HDBank unexpectedly increases interest rates, highest 8.1%/year

According to Lao Dong on August 30, Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank) issued a new savings interest rate schedule, recording an increase of 0.3 percentage points for some terms.

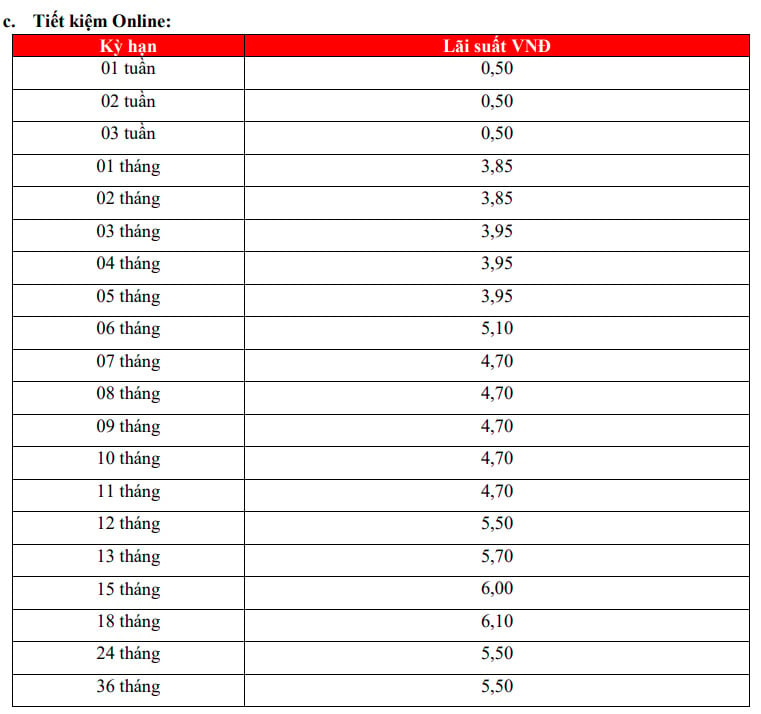

HDBank's online deposit interest rate table records the following changes:

One-month interest rate increased by 0.3 percentage points to 3.85%/year.

3-month term interest rate increased by 0.4 percentage points, to 3.95%/year.

6-month term interest rate is 5.1%/year.

9-month term interest rate is 4.7%/year.

12-month term interest rate is 5.5%/year.

18-month term interest rate is 6.1%/year.

36-month term interest rate is 5.5%/year.

The online deposit interest rate table at HDBank is currently listed as follows:

