Dialogue with the US for the best advantage

According to President Donald Trump's announcement, the US will apply a 10% import tax on all imported goods into the country from April 5. That means all countries and territories will be subject to a common import tax of 10%. Then, from April 9, the country's largest trading partners will be subject to a higher reciprocal tax, of which Vietnam will be subject to a rate of 46%.

Thus, Vietnam has nearly 1 week before this tax rate is applied. And experts say that now is the time for Vietnam to quickly discuss and negotiate with the US to lower the tax rate.

Even in the short term, businesses themselves need to review contracts and renegotiate prices with US partners to negotiate tax cost sharing to reduce financial risks.

Vietnam needs to quickly discuss and negotiate with the US to reduce tax rates. (Illustration photo)

Responding to VTC News, Mr. Bill Nguyen, Business Development Director of Cainver Import-Export Company, expressed his opinion: “I hope that policymakers and diplomats will renegotiate reasonable tax rates. And we must also explain to Americans that, because of the nature of a commodity processing economy like Vietnam, raw materials are imported from the US, Canada or Europe. We process goods based on orders and then re-export them to the US and European markets, which means we have a labor deficit.

We are not proactive in raw materials from fabric, wood, even accessories that are almost imported for processing, which means we have a labor deficit. So this tax is a tax on the workers themselves. If applied, the workers will be the first to suffer.

Professor Vu Minh Khuong also said that as soon as possible, Vietnam should immediately start discussions with the US side to ensure that imported products from the US enjoy the highest possible preferential policies.

Mr. Khuong explained that the Singapore model has been highly appreciated by the US. Accordingly, the US-Singapore Free Trade Agreement (USSFTA), which came into effect in 2004, has played an important role in promoting trade and investment between the US and Singapore.

"For a long time, Vietnam has applied 0% tax to partners in free trade agreements, but with the US we still apply tax like a normal country. Recently, we have reduced this tax rate significantly but it is still high and the US side considers it not really fair," said Mr. Khuong.

Therefore, according to Mr. Khuong, Vietnam needs to quickly discuss directly with the US to reach a more favorable conclusion, in the context that the US is still leaving open the possibility of negotiation.

Sharing the same view, economic expert Bui Trinh suggested: "We need to clarify the US tax calculation method to be able to renegotiate a more appropriate and fair tax rate."

Dr. Le Duy Binh, Director of Economica Vietnam said: " We also need to continue negotiating to reduce tariffs, we must persevere in dialogue to get the best advantage for ourselves."

