The Investment Support Fund is established from additional corporate income tax revenue according to regulations on preventing global tax base erosion and other legal sources to stabilize the investment environment, encourage and attract strategic investors, multinational corporations and support domestic enterprises in a number of areas requiring investment incentives.

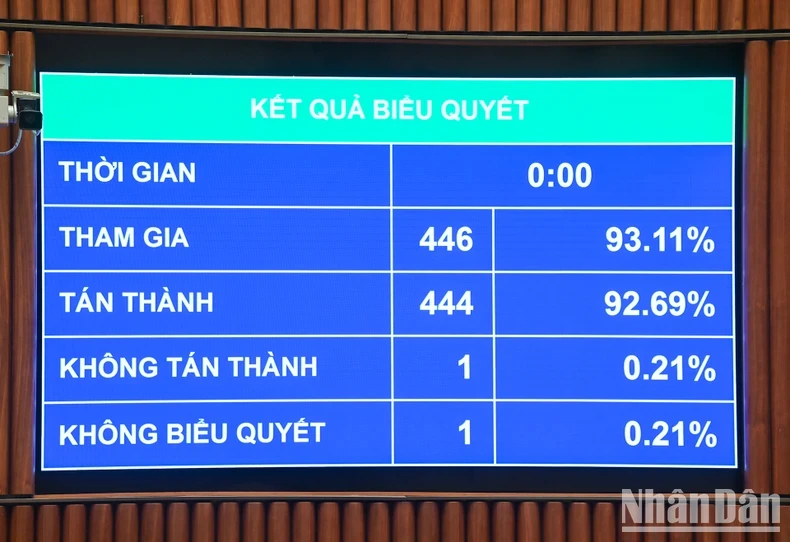

On the afternoon of November 29, with 444/446 National Assembly delegates participating in the vote in favor (equal to 92.69% of the total number of National Assembly delegates), National Assembly officially passed the Law amending and supplementing a number of articles of the Law on Planning, the Law on Investment, the Law on Investment under the public-private partnership model and the Law on Bidding (1 law amending 4 laws).

Accordingly, on adjustment planning According to the simplified procedures and order, the Law stipulates that adjusting the planning according to the simplified procedures and order does not change the viewpoint and objectives of the planning; ensuring the connection, synchronization, inheritance and stability between the plans.

National, regional and provincial planning are adjusted according to simplified procedures when there is one of the following grounds: the implementation of Resolutions of the National Assembly, the National Assembly Standing Committee or the Government on ensuring national defense and security; the arrangement of administrative units and important national projects changes one or several planning contents; the planning conflicts with higher planning; the planning conflicts with planning at the same level; the implementation of urgent projects and tasks changes one or several planning contents according to Government regulations.

About Investment Support Fund, the Law stipulates that the Government shall establish an Investment Support Fund from additional corporate income tax revenue in accordance with regulations on preventing erosion of the global tax base and other legal sources to stabilize the investment environment, encourage and attract strategic investors, multinational corporations and support domestic enterprises in a number of areas requiring investment incentives.

The Government shall specify in detail the operating model, legal status, annual and additional budget sources for the Fund, forms of support, support reimbursement mechanisms and other specific policies of the Fund, and report to the National Assembly Standing Committee for comments before promulgation.

Supplementing regulations on special investment procedures

Regarding special investment procedures, according to the provisions of the Law, except for investment projects specified in Article 30 of this Law, investors have the right to choose to register investment for projects in industrial parks, export processing zones, high-tech zones, concentrated information technology zones, free trade zones and functional zones in economic zones in a number of fields.

Specifically, investment in building innovation centers, research and development centers; investment in the field of semiconductor integrated circuit industry, design technology, manufacturing of components, integrated electronic microcircuits, flexible electronics, chips, semiconductor materials; investment in the high-tech field is prioritized for investment in development, production of products in the list of high-tech products encouraged for development according to the Prime Minister's decision.

The registration dossier is sent to the Management Board of industrial parks, export processing zones, high-tech zones, and economic zones. Within 15 days from the date of receipt of the dossier, the Management Board of industrial parks, export processing zones, high-tech zones, and economic zones shall evaluate the dossier and issue the Investment Registration Certificate.

The Law also stipulates that investment projects under the PPP method are implemented in public investment sectors and fields for the purpose of investing in and constructing works, infrastructure systems, and providing public products and services, except for projects in the following cases: projects subject to state monopoly as prescribed by law; projects in the sectors and fields of national defense, security, and social order and safety as prescribed by law on public investment.

According to the provisions of this Law, projects with a total investment equivalent to group A projects according to the provisions of the law on public investment using public investment capital from VND 10,000 billion or more managed by ministries and central agencies; projects applying BT contracts paid by state budget sources obtained after auctioning land funds and public assets for land funds and public assets under central management with original book value from VND 500 billion or more.

Regarding the selection of investors in special cases, the Law stipulates that the selection of investors in special cases is applied to business investment projects with one or several special requirements and conditions regarding investment procedures; procedures for land allocation, land lease, and sea area allocation; procedures, methods, and standards for selecting investors and the content of business investment project contracts or requirements to ensure national defense, security, foreign affairs, territorial borders, national interests, and the implementation of national political tasks for which one of the forms of investor selection specified in Clause 1 and Clause 2, Article 34 of this Law cannot be applied.

The Law also stipulates that the time for preparing bidding documents for open bidding and restricted bidding is at least 18 days for domestic bidding and 35 days for international bidding from the first day the bidding documents are issued to the date of bid closing.

For construction and mixed bidding packages with a package price not exceeding VND 20 billion, and bidding packages for the procurement of goods and non-consulting services with a package price not exceeding VND 10 billion, the minimum time for preparing bidding documents is 9 days for domestic bidding and 18 days for international bidding.

For simple consulting packages or consulting packages with a value of no more than VND 500 million or urgent consulting packages that need to be implemented immediately due to progress requirements, the minimum time for preparing bidding documents is 7 days for domestic bidding.

Source

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)