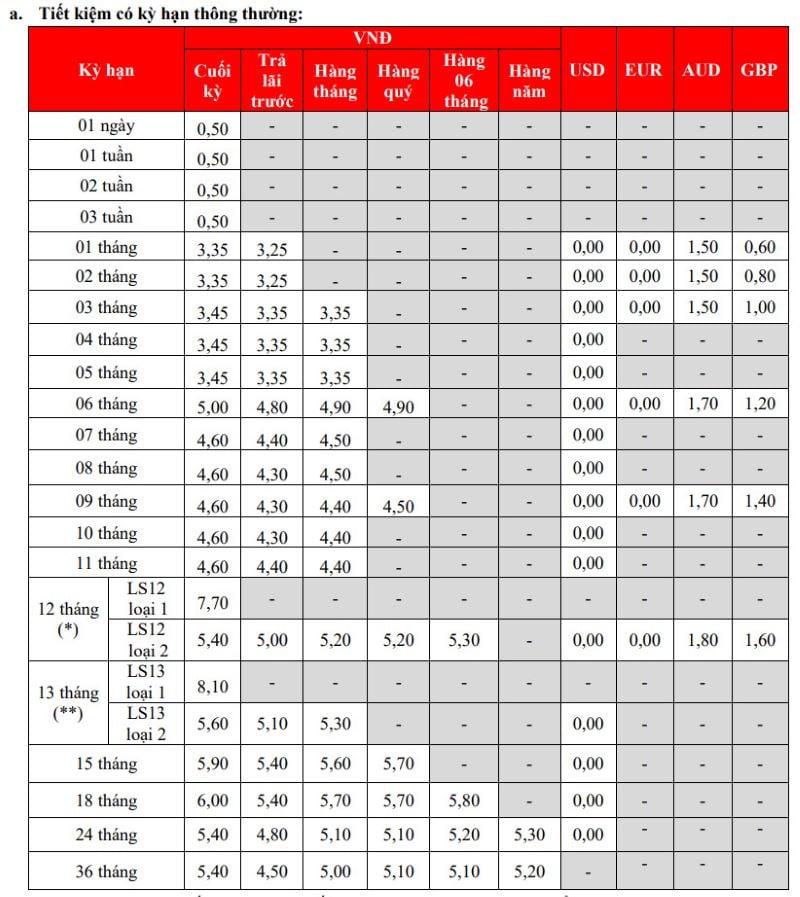

1-month term interest rate is 3.35%/year.

3-month term interest rate is 3.34%/year.

6-month term interest rate is 5.0%/year.

9-month term interest rate is 4.6%/year.

12-month term interest rate at 5.4%/year.

18-month term interest rate at 6.0%/year.

36-month term interest rate is 5.4%/year.

In addition, HDBank currently applies an interest rate of 8.1%/year for a 13-month term and 7.7% for a 12-month term, with a minimum balance of VND500 billion. These are also two of the highest interest rates on the market to date.

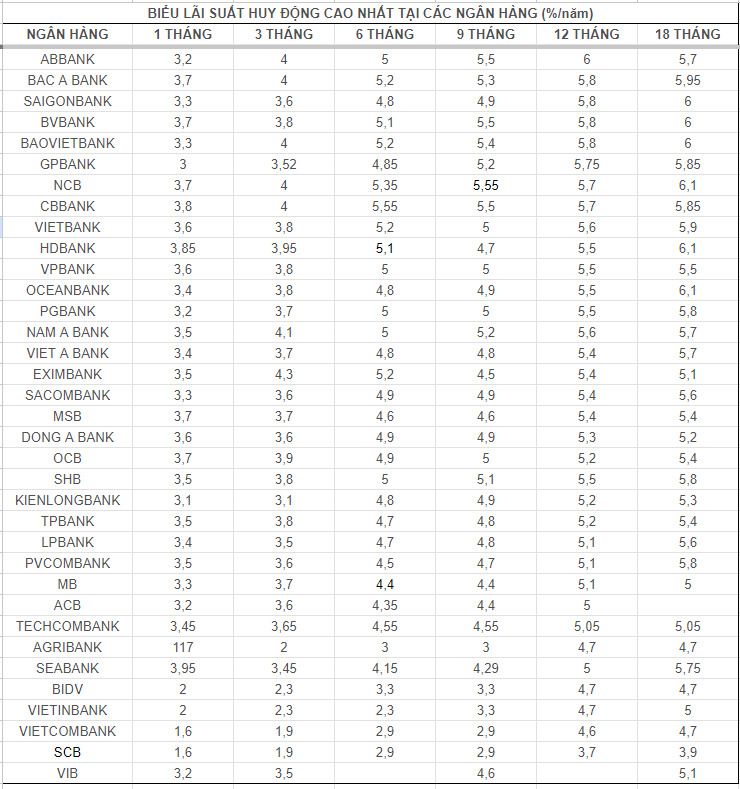

According to statistics, a series of 17 banks have increased savings interest rates since the beginning of August, including: Eximbank, ACB, Agribank, Sacombank, Saigonbank, VietBank, TPBank, CBBank, VIB, Dong A Bank, VPBank, Techcombank, SHB, VietBank, PVCombank, Nam A Bank, HDBank.

(See more high interest rates HERE)

Details of deposit interest rates at banks, updated on August 30, 2024

Source: https://laodong.vn/kinh-doanh/bien-dong-lai-suat-308-ong-lon-tang-bat-ngo-vot-nguong-8-1387026.ldo

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)