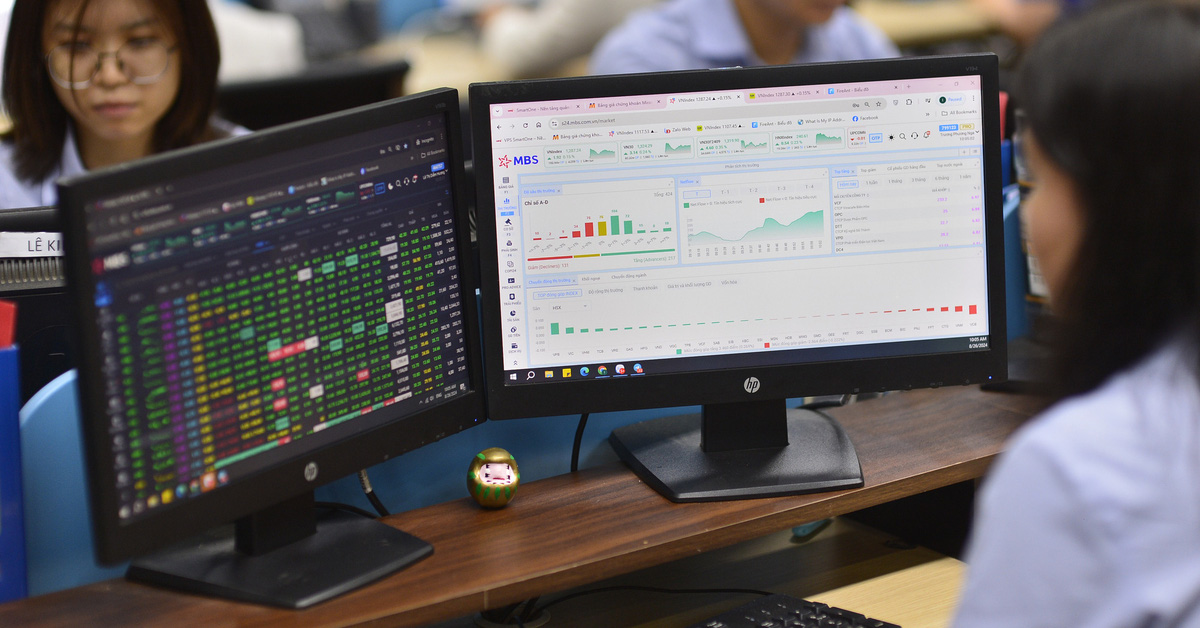

East Asia Securities : Market liquidity is high, with foreign investors continuing their net selling streak over the past two weeks, which has also affected investor sentiment. The market is trading at an 18-month peak, with many continuous reversals and has not yet surpassed the psychological mark of 1,280 points.

Investors should switch to a cautious trend, short-term buying positions are risky, while the current price range is not attractive to medium- and long-term investors. The strategy of holding the portfolio and waiting for the market to have a clearer trend, can be interested in real estate, construction, industrial park and public investment stocks.

Vietcombank Securities (VCBS) : VN-Index recorded a volatile adjustment session at the beginning of the week, retesting the peak area around 1,270 points. On the daily chart, the RSI and MACD indicators continued to form a downward peak, but there was no consensus to form a negative divergence on both the daily and hourly charts, so the probability of a sharp decline is unlikely.

The market had a good increase last week, and the VN-Index is at its old peak, so the correction and fluctuations in the session on March 25 are understandable. The Bollinger band tends to narrow, so the VN-Index will need to accumulate before continuing the increase. On the hourly chart, the MA20 moving average is still pointing up, and the VN-Index is still above the Ichimoku cloud, showing that the VN-Index is still maintaining a good trend in the short term.

VCBS recommends that investors stay calm and take advantage of the fluctuations in the session to restructure their portfolios, in the direction of taking partial profits from stocks that have recorded good increases in previous sessions but have not yet surpassed the nearest resistance or stocks with an upward trend showing signs of weakening, to switch to holding stocks that show signs of building a good accumulation foundation and attracting stable cash flow.

Asean Securities (Aseanc) : Aseansc maintains the view that the short-term trend is under threat as divergence risks remain despite the general index surpassing its peak.

Therefore, Aseanc maintains the recommendation that investors should only focus on short-term speculative transactions and proactively reduce positions during market uptrends for stocks currently held in the upcoming sessions.

Stock news

- Wall Street cautious on gold prices this week. Last week, after the US Federal Reserve's two-day policy meeting, the gold market saw strong buying, pushing the precious metal to $2,204 an ounce on March 21 - an all-time high. Kitco News' forecast for this week shows that Wall Street experts are divided and cautious on the direction of gold, while retail traders support the bullish trend.

- The Japanese government's interest burden after BOJ rate hike. The Japanese government is facing increasing pressure to cut spending after the Bank of Japan (BOJ) decided to end negative interest rates last week. The higher interest rate environment could see Tokyo triple the amount of interest it has to pay bondholders over the next decade, according to Nikkei Asia.

Citing an estimate from Japan's Cabinet Office, Nikkei said the country's nominal long-term interest rate will rise to 1.5% in fiscal 2028 from 0.6% in fiscal 2023, if the country's economy achieves a high growth rate. Such a rise in interest rates would increase the amount of interest the Japanese government has to pay annually on bonds by about 50% to 11.5 trillion yen ($76.2 billion) from 7.6 trillion yen in 2023 .

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)