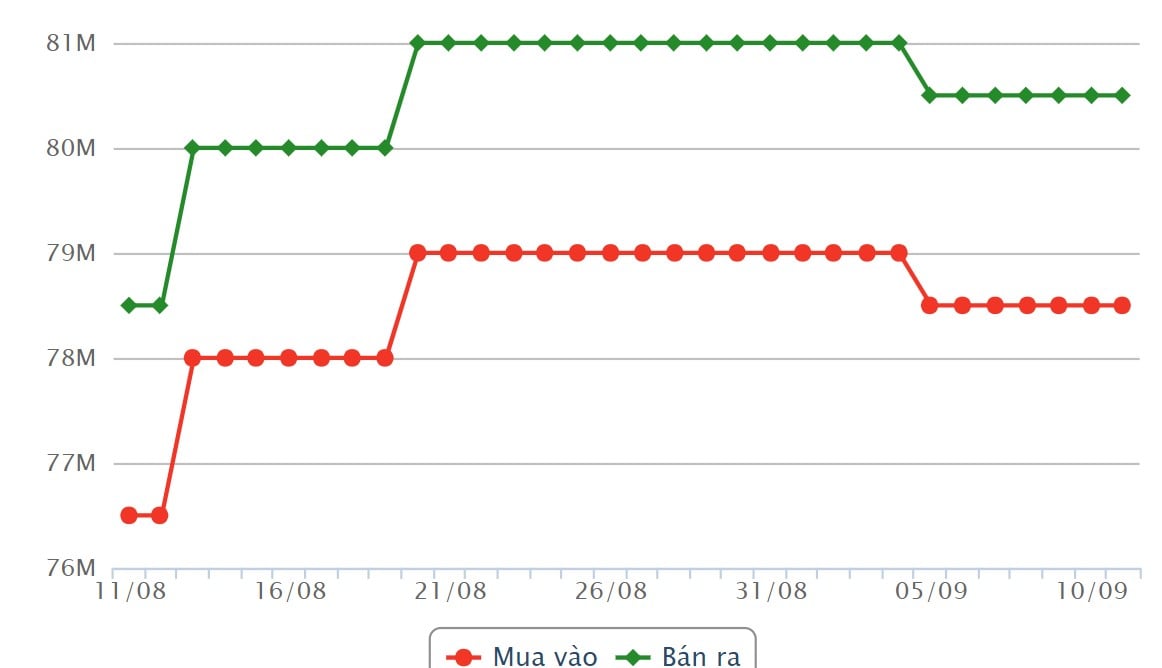

SJC gold bar price

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 78.5 - 80.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 78.5 - 80.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

9999 gold ring price

This morning, the price of 9999 Hung Thinh Vuong round gold ring at DOJI was listed at 77.5-78.65 million VND/tael (buy - sell); increased by 150,000 VND/tael in both directions.

Saigon Jewelry Company listed the price of gold rings at 77.4 - 78.65 million VND/tael (buy - sell); an increase of 150,000 VND/tael in both directions.

In recent sessions, the price of gold rings has often fluctuated in the same direction as the world market. Investors can refer to the world market and expert opinions before making investment decisions.

World gold price

As of 9:15 a.m., the world gold price listed on Kitco was at 2,519.3 USD/ounce, up 16.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased in the context of the falling USD index. Recorded at 9:40 a.m. on September 11, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 101.447 points (down 0.15%).

Spot gold is supported above the psychological level of $2,500 an ounce and any dip after the CPI data will attract buyers, said market analyst Han Tan of Exinity Group.

TD Securities commodity strategist Daniel Ghali said gold is waiting for further momentum, including the consumer price index. A Reuters poll showed that experts forecast the CPI to increase 0.2% in August, unchanged from the previous month.

Gold prices have risen 21% so far this year, hitting an all-time high of $2,531.60 an ounce on Aug. 20. A lower interest rate environment typically increases the appeal of gold by reducing the opportunity cost of holding the precious metal.

Currently, according to the CME FedWatch tool, the market is pricing in a 73% chance that the US Federal Reserve (FED) will cut interest rates by 25 basis points at its meeting on September 17 and 18 and a 27% chance that the US Central Bank will cut interest rates by 50 basis points.

Peter A. Grant, vice president and senior metals strategist at Zaner Metals, predicts that the Fed will almost certainly cut interest rates by 25 basis points at its meeting on September 18. He believes that this is what has caused gold prices to fluctuate between $2,470 and $2,520 per ounce in recent times.

However, Peter A. Grant is optimistic that the precious metal could set a new record as expectations for a 50 basis point Fed rate cut are rising. However, he still warns investors to be cautious with expectations of a sharp Fed rate cut.

Looking ahead to gold, ING commodity strategist Ewa Manthey said the gold rally is just getting started and the most anticipated US interest rate cut in decades will push prices to new record highs this month.

Source: https://laodong.vn/tien-te-dau-tu/gia-vang-hom-nay-119-o-at-tang-cao-vang-nhan-huong-toi-dinh-moi-1391938.ldo

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)