The essential role of increasing charter capital

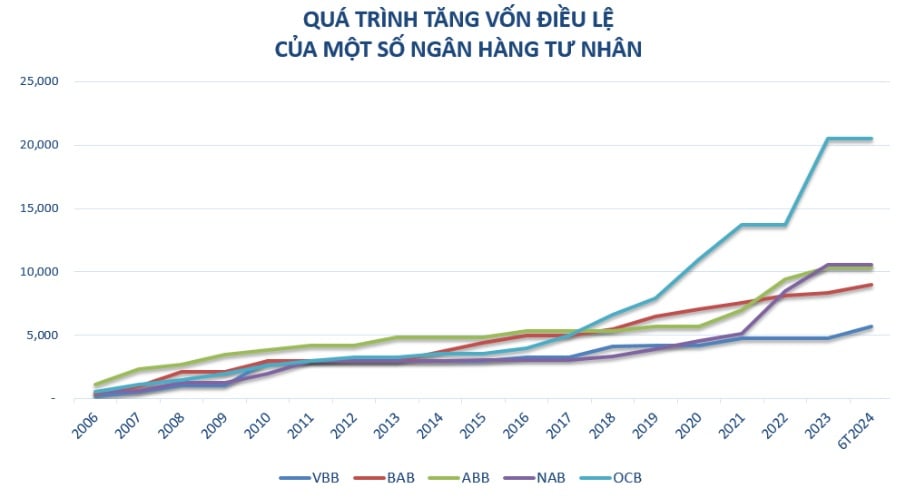

According to Decree 141, by December 31, 2010, commercial banks must ensure a legal capital of VND 3,000 billion and then be extended to December 31, 2011. Therefore, 2011 is also the time when banks race to increase capital to meet the regulation of VND 3,000 billion in charter capital such as SGB, KLB, VBB, NCB, OCB, NAB...

According to data released by the State Bank of Vietnam (SBV), 10 years ago, in 2014, the charter capital of the State-owned commercial bank group accounted for 30% of the entire system, and the private commercial bank group accounted for 44%. However, by the end of June 2024, the charter capital ratios of these two groups were 21% and 55%, respectively, showing outstanding growth in the capital increase race of the private commercial bank group. Specifically, the charter capital of the State-owned commercial bank group as of December 31, 2024 was VND 228,229 billion, an increase of only VND 94,023 billion, equivalent to an increase of 41% compared to the end of 2014. Meanwhile, the charter capital of the private commercial bank group reached VND 587,850 billion, an increase of VND 587,850 billion, equivalent to an increase of 67%.

The private commercial bank group has the opportunity to make a breakthrough in charter capital, especially in the period of 2017-2018, when banks are massively listed on the stock exchange, opening up opportunities to increase capital as well as seek potential strategic shareholders, taking advantage of both domestic and foreign capital mobilization opportunities.

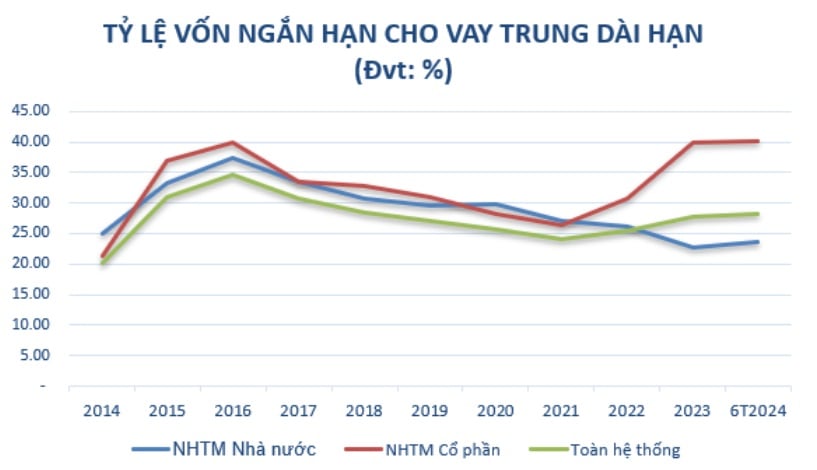

In addition to ensuring the regulations of the management agency, increasing charter capital is a prerequisite, helping banks increase medium and long-term capital to expand business operations when the ratio of using short-term capital for medium and long-term lending is gradually being tightened according to the roadmap in Circular No. 08/2020/TT-NHNN dated August 14, 2020 of the State Bank of Vietnam amending and supplementing Circular No. 22/2019/TT-NHNN stipulating limits and safety ratios in the operations of banks and foreign bank branches.

