What personal income tax deductions should be added and should there be a unified family deduction across the country?

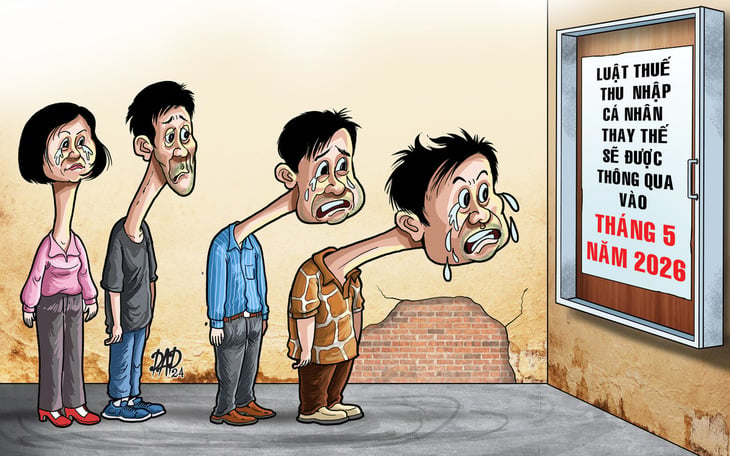

HCM City Tax Department staff guides a case of declaring dependents for family deduction - Photo: TTD

Since the last approval in 2007, the Ministry of Finance has only recently issued a document requesting ministries, branches and localities to contribute opinions to develop and comprehensively amend the Personal Income Tax Law.

Over the past 16 years, the implementation of this law has shown many shortcomings that need to be changed.

There are a number of issues that the Ministry of Finance and relevant units should consider and add to the new Personal Income Tax Law.

Single parent deduction, please?

First of all, it is necessary to research and supplement deductible expenses.

Currently, in addition to mandatory payments such as social insurance, unemployment insurance, health insurance, and personal family deductions that are automatically included and excluded from taxable income, some people are also entitled to deductions for dependents and deductions for expenses related to contributions to charity and education promotion funds.

However, in reality, in addition to the above insurance, many people today also have to pay a lot for personal health insurance and life insurance packages.

These are all legitimate needs and rights of the people to comprehensively protect themselves and their families. These expenses are not small.

In addition, annual medical expenses, hospitalization, and medical examination and treatment also cost a lot but are not included in personal income tax deductions.

In fact, Japan and Thailand both exclude the costs of purchasing personal health insurance and life insurance packages when calculating personal income taxable income.

Japan deducts medical expenses if medical expenses exceed 100,000 yen/person (about 16.5 million VND/year) in a year. Thailand allows deductions of up to 60,000 baht/case (about 45 million VND) for maternity expenses.

Both countries also allow bank interest expenses for mortgage loans to be deducted from personal income tax, so those who have mortgage loans through banks can also reduce their personal income tax burden.

Another deduction that I think is quite humane that Japan is applying is the deduction for single parents, helping them reduce taxes and increase their actual income to cover the expenses of raising children alone.

In Vietnam, there are currently many such cases but they have not been mentioned in the documents drafting the Personal Income Tax Law.

Agree on a family deduction?

Next is the issue of family deductions.

Currently, the deduction for taxpayers is 11 million VND/month, and the deduction for each dependent is 4.4 million VND/month, which is no longer suitable for the actual situation when the cost of caring for the elderly, the cost of education for children under 18 years old, and dozens of other expenses in life have all increased significantly.

I completely agree with the proposal that the personal deduction should be increased to 18 million VND/month and the deduction for dependents should be increased to 8.8 million VND/month, twice as high as the current level.

This deduction should be applied uniformly across the country instead of being calculated based on local GDP as some proposals.

Just because a local GDP is high, it is not possible to require workers there to pay higher personal income taxes.

Applying a single family deduction nationwide ensures uniformity of the law, does not create discrimination, and avoids the situation where everyone "competes" to claim that their locality is poor, trying to lower the GDP to reduce taxes.

Not to mention that big cities often have more job opportunities, better real income, and better economic and infrastructure conditions than other localities, but the cost of living is higher.

Another problem is that the adjustment of deductible expenses, adjustment of family deduction levels, or more broadly, the adjustment of regulations related to personal income tax is currently relatively slow.

This affects the lives of many taxpayers when the actual cost of living increases rapidly, and the adjustment cannot keep up.

Therefore, people really hope that the revised Personal Income Tax Law can add provisions so that the adjustment of deduction levels is flexible and suitable to practical situations.

The adjustment can be applied annually or when the Government adjusts the basic salary, instead of having to wait several years to do it once.

Personal income tax, expectations and disappointments!

Personal income tax, expectations and disappointments!Source: https://tuoitre.vn/nhieu-khoan-giam-tru-can-bo-sung-khi-sua-doi-luat-thue-thu-nhap-ca-nhan-20250211082732811.htm

Comment (0)