ANTD.VN - The General Department of Taxation has just sent an official dispatch to the Tax Departments of provinces and centrally-run cities regarding the direction of rectifying discipline in the performance of public duties.

In the dispatch, the General Department of Taxation said that in recent times, in addition to the efforts of the entire sector, there are still tax officials and civil servants who have violated the law, been prosecuted, and temporarily detained in relation to tax management for business households and individuals in some localities. These violations have caused public outrage; seriously affecting the image and reputation of the entire tax sector.

In addition to objective causes, there are also subjective causes for violations, such as some leaders of the Tax Department and tax officials assigned to direct and be in charge of the management of business households and individuals, but lacking inspection and supervision, not properly implementing the regulations and management processes of the industry, not participating in Tax Advisory Council meetings... violating regulations on principles and working regime of the Tax Advisory Council;

Civil servants do not organize revenue surveys according to procedures and self-instruct business households to declare revenue that is not true to reality, there are tax violations by business households in the management area.

Along with that, the organization, dissemination and implementation of discipline in public service at some tax agencies are not really serious and not practical; the responsibility for inspection and supervision in tax management is also lax.

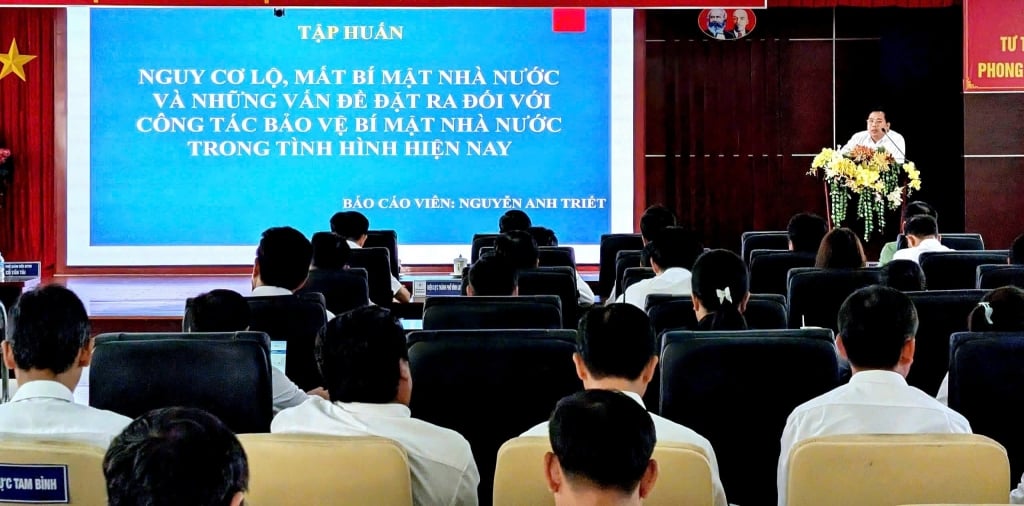

|

Some tax officials have been prosecuted recently. |

In order to promptly prevent, detect, correct and handle violations by tax officials in the performance of their duties; to prevent similar violations from occurring, the General Department of Taxation requires leaders of lower-level tax agencies to focus on directing the immediate organization of review, inspection and re-evaluation of all tax management for business households and individuals in the management area. Thereby, to promptly detect and prevent violations, failure to fully and promptly implement legal regulations, improper implementation of procedures, and failure to strictly comply with directives from superiors.

In cases of civil servants who violate or show signs of violating, they must be strictly handled to set an example in accordance with the provisions of the law. At the same time, review and clarify the responsibilities of relevant groups and individuals; strictly handle the responsibilities of the heads and deputy heads who let negative incidents occur in units under their responsibility and management; especially in cases of law violations that are prosecuted, temporarily detained, causing public outrage.

The General Department of Taxation requests that units, together with Party committees, immediately organize in the fourth quarter of 2024 a broad political activity, disseminate and thoroughly educate key leaders and all civil servants assigned to manage business households in the unit to promptly draw lessons and experiences from the above cases;

Educate and deepen awareness of the urgency of maintaining discipline, discipline, and image of the Tax sector, strictly implementing legal regulations and procedures of the sector in performing public duties and enhancing the responsibility of leaders in implementing public duties at the units and areas under their management. Ensure that the establishment of tax sets and tax management for business households in 2025 are properly and fully implemented in accordance with legal regulations and procedures of the tax sector.

Correct the working style, attitude, behavior, and communication of tax officials with business households and individuals, resolutely combat and promptly handle violations in the performance of official duties, and strengthen the team of officials managing business households and individuals to ensure sufficient capacity and qualifications to perform their duties.

At the same time, promote support and guidance to raise awareness and compliance with tax laws of business households and individuals and create the most favorable conditions for business households and individuals to fulfill their tax obligations to the State.

The General Department of Taxation requires the Director of the Tax Department and the Director of the Tax Branch to be responsible to the General Department of Taxation for organizing tax management in the area according to the management hierarchy and to be responsible for any violations of legal regulations occurring in the units under their management.

Source: https://www.anninhthudo.vn/nhieu-can-bo-bi-khoi-to-tong-cuc-thue-ra-van-ban-chan-chinh-post597128.antd

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

Comment (0)