Fuel prices remain high

In the structure of electricity production costs, the cost of electricity generation currently accounts for 82.8% of the cost, so fluctuations in the cost of electricity generation greatly affect the cost of electricity production.

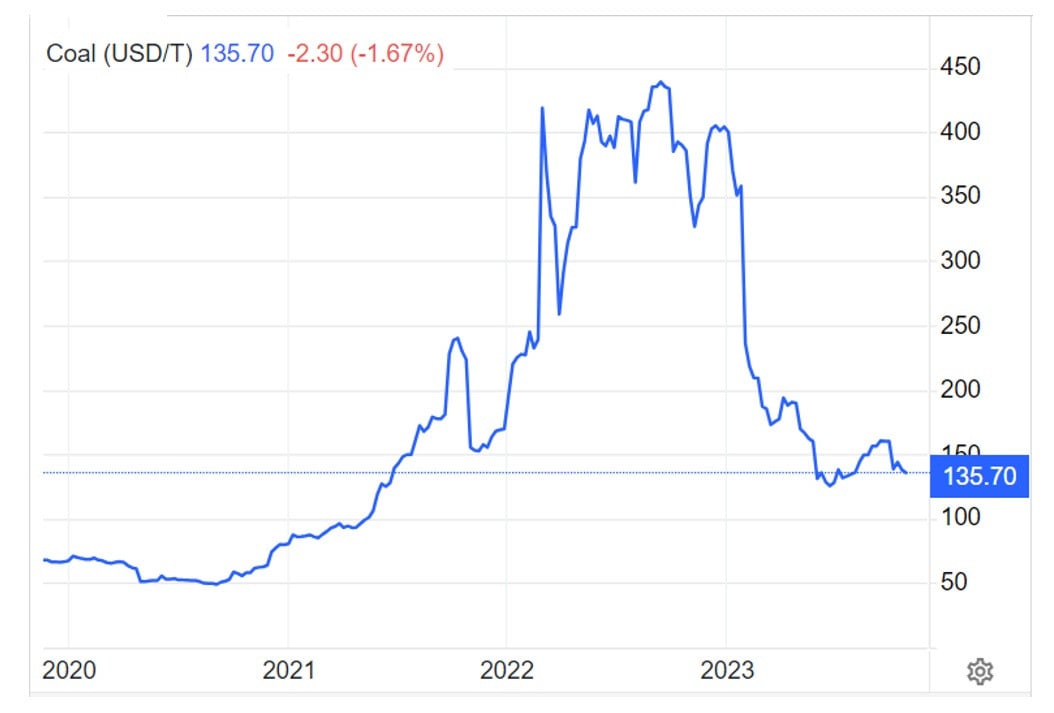

Updates from Vietnam Electricity Group (EVN) show that fuel prices in recent months of 2023, although lower than in 2022, are still high compared to the period of 2020-2021.

Specifically, the price of imported coal gbNewC increased 2.97 times compared to 2020, increased 1.3 times compared to 2021; the price of HSFO oil increased 1.86 times compared to 2020 and increased 1.13 times compared to 2021.

Although input parameters have decreased compared to 2022, they continue to remain high compared to previous years.

Specifically, the price of imported coal NewC Index is expected to increase by 186% in 2023 compared to 2020 and 25% compared to 2021. Mixed coal purchased from Vietnam National Coal and Mineral Industries Group and Dong Bac Corporation also has a very high increase compared to 2021.

The average increase in TKV's blended coal price in 2023 is expected to be from 29.6% to 46% (depending on the type of coal) compared to the coal price applied in 2021. The average increase in the blended coal price in 2023 of Dong Bac Corporation is expected to be from 40.6% to 49.8% (depending on the type of coal) compared to the coal price in 2021.

Due to the sharp decline in Nam Con Son gas output, gas-fired thermal power plants (Phu My 1, Phu My 2.1, Phu My 2.1 expansion, Phu My 4, Nhon Trach 1&2 and Ba Ria) receive a lot of Hai Thach - Moc Tinh, Sao Vang - Dai Nguyet gas and Dai Hung, Thien Ung gas with high prices, especially Thien Ung, Sao Vang - Dai Nguyet gas with very high prices.

The above factors cause the cost of coal-fired thermal power sources and gas turbines to increase very high - while coal and gas thermal power plants account for up to 55% (in 2023) of the total electricity output of the entire system.

The selling price of electricity is still lower than the cost price.

EVN representative said that recently, thermal power sources had to increase mobilization to compensate for the shortage of hydropower output due to insufficient water. This is also a source of electricity with high purchase price, causing EVN's electricity production and business costs updated in the third quarter of 2023 to continue to increase.

