Steel prices in the North

According to SteelOnline.vn, Hoa Phat steel brand, with CB240 rolled steel line at 13,940 VND/kg; D10 CB300 ribbed steel bar is priced at 14,440 VND/kg.

Viet Y Steel brand, CB240 rolled steel line stops at 14,090 VND/kg; D10 CB300 ribbed steel bar is priced at 14,340 VND/kg.

Viet Duc Steel simultaneously reduced the price of two of its products, with CB240 rolled steel at 14,040 VND/kg, and D10 CB300 ribbed steel at 14,540 VND/kg.

Viet Sing Steel, with CB240 coil steel priced at 13,850 VND/kg, D10 CB300 ribbed steel remains at 14,210 VND/kg.

VAS steel, with CB240 coil steel down to 14,160 VND/kg; D10 CB300 ribbed steel bar priced at 14,110 VND/kg.

Steel prices in the Central region

Hoa Phat Steel, with CB240 coil steel line remaining at 13,990 VND/kg; D10 CB300 ribbed steel bar priced at 14,440 VND/kg.

Viet Duc Steel, currently CB240 coil steel is at 14,490 VND/kg; D10 CB300 ribbed steel is priced at 14,900 VND/kg.

VAS steel, currently CB240 coil steel is at 14,210 VND/kg; D10 CB300 ribbed steel is priced at 14,260 VND/kg.

Pomina steel, with CB240 coil steel line at 14,690 VND/kg; D10 CB300 ribbed steel bar is priced at 15,300 VND/kg.

Steel prices in the South

Hoa Phat Steel, CB240 rolled steel is at 13,990 VND/kg; D10 CB300 ribbed steel is priced at 14,440 VND/kg.

VAS steel, CB240 coil steel line is at 14,310 VND/kg; D10 CB300 ribbed steel bar is priced at 14,210 VND/kg.

Pomina steel, CB240 coil steel line is at 14,590 VND/kg; D10 CB300 ribbed steel bar is priced at 14,990 VND/kg.

Steel prices on the exchange

The price of rebar futures on the Shanghai Futures Exchange (SHFE) for delivery in May 2025 fell 16 yuan to 3,647 yuan/ton.

Iron ore futures were mixed, with the Dalian benchmark extending gains for a third session, boosted by the latest efforts by China’s top consumer to prop up its struggling property market.

The most-traded iron ore contract for September on China's Dalian Commodity Exchange (DCE) DCIOcv1 was 1.2% higher at 819 yuan ($112.67) a tonne.

However, the benchmark July iron ore SZZFN4 on the Singapore Exchange pared early gains to trade 0.9% lower at $105.65 a tonne, as weak industry data and caution over high port stockpiles prevailed. It hit an intraday high of $107.45 a tonne in the morning.

China's capital Beijing has announced steps to reduce the cost of buying a home, including cutting mortgage interest rates and minimum down payments, in an attempt to boost the local property market.

Expectations of a short-term recovery in demand are playing a supporting role in prices of key steelmaking raw materials, analysts said.

Analysts at Everbright Futures said average daily hot metal output in July is expected to reach around 2.37 million tonnes based on current production and maintenance plans, meaning ore demand will be relatively stable.

“Traders may also be encouraged by a Hong Kong court decision to postpone the liquidation hearing of Chinese (property) developer Shimao Group Holdings to July, giving it more time to fine-tune its debt restructuring plan,” ANZ analysts said in a note.

But gains were pared after official data showed China's industrial profits rose at a much slower pace in May, suggesting the world's second-largest economy is facing headwinds as weak domestic demand dampens overall growth.

Other steelmaking raw materials on the DCE reduced their gains, with coking coal DJMcv1 and coking coal DCJcv1 down 0.32% and 0.11%, respectively.

Benchmark steel futures on the Shanghai Futures Exchange were mixed. Rebar SRBcv1 fell 0.2%, hot-rolled coil SHHCcv1 was little changed, rebar SWRcv1 fell 0.3%, and stainless steel SHSScv1 rose 0.8%.

Source: https://kinhtedothi.vn/gia-thep-hom-nay-28-6-quay-dau-giam-tren-san-giao-dich.html

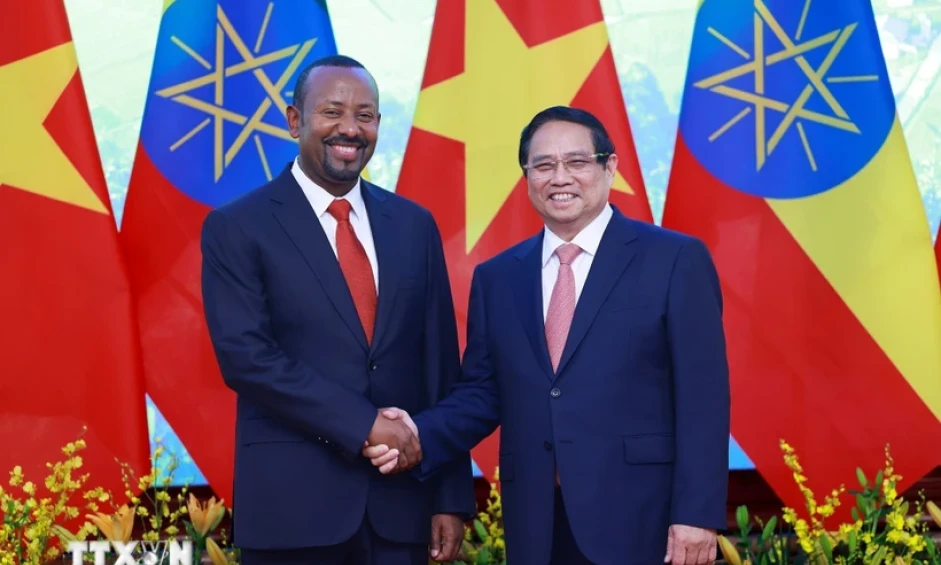

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)