|

| Tax officer of the Taxpayer Support and Propaganda Department, Bac Giang Tax Department. (Photo: Nguyen Hung) |

Entering 2023, along with the whole country, Bac Giang has opportunities, advantages and difficulties, challenges intertwined, but difficulties and challenges are more. As a province with a large open economy, small scale, limited resilience, low labor productivity, the province's economy is negatively affected by rapid, unpredictable developments in the world situation, the decline of major economies, broken supply chains, export issues, inflation; the stagnation and decline of the real estate market...

Faced with that situation, the Provincial People's Committee and the Chairman of the Provincial People's Committee have seriously implemented and concretized the Resolutions of the Government, the Provincial Party Committee, the Provincial Party Standing Committee, the Provincial People's Council, the Party Committee of the Provincial People's Committee and resolved practical issues.

Focus on handling outstanding issues and promptly responding to newly arising issues; concentrating resources, removing bottlenecks and bottlenecks in the development process; supporting and creating conditions for enterprises to proactively adapt, recover, and boost production. Expanding domestic and foreign cooperation; promoting investment, creating new momentum for immediate growth and preparing for the long term.

Domestic budget revenue reached 66.2% of estimate

Thanks to the drastic participation, close and timely leadership and direction of the Provincial Party Committee; the efforts, creativity and flexibility in the direction and administration of the Provincial People's Committee, departments, branches and authorities at all levels; the support and active participation of the people and the business community; the socio-economic situation in the first 6 months of 2023 of Bac Giang achieved positive and comprehensive results. Specifically, the economic growth rate (GRDP) in the first 6 months of 2023 of Bac Giang province is estimated at 10.94% (ranked 2nd in the country), this is a favorable condition for the implementation of tax collection work in the area, so the tax work in the first months of 2023 also achieved many impressive results.

Budget revenue in the first 8 months of 2023 achieved positive results, especially tax and fee collection reached 124.2% compared to the same period in 2022. Some taxes, collection areas and units had revenue that ensured good progress compared to the assigned annual estimate: Foreign-invested enterprises reached 152.2% of the ordinance estimate, equal to 130.1% of the provincial estimate, up 154.1% over the same period; Local state-owned enterprises reached 88.0% of the assigned estimate, up 29.7% over the same period; Land tax and water surface rental collection reached 230.7% of the ordinance estimate, equal to 76.9% of the provincial estimate, up 33.0% over the same period....

In order to help businesses have more motivation for production and business, as soon as the Government issued Decision No. 01/2023/QD-TTg on reducing land and water surface rents in 2022, the Tax Department urgently deployed extensive propaganda work, fully disseminating the content of the policy through the provincial Radio and Television Station, on the tax authority's website...

At the same time, specific instructions are provided to ensure that taxpayers soon enjoy full benefits when implementing policies, contributing to the correct and timely implementation of the Party and State's policies and guidelines.

The Department also created all favorable conditions for taxpayers, promptly supported, answered and guided taxpayers on tax laws and policies in accordance with regulations such as: Answering questions, guiding taxpayers on tax laws and policies through the following forms: Directly at the tax office 813 times; by phone 999 times, answering 96 documents in writing; receiving and answering taxpayers' questions on the Electronic Tax Service System (eTax) 54 questions. Organizing 2 training conferences on new tax policies; 03 dialogue conferences with taxpayers.

In general, in the first 8 months of 2023, the propaganda and support work for taxpayers of Bac Giang Provincial Tax Department continued to be implemented according to the program and plan, with focus and key points, promptly meeting the information needs of taxpayers, demonstrating the concern, sharing and companionship of the tax authority with taxpayers, contributing to helping taxpayers fulfill their tax obligations to the State.

|

| Bac Giang Tax Department received the Third Class Independence Medal on December 29, 2022. (Source: Bac Giang Newspaper) |

Maintain budget revenue momentum

It is forecasted that in the last months of 2023, the world situation will continue to develop in a complicated and unpredictable manner, continuing to negatively impact the province's economy, especially industry, construction, import and export, etc. Budget revenue is under great pressure; attracting social resources is facing many difficulties.

The situation of climate change, natural disasters, and epidemics is increasingly complex and unpredictable. Regular tasks are increasing, requirements and demands are increasing; we must both focus on handling long-standing issues and promptly respond to urgent and newly arising issues.

Besides, there are also advantages and positive signals, creating momentum for the growth and development of the province. The achievements in recent years have created the position and strength to make Bac Giang one of the important and attractive destinations for domestic and foreign investors.

Many large projects and works have been put into operation and use, contributing to increasing production capacity and promoting growth. The early approval of the provincial planning is the basis for implementing projects, the advantages of the province are promoted, the socio-economic infrastructure continues to be improved; political security, social order and safety are ensured; the shift in investment waves and the expansion of international cooperation have opened up many great opportunities, especially in attracting quality investment projects...

Faced with intertwined advantages, difficulties and challenges, the Bac Giang Provincial Tax Department has set out the following tasks: Focusing on implementing solutions to support taxpayers, contributing to helping taxpayers maintain and restore production and business; Deploying and strictly implementing newly issued or supplemented and amended tax laws and policies, and the industry's professional processes; Promoting and improving the quality of tax inspection and examination work according to the risk management method, preventing loss of state budget revenue, striving to complete the inspection and examination plan for 2023.

At the same time, focus on debt management and tax debt enforcement to ensure proper and sufficient debt management measures according to the tax debt management process; Promote the modernization of tax management associated with administrative reform; Improve discipline and order in performing public duties; focus on training the quality of civil servants.

Regarding solutions, in the rest of the year, Bac Giang Tax Department will continue to proactively and strongly propagate new tax laws and regulations, draft legal documents related to the tax sector, tax management, etc.

In particular, continue to propagate and disseminate to taxpayers in the area to promptly implement Decree No. 12/2023/ND-CP of the Government on extending the deadline for payment of VAT, CIT, PIT and land rent in 2023 to support businesses and people, and promote production and business.

Tax authorities also strengthen monitoring, supervision, and urging taxpayers to submit declarations on time; regularly check tax declarations, promptly detect errors to guide adjustments; promptly resolve procedures for tax code registration, electronic tax declaration, payment and refund, and electronic invoices.

At the same time, promote administrative procedure reform, simplify processes, and create the most favorable conditions to help people and businesses fully fulfill their obligations to the state budget.

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

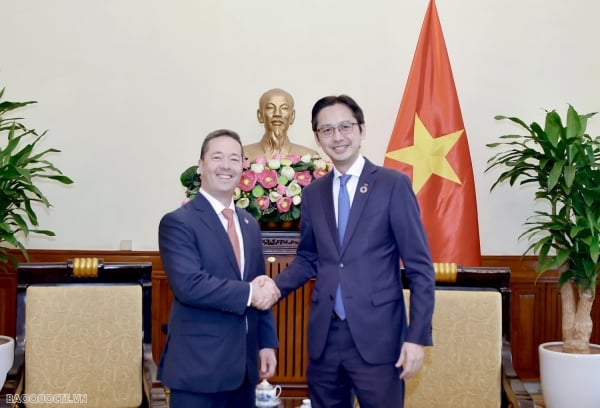

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)