With the determination to bring capital to help rural people, especially ethnic minority mountainous areas in a timely and effective manner, the Bank for Agriculture and Rural Development of Tam Dao District (Agribank Tam Dao) always stays close to the grassroots, seeks customers to mobilize savings; actively propagates, advises, and guides customers to use loans to invest in production and business effectively, increase income, and contribute to promoting the restructuring of the agricultural economy and building new rural areas in the area.

Visiting the sow and pork farm of Mr. Luu Van Giap, 41 years old, San Diu ethnic group in Luu Quang village, Quang Minh commune, regularly maintains a herd of 500 pigs with high economic efficiency.

Mr. Giap said: 5 years ago, thanks to a loan of 1.7 billion VND and the guidance and help of Agribank Tam Dao staff, his family was able to build 2 closed barns that were "warm in winter and cool in summer", avoiding disease, and expanding the scale of regular farming to nearly 500 pigs and 40 sows providing local breeding.

In 2024, the revenue from selling 2 batches of pigs was more than 6.4 billion VND. After deducting expenses, the family made a profit of nearly 700 million VND, creating jobs for 3 workers with an average income of 8 million VND/person/month.

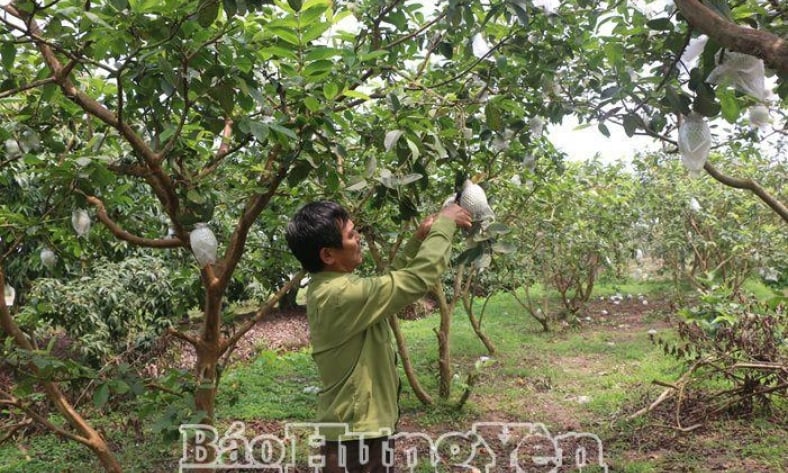

Ms. Nguyen Thi Huong, Dong Sinh village, Ho Son commune, borrowed 300 million VND from Agribank Tam Dao to invest in planting more than 1.05 hectares of Black Summer grapes and Korean melons, creating jobs for 4-6 workers, and earning 200-250 million VND each year from selling grapes and melons...

With the orientation of "Focusing on credit investment for the rural agricultural sector; exploiting well, selectively investing in key market segments and customer groups, not losing market segments", Agribank Tam Dao always closely follows the guidelines and policies of the Party and State, the operational strategy of Agribank Vietnam and the economic development goals of the locality.

Actively promote and expand convenient services in payment and treasury services; apply the IPCAS program (automation of the whole industry); domestic electronic money transfer services, foreign currency trading, remittance payments, ATM card opening; preferential policies for potential customers and customers who have long-term ties with the unit.

Regularly update knowledge and innovate attitudes and service styles of credit officers and transaction officers; assign competent and reputable credit officers to closely follow the area to find customers with potential to mobilize capital.

Pay attention to the appraisal and checking of loan applications before, during and after disbursement, and guide customers to use loans for the right purposes and effectively. Actively innovate management work, arrange and reorganize the organizational structure, encourage and create conditions for competent and reputable officers and credit officers to promote their strengths and improve the quality of credit activities.

Focus on lending for economic restructuring such as renovating low-lying fields for aquaculture; developing large-scale livestock and poultry farms; investing capital to restore traditional craft villages.

With many synchronous and positive solutions, by March 15, 2025, the branch's total capital reached more than 1,400 billion VND, an increase of 60 billion VND compared to the beginning of the year, with a growth rate of nearly 5%; total outstanding debt reached 1,294 billion VND, an increase compared to the beginning of the year.

The district currently has more than 3,500 borrowers with a total outstanding loan balance of VND 1,270 billion, of which more than 96% are farmers. The timely loan capital has helped thousands of new borrowers have capital to effectively implement production and business projects; purchase production materials, invest in high-yield, high-quality crop and livestock varieties, and create new jobs for thousands of rural workers in the district.

Mr. Nguyen Hong Ha, Director of Agribank Tam Dao said: Closely following the local economic development orientation and the business development orientation of Agribank Vinh Phuc II, from the beginning of the year, Agribank Tam Dao built a realistic business plan, focusing on lending capital according to Decree 55/2015 of the Government; lending with interest support according to Decree 68 of the Government and lending to serve rural agriculture.

Implement business strategies well from the beginning of the year, quarter and month. Implement corporate culture well at the trading floor and customer relations with a friendly service spirit and attitude, increasingly going into depth and credit quality.

Thanks to that, capital sources have been mobilized from the population and economic sectors, capital sources from international financial and credit organizations have been received through superior banks, loan funds have been established, and more and more customers have been attracted to deposit capital; at the same time, people have been guided to effectively implement the Party and State's policies on accumulation - consumption and savings, to stimulate temporarily idle capital sources, and to promote development potential to have more investment capital for the district's new rural construction.

Currently, Agribank Tam Dao provides enough capital for agricultural, rural, farmer development and production and business activities, and new rural construction in the area. Up to now, the business scale of Agribank Tam Dao is one of the leading strong banks in the Agribank Vinh Phuc II system.

In 2025, the branch strives to increase mobilized capital by 10 - 15% compared to 2024. Outstanding loans will increase by more than 10% compared to 2024. The ratio of loans serving the agricultural and rural areas will maintain a proportion of 96% of the capital structure; ensure profits and full payment of tax obligations to the State, actively contributing to the local economic and social development and new rural construction.

Article and photos by Xuan Hung

Source: http://baovinhphuc.com.vn/Multimedia/Images/Id/125823/Agribank-Tam-Dao-Kenh-dan-von-hieu-qua

![[Photo] Opening of the 11th Conference of the 13th Party Central Committee](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/f9e717b67de343d7b687cb419c0829a2)

![[Photo] Unique folk games at Chuong Village Festival](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/cff805a06fdd443b9474c017f98075a4)

![[Photo] April Festival in Can Tho City](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/10/bf5ae82870e648fabfbcc93a25b481ea)

Comment (0)