Source: Compiled from State Bank

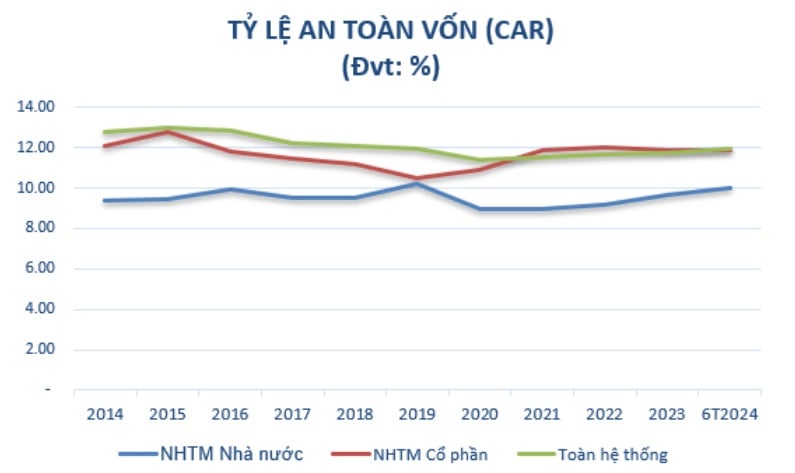

At the same time, the capital increase aims to ensure the capital adequacy ratio (CAR) according to the regulations of the competent authorities, aiming to meet international standards, and continuously increase profits every year. Capital increase is also a task to implement according to the Project on restructuring the system of credit institutions associated with bad debt settlement in the period of 2021 - 2025 in Decision No. 689/QD-TTg dated June 8, 2022 of the Prime Minister. One of the important goals is that by 2023, the CAR ratio of commercial banks will reach at least 10 - 11%; by 2025, it will reach at least 11 - 12%.

After 10 years, the high growth rate of charter capital has led to the CAR ratio of the private commercial bank group being much higher than that of the state-owned commercial bank group. Specifically, in 2014, the minimum capital adequacy ratio of the state-owned commercial bank group was 9.4%, and that of the private commercial bank group was 12.07%. By June 2024, the capital adequacy ratio of the joint-stock commercial bank group (11.86%) will also be higher than that of the state-owned commercial bank group (9.99%), applied according to Circular 41/2016/TT-NHNN.

(*) From 2020, CAR ratio is drawn according to banks applying Circular 41/2016/TT-NHNN. Source: Compiled from SBV

Thus, it can be seen that increasing charter capital plays an important role in ensuring the stability and sustainable development of banks. Not only does it help banks meet the legal and regulatory requirements of management agencies, increasing charter capital also expands business operations, improves financial capacity, and strengthens banks' competitiveness in the market.

Currently, banks are always proactively looking for suitable solutions, especially small and medium-sized banks, including flexible capital raising methods, improving operational efficiency, and complying with new legal regulations to maintain sustainable development in the current market context.

Increasing charter capital through dividend payment is becoming a trend.

There are many ways for banks to increase their charter capital, such as: Issuing new shares, convertible bonds, and cooperating with strategic investors. However, depending on the financial situation, strategic orientation, shareholders' wishes, and the economic situation at each point in time, the bank decides on the method of capital increase.

In the context of the current stock market not really vibrant, issuing new shares faces many difficulties in attracting shareholders to buy shares. In addition, banks must also consider the impact of issuing new shares on the current ownership ratio of shareholders and comply with the regulations of the management agency.

