Most small businesses rely on labor for profit, so unreasonable tax calculation will affect their lives. In the photo: a grocery store in Phu Nhuan district (HCMC) - Photo: TU TRUNG

The current VAT turnover threshold is putting a lot of pressure on small businesses. In the context of constantly escalating prices and rising living costs, adjusting the turnover threshold is not only an urgent need but also a fair requirement to maintain the sustainable development of small businesses.

The tax industry needs to listen and make timely adjustments so that the revenue threshold is more in line with reality. Don't worry about losing revenue because when we have the conditions to do business, we still contribute in many other forms, from VAT to additional spending for children and family.

Ms. Kim Tram (owner of a beef noodle shop in Ho Chi Minh City)

Don't be afraid that loosening means losing tax revenue.

After 10 years of maintaining the VAT revenue threshold at VND100 million/year, the tax industry recently proposed an adjustment but was said to not meet the reality of price fluctuations. Small businesses – who are under a lot of cost pressure – are looking forward to a more flexible policy to reduce the burden.

Mr. Thanh Tung, owner of a noodle shop in Binh Thanh District (HCMC), said that the cost of goods sold each day exceeds 3 million VND, including bones, meat, noodles, spices, gas, premises and labor costs. With a monthly revenue of about 90-100 million VND, he is automatically subject to tax.

“My family of three adults works hard from morning to night, with the addition of a woman, but we still only earn money by working. However, we are not entitled to family deductions like salaried employees. I hope the tax authorities will consider raising the taxable revenue threshold to make it easier for us,” he said.

Ms. Kim Tram, owner of a beef noodle shop in Ho Chi Minh City, agrees. She and her husband both sell goods and raise two children in middle and high school with many large expenses. “Prices are increasing every day, life is getting harder and harder, but the threshold for taxable revenue is too low. We not only pay taxes but also have to pay on the entire revenue, regardless of actual profits. This is very unreasonable,” she shared.

According to Ms. Tram, when income does not increase in proportion to living expenses, people are forced to spend frugally, making her business more difficult. “The tax industry needs to listen and adjust promptly so that the revenue threshold is more suitable to reality. Don’t worry about losing revenue because when we have the conditions to do business, we still contribute in many other forms, from VAT to additional spending for children and family.”

Many argue that keeping the tax threshold unchanged in the context of a decade of rising prices is unfair to business households. Flexible adjustments not only help reduce pressure on people but also encourage more sustainable business development.

A small grocery store on Vuon Lai Street, An Phu Dong, District 12, Ho Chi Minh City – Photo: BE HIEU

Assign the Government to regulate for timely adjustment

At the meeting of the National Assembly Standing Committee on the draft revised VAT Law, Vice Chairman of the National Assembly Nguyen Duc Hai proposed to delegate authority to the Government to regulate the threshold of non-VAT revenue for business households and individuals. The goal is to help manage policies in a timely manner and in accordance with the changing socio-economic context.

Dr. Nguyen Ngoc Tu, a tax expert, said this is a reasonable solution, avoiding the situation of waiting for submission and approval from the National Assembly, which slows down the adjustment process. He emphasized that removing the regulation requiring the consumer price index (CPI) to fluctuate by 20% before the Government submits to the National Assembly to adjust the revenue threshold is necessary. "We need to avoid repeating mistakes such as the family deduction regulation in the Personal Income Tax Law, which is outdated and has not been amended despite being inadequate for many years," said Mr. Tu.

According to Mr. Tu, the threshold for non-taxable revenue needs to be carefully studied and transparently announced. For example, if the threshold is 200 million VND or 300 million VND, the Ministry of Finance needs to provide a convincing basis for taxpayers to understand and accept.

A long-time tax expert agreed, stressing that in the current difficult context, small businesses are under great pressure. Not only do they have to worry about maintaining their operations, but they can also easily fall into poverty if they encounter an incident.

“Although business households are called small traders, their income is actually just enough to live on. Therefore, policies need to be based on the spirit of sharing with taxpayers. Don’t set a rigid threshold just because you are worried about losing revenue. Taxes will not disappear but will “pass through the sieve and into the tray”, contributing indirectly through consumption and investment,” he said.

Both experts called on the tax industry to change its mindset, from collecting all revenue to nurturing revenue sources, because "only when policies demonstrate sharing will taxpayers be willing to contribute, helping to stabilize and sustain revenue sources."

Mr. Nguyen Hai Minh (Phu Nhuan District, Ho Chi Minh City) with groceries just enough to cover his frugal life - Photo: YEN TRINH

Need to pay attention to the characteristics of business households

Dr. Le Dinh Thang, Chief Auditor of Sector 2 (State Audit), agreed with the Government's decision to regulate the threshold of revenue not subject to VAT. He proposed that the basis for calculating this threshold should be based on the basic salary of the State. For example, the revenue threshold should not exceed 7, 10 or 15 months of basic salary. With the salary in 2024 increasing to 2.34 million VND/month, the revenue threshold will flexibly increase accordingly.

Mr. Thang emphasized that tax policies need to encourage production and business. Therefore, the revenue threshold may vary depending on the industry. Industries that need to be promoted may set a higher threshold, such as 300 or 500 million VND, to support people to invest and expand their businesses.