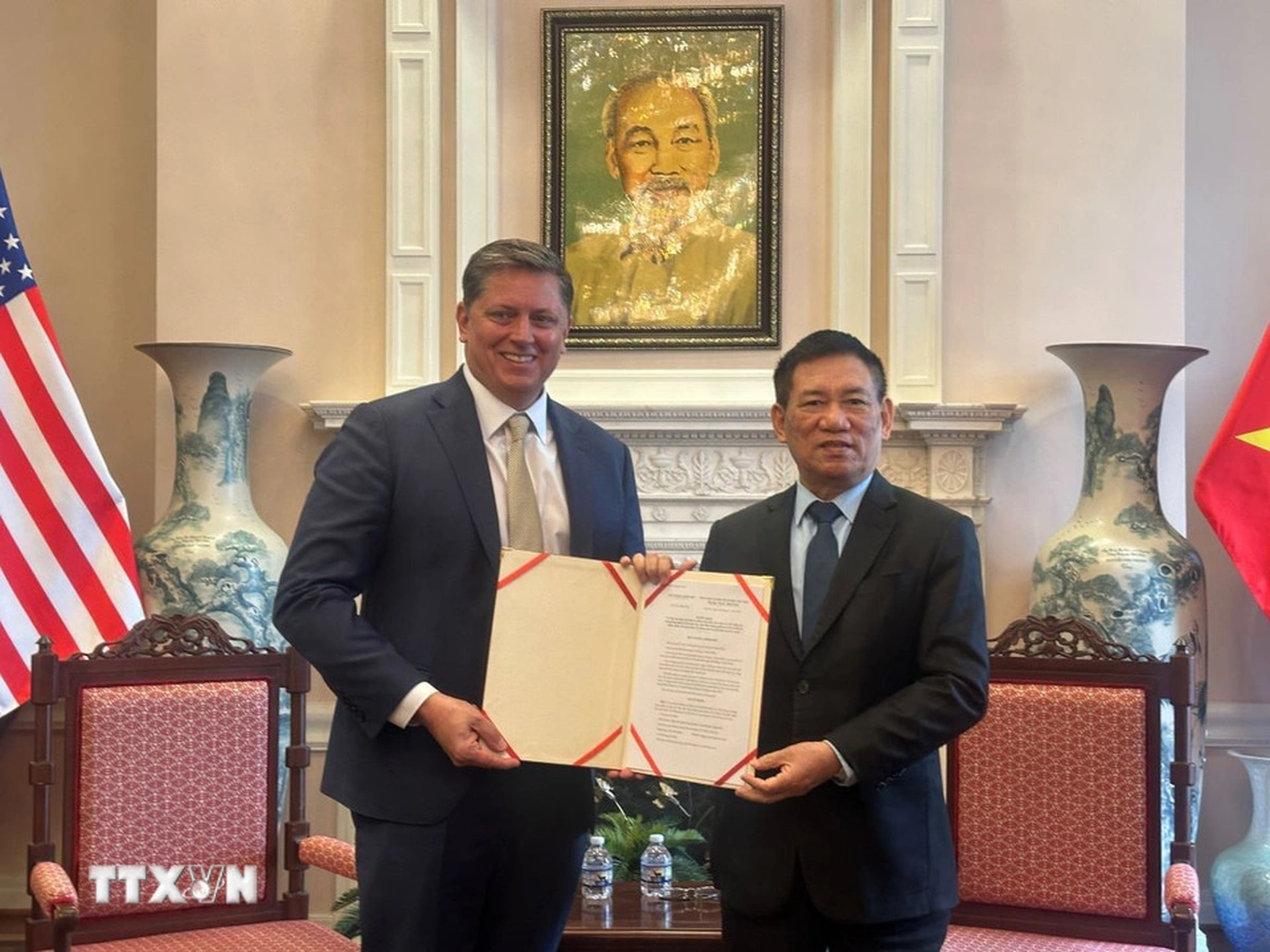

Negotiations with the US also seem to be a solution that the Vietnamese Government has oriented and will soon implement. According to information from the Government's Electronic Information Portal, from April 6 to April 14, Deputy Prime Minister Ho Duc Phoc will attend the High-Level Policy Dialogue program at Columbia University (New York), pay a working visit to the US and pay an official visit to the Republic of Cuba.

Deputy Prime Minister Ho Duc Phoc's working trip to the US took place in the current context and is expected to help negotiate and change the reciprocal tax imposed by the US presidential administration on Vietnam.

At a meeting with ministries and sectors this morning, Prime Minister Pham Minh Chinh also requested the immediate establishment of a rapid response team on this issue. The Prime Minister also assigned Deputy Prime Minister Ho Duc Phoc to chair and direct ministries and sectors to listen to opinions from businesses, including large export enterprises.

Increase import of US goods, diversify export markets

Dr. Le Duy Binh analyzed that when looking at Mr. Trump's tax calculation table, it can be seen that he targets countries with a fairly large trade deficit compared to the US, and at the same time has a low proportion of imported goods from the US.

According to the US announcement, Vietnam's exports to this country are 136.6 billion USD and in return Vietnam buys goods from the US is 13.1 billion USD. The US has a trade deficit of 123.5 billion USD, equivalent to a rate of 90%. Thus, the US chooses a reciprocal tax rate of about 1/2 of the above rate but chooses a higher rate of 46% (instead of 45%).

For example, Cambodia exports 12 billion USD to the US and imports 0.3 billion USD from the US. The US trade deficit with Cambodia is 11.7 billion USD, equivalent to 97.5% and the US imposes a reciprocal tax on Cambodia at 49%.

“ Therefore, to limit this, we should have a solution to reduce the trade deficit from the US by increasing imports of goods from the US instead of some other markets. In particular, Vietnam can focus on high-tech goods to serve the process of technology absorption and innovation.

Vietnam can also expand imports of liquefied natural gas (LNG) from the US to serve the need for clean energy transition.

Another sector that could help Vietnam increase imports from the US is aviation and high technology. Vietnam Airlines and VietJet have signed contracts to buy Boeing aircraft but could speed up the delivery process to increase import turnover from the US,” Mr. Binh suggested.

Vietnamese businesses need to prepare to respond flexibly, proactively and strategically. (Illustration photo)

According to Mr. Mac Quoc Anh, Vice President of the Hanoi Association of Small and Medium Enterprises, facing such a "global shock" policy, businesses need to prepare to respond flexibly, proactively and with a methodical strategy.

Diversifying export markets is an urgent task because the current dependence on the US market is too high. Therefore, it is necessary to increase the search for orders in the EU, Japan, Korea, Australia, ASEAN, the Middle East, and take advantage of signed FTAs (EVFTA, RCEP, CPTPP, etc.).

In addition, Mr. Quoc Anh said that Vietnamese enterprises need to transform their production and investment models in the direction of "green - digital - sustainable", restructure the supply chain according to international standards, optimize energy, save resources, and reduce carbon emissions as mandatory trends.

"The business that goes first will stand firm in the long run," he emphasized.

From a more optimistic perspective, Mr. Quoc Anh believes that the US imposing a 46% tax on Vietnamese goods is also an opportunity for our businesses and national policies to reposition their development strategy - market - production model.

Similarly, Mr. Bill Nguyen emphasized that Vietnamese businesses cannot completely depend on cheap goods thanks to cheap labor anymore, but must increase product value, invest in technology and design to optimize production, and suit market tastes.

“It is important to diversify the market, do not put all your eggs in one basket, do not just depend on the US market. In addition to exporting to the domestic market with 100 million people, the demand for quality products is increasing. For example, in the furniture industry, Japanese enterprises are currently doing very well in Vietnam, so we cannot ignore it.

The coming time may be difficult for businesses, so it requires more initiative. This may be a very big challenge, forcing businesses to change their business models and diversify their markets.

In some ways, we see that all Vietnamese businesses have prepared for market uncertainties. For example, the wood industry has prepared relatively early, since President Trump's previous term.

"Businesses just focus on what they do well, ensure quality goods, clear origin, clear invoices and documents, then there is no reason why they cannot sell products," he analyzed.

Taking an example from his own unit, Mr. Ma Thanh Danh, Chairman of the Board of Directors of CIB International Consulting Company, said that in the immediate future, to cope with the US tax situation, businesses are looking for ways to expand new markets, improve product quality to find alternative markets, or take advantage of incentives from free trade agreements that Vietnam has signed with other countries.

Businesses can also proactively shift part of their production processes or seek creative solutions to reduce the impact of US tariffs.

Vietnamese enterprises are forced to adapt, pay attention to market diversification, promote the development of new markets, especially the European market through trade agreements.

Policymakers also need to regularly share information and provide guidance to businesses, and recommend that businesses shift to new markets and focus on less competitive products.

Source: https://vtcnews.vn/my-ap-thue-doi-ung-46-viet-nam-can-lam-gi-ar935569.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)