Recessions in many countries and people spending more on services than goods are threatening manufacturing in the US, the eurozone and China.

Factories in the US and the eurozone both reported a decline in new orders in May, according to a recent survey by data firm S&P Global. They are still working through backlogs that arose early in the pandemic, but it is unclear how long those orders will keep them producing.

S&P Global data also showed that US manufacturing contracted in May. A similar survey by the Institute for Supply Management (ISM) also showed that the sector contracted for the seventh consecutive month. The ISM's May manufacturing PMI fell more sharply than the previous month.

US Commerce Department data last week also showed factory orders fell for a third straight month in April. Excluding the military sector, factory orders have fallen in four of the past six months.

In the eurozone, new orders and backlogs both fell in May, according to S&P Global. Industrial output in the region also fell sharply in March.

In China, the situation is no better. Manufacturing activity at the world’s largest factory improved in May, according to the Caixin Manufacturing Purchasing Managers’ Index. But exports fell 7.5% in May from a year earlier, the biggest drop since January, suggesting weaker demand for Chinese goods at a time when the country is facing other problems, such as rising unemployment and a property slump.

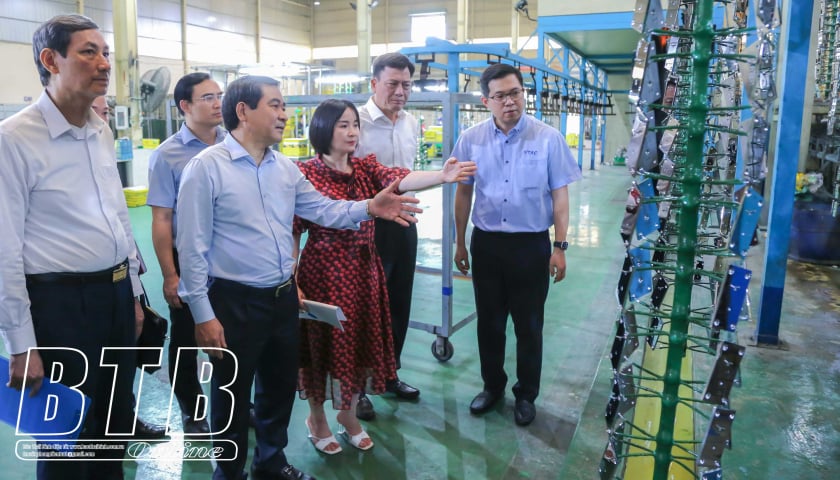

Workers at an SMC factory in Beijing (China). Photo: Reuters

Globally, the JPMorgan Global Manufacturing PMI also showed that confidence among manufacturers has fallen to a six-year low. "While manufacturing appeared to improve somewhat in May, this was largely driven by large emerging markets. The outlook for the sector remains bleak. New export orders are still falling sharply," said Ariane Curtis, an economist at Capital Economics.

In 2020, when the pandemic hit, consumers around the world cut back on spending on services, causing a surge in purchasing power for goods. This helped manufacturers increase orders rapidly.

But then, as countries adapted, people shifted their spending habits back to the service sector. In the US and Europe, the hotel and restaurant industry saw record numbers of tourists during the summer. The shift in spending to services has caused problems for manufacturers.

China's recent reopening after years of strict lockdown was predicted by the International Monetary Fund (IMF) to "give new impetus" to the global economy. However, the country's recovery has not been as strong as expected.

"Global demand for goods is weak, as people are spending more on services rather than goods. That's why the services PMI is rising," said Tom Garretson, portfolio strategist at RBC Wealth Management.

Central banks are also continuing their fight against inflation by raising interest rates. Higher interest rates discourage spending and make banks tighten lending standards. This is the case in the US and the eurozone, especially after a series of bank failures in just a few months.

Consumers often borrow to buy durable goods—like cars and appliances—so when credit tightens, manufacturers will feel the squeeze. In the long run, if demand for goods continues to weaken and backlogs shrink, factories around the world will cut jobs.

Meanwhile, economists at the Fed are still predicting a mild recession in the US later this year, despite a strong job market. The eurozone and Germany, Europe's largest economy, have also fallen into recession.

This is not good news for manufacturers. Electronics manufacturer Foxconn forecasts flat revenue from its network and cloud businesses this year, and unexpectedly down in the second quarter.

Monish Patolawala, CFO of manufacturing giant 3M, said last month that its electronics division was “severely impacted by the decline in demand for consumer electronics.” In April, 3M announced plans to lay off 6,000 employees globally.

A survey released last week by the National Association of Manufacturers found that just 67% of U.S. manufacturers were optimistic about their future, the lowest since the third quarter of 2020. Their top challenges were retaining good employees, a weak domestic economy and a less-than-favorable business environment.

Ha Thu (according to CNN)

Source link

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)