Analysts say that Mr. Trump’s election will bring many changes in taxes, trade, and investment. Accordingly, many industries and sectors of Vietnam may be affected…

On the afternoon of November 6 (Vietnam time), Reuters news agency reported that US House Speaker Mike Johnson announced Mr. Donald Trump is president-elect.

With a large economic influence like the US, the election results are an important event that has a profound impact on other countries, including Vietnam.

Which sectors in Vietnam should pay attention when Mr. Trump is elected?

How the new US president’s policies will impact the economy remains to be seen. However, according to analysts, Vietnam could be affected in two ways, in terms of trade and investment.

Regarding exports, Mr. Trinh Viet Hoang Minh - ACBS Securities analyst - said that the US is Vietnam's largest export partner (in 2023, Vietnam had a trade surplus of 83 billion USD).

In the first 9 months of 2024, Vietnam's export turnover to the US increased by 25.5% over the same period last year.

During Trump’s previous term, the US withdrew from the Trans-Pacific Partnership (TPP) and placed Vietnam on a watch list for “currency manipulation”. However, the Trump administration did not impose any sanctions on Vietnamese products.

Mr. Minh said that at the top of the list of businesses that will benefit when Mr. Trump takes office are Vietnamese industrial real estate businesses. Next are export businesses that can prove their origin.

Delving into the analysis of industry groups on the Vietnamese stock market, Agriseco experts predict that three industry groups will benefit, be neutral, or even suffer negative consequences when Mr. Trump is elected.

In which, with the positive group, the forecast industrial real estate, textiles (this industry is highly labor-intensive and unlikely to be replaced by American businesses) and wood (policies to support the real estate market).

As for steel, experts are concerned that it will be affected in both directions by the tax policy. It may be good in the short term, but in the long term, it will be affected by the direction of restoring the US steel industry. In addition to steel, energy and plastics are also industries that are affected by both positive and negative impacts.

Problems that may be faced

Many experts predict that under the Trump administration, Vietnam may also face economic challenges.

In particular, imposing strong tariffs could cause export industries (seafood, textiles, tires, wooden furniture, steel...) to face difficulties when demand from the US market decreases because imported goods are too expensive.

According to Ms. Bui Thi Quynh Nga - analyst at Phu Hung Securities (PHS), when Mr. Trump is re-elected, the Vietnamese Government needs to have policies and select investment capital sources effectively.

"Choose foreign investors with financial and technological potential, who have a spreading role, promote the development of domestic enterprises, and contribute to the domestic economy. At the same time, it is necessary to strengthen the mechanism of inspection and supervision of input and output of FDI enterprises to ensure sustainable benefits," Ms. Nga emphasized.

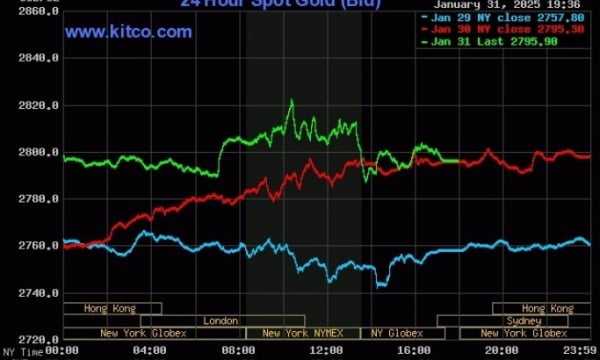

Regarding the exchange rate issue, there are still many different forecasts. However, Ms. Nga is inclined towards the possibility exchange rate could fall after the election due to the Fed's policy of lowering interest rates amid inflation gradually returning to target levels.

"In the long term, thanks to expectations of USD capital sources from international investment and trade along with the Government's control measures, the exchange rate will also be within a reasonable range, ensuring that the economic promotion goals of the Government and relevant agencies are effectively implemented," Ms. Nga commented.

Expert Trinh Viet Hoang Minh also pointed out that during Mr. Trump's previous term, the USD index (DXY) fluctuated between 89 and 112 points and the VND remained relatively stable, only losing 2.05% of its value from 2016 to 2020.

What will happen to stocks after the US election? Agriseco Securities cited statistics showing that the Vietnamese stock market has gone through 6 US elections. Preliminary results six months after the election day, VN-Index increased in 5/6 sessions. The average performance of VN-Index after 6 months for all 6 presidential elections was +28.62%. If we ignore the year 2000 when the market was still in its infancy, the average rate is +11.92%. However, experts note that due to the small sample size, the results are only for reference. According to Ms. Nien Nguyen - Shinhan Securities expert, the exchange rate from now until the end of the year will have certain challenges when the market psychology chooses low-risk investment options and waits for direct impacts from Mr. Trump's policies, instead of acting according to expectations from the Fed's interest rate cuts. |

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)