Therefore, issuing shares to pay dividends - a method of increasing capital without raising additional capital from outside - is gradually becoming a trend at banks, especially after the COVID-19 pandemic. Banks can use accumulated dividends to issue shares to current shareholders. This is a reasonable solution when banks want to maintain the consensus of shareholders and do not want to share ownership with new investors.

During the post-COVID-19 recovery period (2021-2022), the State Bank of Vietnam (SBV) encouraged banks not to pay cash dividends to save resources to reduce lending rates. Therefore, most banks had to switch to paying dividends in shares. By 2023, in addition to the dividend rate in shares, banks will pay additional cash dividends at a certain rate. This is not only because the SBV no longer tightens the cash dividend policy, but also to satisfy a group of shareholders who are no longer interested in receiving stock dividends when the recent stock market has not been very positive.

In the group of State-owned commercial banks, from the end of 2023, the SBV has allowed this group to increase its charter capital to ensure capital safety ratio and strengthen lending space. Vietcombank issued an additional 2.17 billion shares to existing shareholders to pay stock dividends at a rate of 38.79%. After completion, the bank's charter capital will increase from VND 55,891 billion to more than VND 77,571 billion. VietinBank was also approved to use the remaining profit in 2022, about VND 11,648 billion, to pay stock dividends, raising its charter capital from VND 53,700 billion to more than VND 65,300 billion.

Or, Agribank has been approved by the 15th National Assembly to supplement its charter capital for the 2021-2030 period to a maximum of VND 17,100 billion. If supplemented, Agribank will increase its charter capital to more than VND 51,500 billion.

Private banks have also been continuously approved by the State Bank to increase charter capital and complete license change procedures since the beginning of 2024.

At the end of July 2024, the State Bank of Vietnam approved OCB to increase its charter capital through the issuance of shares to pay dividends to existing shareholders at a rate of 20%, with a maximum of VND 4,109 billion. After the successful issuance, the Bank's charter capital will increase from VND 20,548 billion to VND 24,658 billion.

Previously, NAB was also approved to increase its charter capital from VND10,580 billion to VND13,725 billion through stock dividend payment at a rate of 25% and issuance of 50 million ESOP shares at a price of VND10,000/share.

Meanwhile, Vietbank plans to use nearly VND1,445 billion to pay dividends in shares and retain VND148 billion. Specifically, Vietbank continues to implement the capital increase plan through offering shares to existing shareholders (approved by the State Bank in July 2023) with a total increase of VND1,003 billion, raising charter capital from VND4,777 billion to VND5,780 billion. To date, the Bank has completed the offering of more than 100.3 million shares and is carrying out procedures to request the State Bank to approve the license amendment, expected to be completed in the third quarter of 2024.

Vietbank also plans to issue nearly 144.5 million shares to pay dividends to existing shareholders, equivalent to a rate of 25%, expected to be implemented in the third and fourth quarters of 2024. The total par value of the issuance is nearly VND 1,445 billion. If the procedures for amending the charter capital license are completed and shares are successfully issued to pay dividends, Vietbank's charter capital will increase to nearly VND 7,225 billion.

In recent years, small and medium-sized banks are the group of banks that have actively increased their charter capital continuously such as Vietbank, OCB, NamABank... Along with the annual business growth plan, increasing charter capital is necessary to help banks improve their financial capacity such as: Increasing scale, increasing competitiveness and meeting the plan to expand the transaction network; continuing to invest in technology systems to serve the modernization of the bank, supporting the development of new products, and improving customer service experience.

Especially in the current period, charter capital is also considered a reserve "buffer", providing resources for banks to be ready to respond to challenges in an unstable economic environment; creating more favorable conditions for banks to promote credit activities, supporting capital for the economy according to the Government's orientation.

One thing to note is that the new Law on Credit Institutions (CIs) that will take effect from July 1, 2024, will significantly affect the increase in charter capital of banks. The new law sets out requirements and regulations on minimum capital, risk management, and credit institutions, creating both opportunities and challenges. Banks need to comply with these regulations to ensure their operations are in compliance with the law, while improving management quality and improving financial capacity.

Source: https://www.congluan.vn/ngan-hang-chu-dong-tang-von-tao-da-phat-trien-ben-vung-post312608.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)