However, some economists believe that a common revenue threshold should be applied to ensure transparency and ease of implementation. At the same time, the tax rate should be kept low at 1-2% to encourage compliance.

Especially for small businesses with unstable incomes and self-sufficient living conditions, taxation should avoid the goal of collecting all resources, but instead nurture resources and create conditions for them to stabilize their businesses.

Delegate TRAN VAN LAM (standing member of the Finance and Budget Committee):

Ensuring flexibility and practicality

The National Assembly Standing Committee's assignment to the Government to regulate the threshold of revenue not subject to VAT is considered appropriate. This threshold needs to be flexibly adjusted according to the economic and social situation and growth rate of each period.

Currently, if each change in threshold has to be submitted to the National Assembly for consideration and decision, it will cause delay and inefficiency. Delegating power to the Government will increase initiative, responsibility and ensure flexibility in management, in accordance with reality.

This not only helps tax policies adapt to the economic context but also reduces complicated administrative procedures. Specifically, the threshold level will be researched and regulated by the Government based on an objective assessment of the socio-economic situation in each period.

Delegate PHAM VAN HOA (member of the Law Committee):

Can be raised to 300 - 400 million VND

The National Assembly Standing Committee's agreement to assign the Government to regulate the annual revenue threshold not subject to VAT is considered appropriate, helping to flexibly adjust according to socio-economic conditions.

If we continue to maintain the regulation of only adjusting when the CPI increases by more than 20%, implementation will become impossible in the context of a stable macro-economy. On the contrary, if major fluctuations occur, the need for continuous submission and approval will also be time-consuming and ineffective.

In fact, many voters and business owners believe that the current revenue threshold is outdated and causes many difficulties in business operations. Raising the threshold to VND200 million/year, double the current level, as proposed in the draft is reasonable. This level can be applied as soon as the law comes into effect.

Most small traders only make money by working – Photo: TRI DUC

Concerns of small businesses

Ms. Chau Thi Lien, a trader at Nguyen Dinh Chieu market (HCMC), shared that she sells essential goods such as spices and groceries, but this year purchasing power has decreased sharply, and her income is only 40-50% of what it was before. Her daily profit is only a few tens of thousands of VND, not enough to cover the costs of premises, electricity, garbage, flowers and taxes, while the flowers and taxes alone are more than 350,000 VND/month.

Similarly, Mr. Tran Van Dien, owner of a pho restaurant in Binh Thanh District, said he sells about 20 bowls of pho every day, earning VND800,000. However, the cost of premises and labor exceeds VND25 million per month, not to mention the cost of raw materials. He believes that the tax threshold should be higher than VND200 million, because the price of goods is constantly increasing, especially input costs.

At Con Market (Da Nang), Ms. Nguyen Thi Nhung - a daily goods trader - said that the taxable revenue of 550,000 VND/day is unreasonable. She emphasized that the tax threshold should be increased so that small traders can maintain their business.

Meanwhile, Mr. Le Van Dung - a food business owner in Can Tho City - shared that his pho restaurant has a revenue of more than 3 million VND/day but expenses account for more than half. He proposed that the tax threshold should be from 300 million VND/year or more or adjust the family deduction level to make it easier for people.

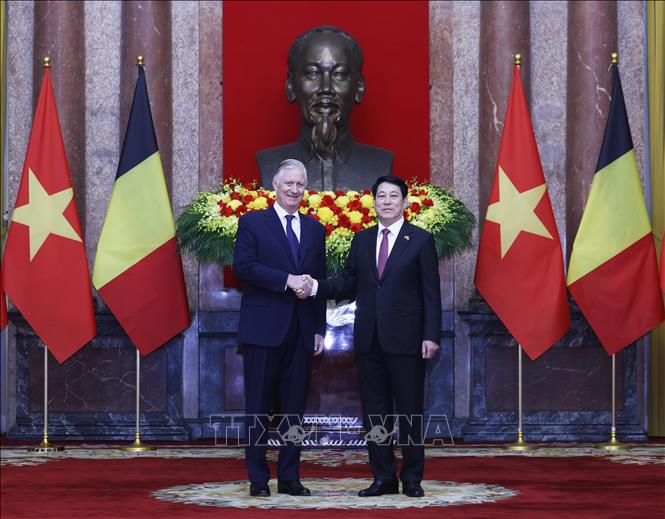

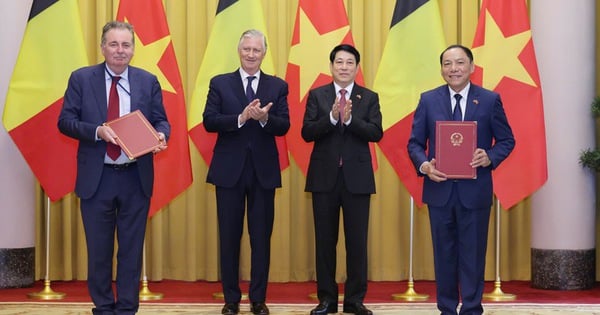

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

Comment (0)