2023 is a difficult business year for Vietnam Dairy Products Joint Stock Company (Vinamilk), but results still increased compared to 2022. Right in the first days of the Year of the Dragon, Vinamilk shares quickly broke out with an increase of more than 5% after 5 trading sessions.

Up to now, the dairy giant, Vietnam Dairy Products Joint Stock Company - Vinamilk (VNM, HOSE) has quickly caught the wave after Tet, returning to the 70,000 VND/share mark, the highest in the past 3 months. VNM shares quickly increased in value by 5.3%, from 67,400 VND/share to 71,300 VND/share after 5 trading sessions, raising the capitalization to approximately 146,300 billion VND.

VNM shares are trading actively again after 3 months (Source: SSI iBoard)

2023 is a challenging year for the economy, from which the demand for milk consumption in Vietnam will also decrease significantly.

The latest report in December 2023 from the US Department of Agriculture shows that the total global milk powder production in 2023 is estimated to reach 9.2 million tons, a figure that is almost unchanged compared to 2022. However, the total domestic milk powder consumption demand of countries in 2023 is estimated to decrease by 3.1%. Therefore, the estimated import demand for milk powder is only 2.5 million tons, a decrease of 8% compared to 2022.

Affected by this reality, dairy enterprises have faced many difficulties. Vinamilk is no exception, in the first 6 months of the year, profits "declined" by 5.6% compared to the same period.

After the rebranding, Vinamilk has really recorded positive growth again. In addition, in the past year, VNM has made many efforts in restructuring the business to meet the development of the new generation of consumers, expand the customer base and reach out to the world market.

As a result, in the fourth quarter of 2023, Vinamilk's net revenue reached VND 15,619 billion, a slight increase of 3.6% over the same period. Thanks to a sharp cut of nearly 50% in financial expenses over the same period, from VND 207 billion to VND 119 billion, VNM achieved positive profit growth of VND 2,852 billion, an increase of 24.3%.

With this figure, VNM is one of the enterprises with the largest growth fluctuations in the fourth quarter of 2023, according to an analysis report by SSI Securities.

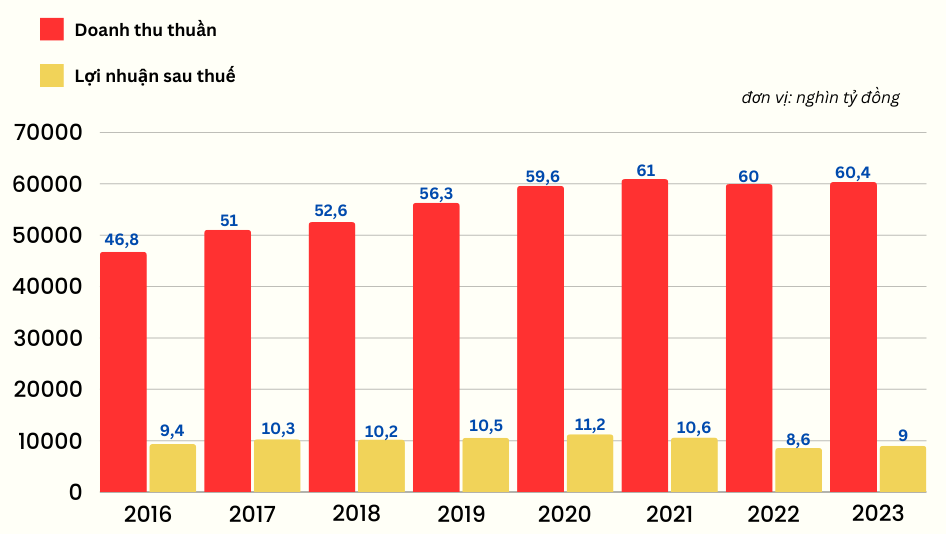

For the whole year of 2023, Vinamilk will reach VND60,369 billion, an increase of more than VND410 billion. Profit will reach VND9,019 billion, an increase of 5% compared to 2022, ending the previous 2 years of decline.

Revenue and profit developments at Vinamilk in recent years

Source: Financial Statements

MCM shares rebounded positively before moving to HOSE (Source: SSI iBoard)

Besides the breakthrough from VNM, MCM stock (Moc Chau Dairy Cattle Breeding JSC - Moc Chau Milk, UPCoM) is also performing quite well, maintaining at 42,400 VND/share. Vinamilk currently holds more than 59% of capital at Moc Chau Milk.

From mid-January 2024, MCM suddenly skyrocketed from VND 36,900 to VND 42,400/share, equivalent to a 13% increase in share value, which somewhat positively impacted Vinamilk's investment revaluation.

Furthermore, MCM is in the process of waiting to move its "house" from UPCoM to HOSE, which will help increase the value of the enterprise, increase transparency in all aspects, both in production and business activities and governance, thereby ensuring the interests of shareholders.

Milk production is expected to increase from mid-2024 thanks to the upward trend in milk powder prices from August 2023. This will create favorable conditions for the profitability of the dairy industry in Vietnam. According to Tien Phong Securities, Vietnam only meets 40-50% of domestic milk demand, the domestic milk market has a large growth potential, however, the domestic dairy industry is facing great competition from imported milk.

Currently, according to 2022 data from VNDirect Securities, Vinamilk is the domestic dairy company with the largest market share at 44%. However, the domestic dairy market is currently facing fierce competition as many businesses are participating in the production and trading of this product. Therefore, it is not easy for Vinamilk to maintain market share under competitive pressure and rising input material prices, narrowing profit margins.

Source

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)