TC Group's presence is increasingly evident

Prosperity and Development Joint Stock Commercial Bank (PGBank - UPCoM: PGB) has just announced information on amending and supplementing documents for the 2024 Extraordinary General Meeting of Shareholders.

Accordingly, the bank plans to submit to the General Meeting of Shareholders for approval the change of headquarters location from HEAC Building to Thanh Cong Building (Thanh Cong Tower) because HEAC Building is currently under renovation, is expected to take a long time to complete and currently does not meet the requirements for the bank's headquarters.

Information on the website of Thanh Cong Asset Management and Services Company Limited (PSC) shows that the HEAC Building and Thanh Cong Building are both invested by Thanh Cong Group (Thanh Cong Tower).

Accordingly, Thanh Cong Building was invested by Thanh Cong Group with a scale of 40 million USD and put into operation from 2020.

PGBank wants to change its headquarters to Thanh Cong Building.

Previously, in the article "PGBank after changing ownership and difficult problems from the Law on Credit Institutions", Nguoi Dua Tin informed that 2/3 of PGBank's strategic shareholders are related to TC Group.

At the same time, a new name appeared on the Board of Directors of PGBank, Vice Chairman Dao Phong Truc Dai. Mr. Dao Phong Truc Dai was an independent member of the Board of Directors of Eximbank, representing the Thanh Cong Group.

Mr. Dai has held many key positions at Thanh Cong "family" enterprises such as Financial Director of Thanh Cong Technical Service JSC, General Director of Thanh Cong Viet Hung Technology Complex Industrial Park JSC, General Director of PV-Inconess Investment JSC...

Revealed 2 additional members elected to the Board of Directors

PGBank has just announced the resumes of two candidates expected to be elected to the Board of Directors, Ms. Cao Thi Thuy Nga and Mr. Dao Quoc Tinh.

Accordingly, Mr. Dao Quoc Tinh was born in 1962 in Thai Binh, has a PhD in Economics from the Banking Academy. Mr. Tinh has nearly 40 years of experience working in the finance and banking sector. He has held many positions at VietinBank and Agribank.

In addition, he has held many positions at the State Bank such as Deputy Head of Payment Department - Economic Research Department, Deputy Head/ Head of Department/ Deputy Head of Department in charge of Internal Audit - General Control Department...

Ms. Cao Thi Thuy Nga was born in 1958 in Nam Dinh, with a Master's degree in Finance from the Academy of Finance. She has 37 years of experience in the banking and finance sector, holding many important positions at BIDV, Public Bank Vietnam, MB and MB Securities (MBS).

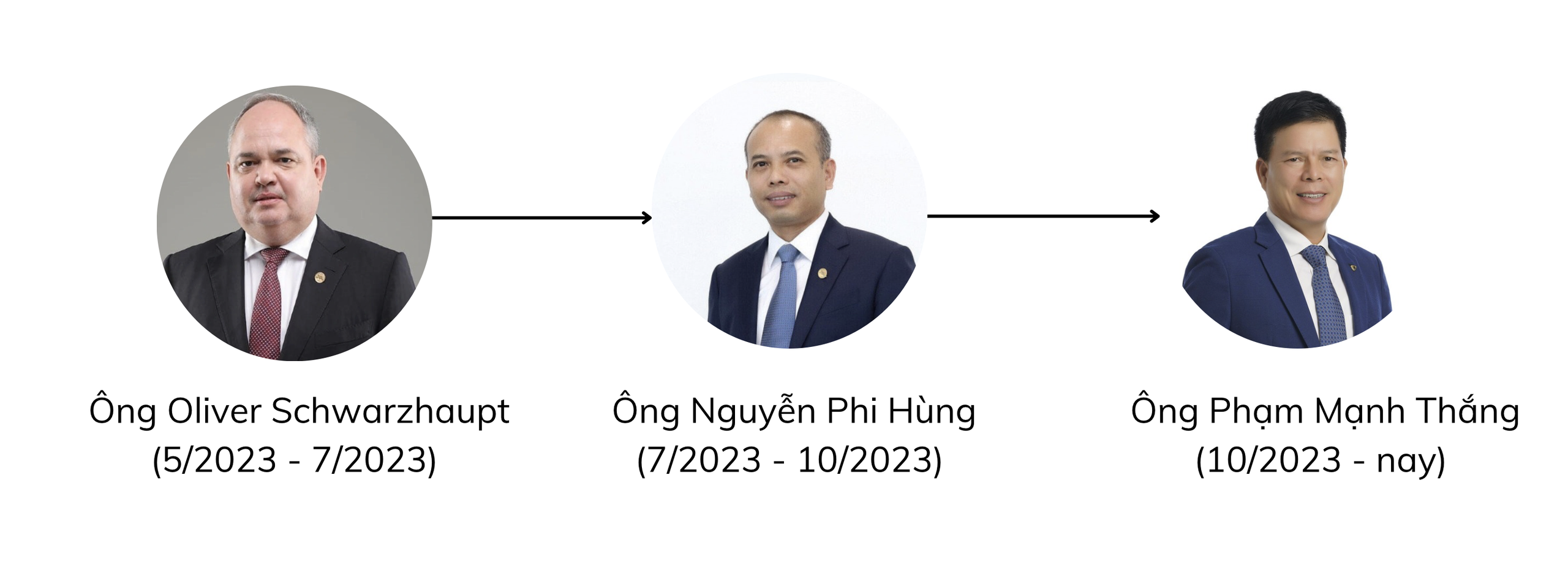

PGBank Chairman through the ages.

