On March 27, Vietnam International Bank (stock code VIB) held its 2025 annual general meeting of shareholders to approve business plans and charter capital increase plans.

According to the Board of Directors' report at the meeting, after 8 years of the 10-year strategic transformation journey (2017-2026), VIB has brought the bank into the leading group in the industry in terms of business efficiency, asset and revenue growth, effective cost management, and tight risk control. VIB's profit achieved an average growth rate (CAGR) of 37%/year over the past 8 years, the average return on equity (ROE) efficiency over 8 years reached 25%.

VIB is the first bank in the industry to hold its 2025 annual general meeting of shareholders. This week, two other banks are expected to hold their general meetings, namely Nam A Bank and NCB.

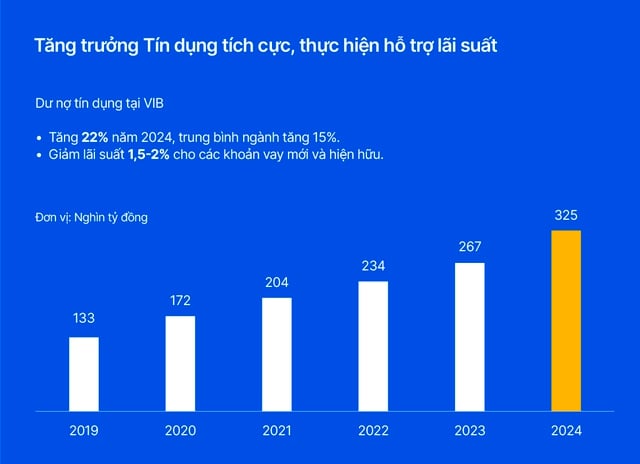

Mr. Dang Khac Vy, Chairman of the Board of Directors of VIB, said that in 2024, VIB's credit growth will be nearly 22%, 1.5 times higher than the industry average. However, profits will decrease by 16% because the bank accepts to sacrifice short-term benefits to invest in long-term benefits for customers and shareholders. Customer deposits in 2024 will exceed VND200,000 billion, growing by 17%, nearly double the industry average.

In 2025, VIB set a target of pre-tax profit of VND 11,020 billion, an increase of 22% compared to the previous year; dividend payment at a rate of 21% including cash dividends and bonus shares, which has been approved by the shareholders' meeting.

Mr. Ho Van Long, Deputy General Director of VIB, informed that the bank will pay cash dividends at a rate of 7%, issue bonus shares to existing shareholders at a rate of 14% and issue 7.8 million ESOP bonus shares to employees. Thus, VIB plans to spend more than VND2,085 billion to pay cash dividends to shareholders.

VIB's credit growth rate over the years is positive, higher than the industry average.

In addition, VIB's Board of Directors also proposed a plan to increase charter capital through the issuance of bonus shares to existing shareholders and employees. In total, after completing the above plans, VIB's charter capital will increase from over VND29,700 billion to over VND34,000 billion.

VIB is also the first bank to reveal its business results in the first quarter of 2025. Accordingly, with a credit growth rate of approximately 3% in the first quarter, it contributed to helping the bank achieve about 20-22% of the annual profit plan of over VND 11,000 billion (about VND 2,200 billion). According to the business roadmap, the business results will be better in the following quarters, so the whole year's outlook for business goals is positive.

Source: https://nld.com.vn/ngan-hang-dau-tien-khai-hoi-chi-hon-2000-ti-dong-chia-co-tuc-tien-mat-196250327131550727.htm

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[Video]. Developing craft villages in rural areas](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/bc880cd4ce0e4ee88eaca6e71d2e8872)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)