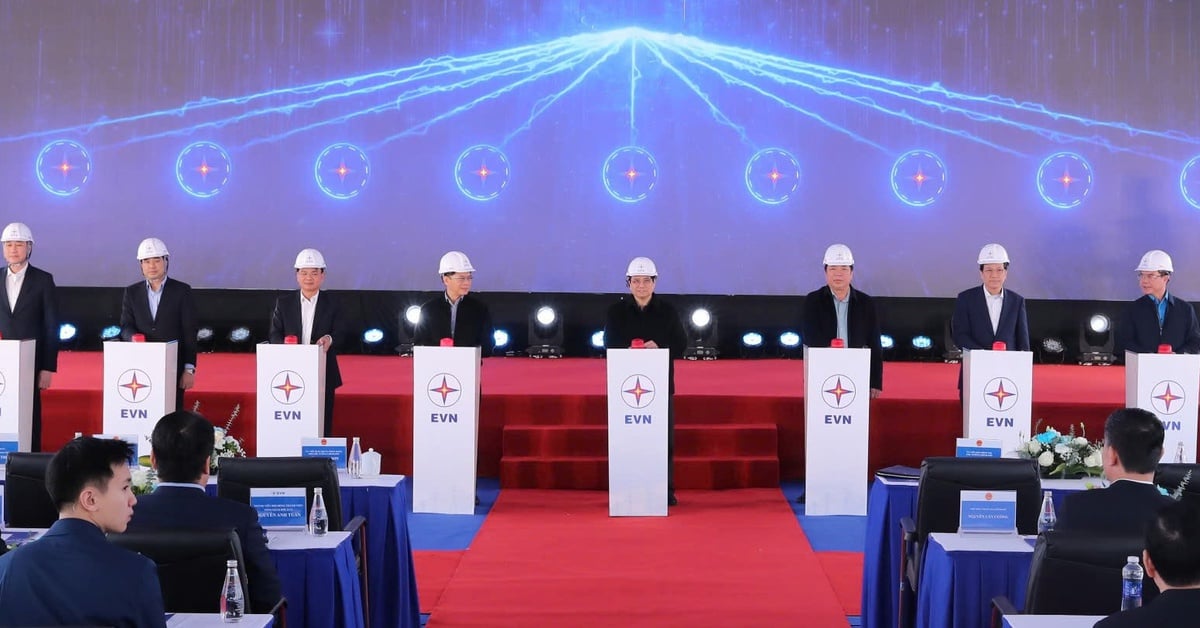

In addition, many transitional solar and wind power plants will be put into operation from June 2023 (a total of 21 plants, with a total capacity of 1,201.42 MW), so the electricity output of renewable energy power plants in the average retail electricity price plan updated in the third quarter will also increase compared to the basic electricity price plan (adjusted on May 4, 2023).

"The above factors make the estimated cost of electricity production in 2023 about 2,098 VND/kWh, higher than the average retail electricity price of about 178 VND/kWh," said a source.

That shows that EVN still has to continue to face many difficulties in financial balance, because adjusting retail electricity prices up by 3% from May 4 also helps EVN's revenue in 2023 increase by about 8,000 billion VND.

In the context of financial difficulties, in 2022-2023, EVN has implemented cost-saving and cost-reduction solutions with the result of cost savings in the first 9 months of 2023 being about more than 4,300 billion VND. The cost of transmission, distribution - retail and auxiliary stages has gradually decreased over the years. In 2020, the cost of these stages was 392.9 VND/kWh but it is estimated that in 2023 it will be about 347 VND/kWh.

However, in fact, in the first 8 months of 2023, EVN's loss is still expected to reach more than VND 28,700 billion. This figure has decreased compared to the level of more than VND 35,400 billion in the first half of the year thanks to the increase in electricity prices in early May. In 2022, EVN lost VND 26,500 billion, excluding exchange rate differences.

Thus, calculating the total loss in 2022 and the first 8 months of 2023, the parent company EVN has lost a total of about 55,000 billion VND.

| In the report sent to the National Assembly Standing Committee on "Implementation of policies and laws on energy development in the 2016-2021 period", the Monitoring Delegation assessed: The electricity price policy still has many unreasonable issues regarding the power generation structure, the adjustment of electricity prices has not yet compensated for input costs and ensured reasonable profits for enterprises; electricity prices have not ensured transparency; market signals at the power generation stage have not been fully reflected in the electricity prices applied to final consumers. |

Source

![[Photo] President Luong Cuong receives Korean Foreign Minister Cho Tae-yul](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/d68c85559fca4772a8e3ca8ab1942a6f)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Lao Prime Minister Sonexay Siphandone](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/e023753be97a4d8e9f5ab03eb5182579)

![[Photo] Summary of training for 36 parade blocks for the April 30th Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/69906ce4b0d1470eb18b8e9bdcdabff1)

![[Photo] Prime Minister Pham Minh Chinh receives South Korean Foreign Minister Cho Tae-yul](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c8a7bf8f15f347d78b4ec317d8979aba)

![[Photo] General Secretary To Lam gave a speech at the National Conference to disseminate the Resolution of the 11th Central Conference, 13th tenure.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/04e0587ea84b43588d2c96614d672a9c)

![[Photo] The 9th Vietnam-China Border Defense Friendship Exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/10e73e2e0b344c0888ad6df3909b8cca)

![[Photo] The capital of Binh Phuoc province enters the political season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c91c1540a5744f1a80970655929f4596)

Comment (0)