Before this extraordinary congress, the senior personnel at PGBank also continuously changed. In just 5 months, the bank changed 3 Chairmen of the Board of Directors.

At the extraordinary general meeting of shareholders in October 2023, PGBank shareholders elected 5 additional members to the Board of Directors and 2 members to the Board of Supervisors.

However, the bank's 2024 Annual General Meeting of Shareholders approved the dismissal of two members from the Board of Directors, Mr. Nguyen Thanh Lam (independent member of the Board of Directors) and Ms. Dinh Thi Huyen Thanh. On April 25, Ms. Dinh Thi Huyen Thanh also requested to withdraw from the position of General Director of PGBank.

How is PGBank doing business?

Regarding business performance, in 2011, PGBank recorded a profit after tax of VND446 billion. However, in 2012, the profit level dropped nearly 2 times compared to the previous year to VND240 billion.

Even in 2013, PGBank's profit dropped to 38 billion VND. PG Bank went through a period of poor business with a loss of several tens of billions of VND.

From 2013 to 2019, PG Bank's after-tax profit fluctuated erratically, but the highest was less than VND 150 billion. In the 2020-2022 period, the bank's after-tax profit also showed improvement but could not reach the VND 500 billion mark.

After Petrolimex divested, PGBank even reported a post-tax loss of VND4.6 billion in the fourth quarter of 2023, showing a gloomy business period, a decline compared to the profit of VND95 billion in the same period last year.

PGBank said that the reason for the decline in profit in the fourth quarter of 2023 was due to the reduction in lending interest rates to customers according to the Government's policy while the cost of mobilization has not decreased due to delay and credit growth concentrated in the last month of 2023.

By the end of 2023, total bank assets increased by 13% compared to the beginning of the year, reaching VND 55,495 billion. Of which, customer loans increased by 22% to more than VND 35,000 billion. On the capital side, customer deposits increased by 14% to VND 35,729 billion.

Notably, in terms of loan quality, by the end of 2023, PG Bank's total bad debt was VND 905 billion, an increase of 21.5% over the previous year, the highest in the past 10 years.

In addition, after the appearance of TC Group, PGBank's 2023 financial statements recorded that the bank's outstanding loans for wholesale, retail, and auto repair increased from VND 1,700 billion (accounting for 5.86% of total outstanding loans) to VND 3,905 billion (accounting for 11.05% of total outstanding loans).

Special bonds issued by VAMC by the end of 2023 recorded more than VND 949 billion and by the end of the second quarter of 2024, it was nearly VND 985 billion, an increase of 3.8%.

However, by the first half of 2024, the bank's bad debt had improved significantly with a total bad debt of VND958 billion, down 5% compared to the beginning of the year. The ratio of bad debt/loan balance decreased from 2.85% to 2.61%.

At the end of the second quarter of 2024, PGBank recorded net interest income of VND437 billion, up 28.1% over the same period last year. The bank reported pre-tax profit of VND151.5 billion and post-tax profit of VND121 billion, both up slightly by 0.7% over the same period last year.

This is the first quarter that the bank has recorded profit growth since the appearance of a new group of shareholders related to TC Group. Accumulated from the beginning of the year until now, PGBank recorded net interest income of VND815 billion, up 19.7% compared to the previous year.

Due to the decrease in profit in the first quarter of 2024 compared to the same period, despite positive business performance in the second quarter, the bank still reported a 7% decrease in pre-tax profit and after-tax profit in the first 6 months of 2024 compared to the same period, down to VND 268 billion and VND 214 billion, respectively.

In 2024, PGBank set a pre-tax profit target of VND 554 billion, an increase of 57.7% compared to 2023. Thus, by the end of the second quarter of 2024, the bank had achieved 48.3% of the set profit target.

PGBank's extraordinary general meeting of shareholders is expected to be held on the morning of August 26 at The Five Residences Hanoi Hotel, 345 Doi Can, Lieu Giai Ward, Ba Dinh District, Hanoi.

Source: https://www.nguoiduatin.vn/nhung-chuyen-dong-tai-pgbank-truoc-them-dhdcd-bat-thuong-204240823163000912.htm

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)