On the morning of April 5, An Binh Commercial Joint Stock Bank (ABBank – UPCoM: ABB) held its 2024 Annual General Meeting of Shareholders. The meeting was qualified to proceed with the participation of 249 shareholders, equivalent to 74.2% of the voting shares.

The target of pre-tax profit of 1,000 billion VND is a challenge.

At the congress, reporting the 2023 business results, Mr. Pham Duy Hieu, Acting General Director of ABBank, informed that total assets were VND 161,977 billion, an increase of 24.5% compared to 2022, equivalent to 118.4% of the 2023 plan; Mobilization from customers reached VND 115,654 billion, an increase of 25.9% compared to 2022. The on-balance sheet bad debt ratio was at 2.17%.

However, pre-tax profit in 2023 reached VND513 billion, down 69.6% compared to 2022. Explaining this, Mr. Hieu said that it was due to having to withdraw interest from matured investment bonds that had not been paid, withdraw interest from loans due to overdue debts; and the provision for credit risks had to increase.

Presidium of ABBank General Meeting of Shareholders.

According to Mr. Dao Manh Khang, Chairman of the Board of Directors of ABBank, in 2023, the world situation will be complicated, unpredictable, and conflicting. In the country, there will be more difficulties and challenges than advantages, causing the currency market to be greatly affected and the forecasted difficulties will continue to create many challenges for the bank.

Mr. Khang also, on behalf of the Board of Directors, took responsibility before shareholders for not being really close to the work of planning and forecasting the expected situation in 2023, leading to results far from the set plan.

Entering 2024, ABBank aims for pre-tax profit of VND 1,000 billion, an increase of 95%, nearly double the results achieved in 2023. For other indicators, ABBank plans to have total assets of VND 170,000 billion, an increase of 5% compared to the results achieved in 2023.

Mobilization from customers increased by 13% to VND113,349 billion. Outstanding credit is expected to increase by 13% to VND116,272 billion, with the bad debt ratio controlled below 3%.

While other indicators are targeted to increase, only the ratio of service fees and guarantees to total income is forecast to decrease by 7.34 percentage points, to 13.66% compared to 2023. Moving forward to 2028, the bank targets $3 billion in market capitalization, 2% ROA and $15 billion in total assets.

Many shareholders believe that the bank is setting a pre-tax profit target of VND1,000 billion, which is limited compared to the total assets. Mr. Dao Manh Khang shared that looking at the reality in 2023, when the bank's profits are at a low point, this target also creates pressure, challenges, and requires efforts from the entire system. This places a heavy responsibility on the entire bank, and it is impossible to be unfaithful to shareholders.

Will not be listed on HoSE this year

Regarding fund allocation and profit distribution after tax in 2023, ABBank's Board of Directors said that the bank's profit after tax in 2023 is 398.2 billion VND.

After setting aside funds, the remaining profit for 2023 is VND 298.7 billion. The remaining unused profit from previous years is VND 1,542 billion. Thus, ABBank's total undistributed profit is nearly VND 1,840.7 billion.

On that basis, propose the Board of Directors to approve and submit to the General Meeting of Shareholders for approval the retention of all remaining undistributed profits to supplement capital sources to implement the strategic plan, creating internal accumulation to increase charter capital in the future.

Shareholders asked questions to ABBank's board of directors at the 2024 Annual General Meeting of Shareholders.

However, shareholders believe that the remaining profits can be used to pay bonuses to shareholders. Mr. Khang said that, looking directly at the limitations, ABBank still needs to make comprehensive changes, from the credit process being too long, uncompetitive products, and weak system capacity.

Not paying dividends is to focus resources on technology, platforms, and building human systems. All of which are not yet available and require investment.

Therefore, shareholders are asked to be patient to "pick the sweet fruit" because the strategy cannot be done quickly. "If you want the bamboo tree to grow tall, you have to wait. When determining the strategic goal as long-term, it is necessary to change the old things, innovate comprehensively, including the board of directors. If it does not meet the professional capacity requirements, it must learn and supplement. If it cannot be learned, it will be replaced" - Mr. Khang emphasized.

Sharing about the bank's plan to list on the stock exchange in the near future, Mr. Khang said that listing on the HoSE will help the bank's operations become more transparent, increase the value of shares, and make investors feel more secure. Major shareholders of the bank such as IFC and Maybank also raised the need for transparent governance.

However, based on the general assessment of the economy in 2024 and advice from McKinsey, this year is not a favorable time to list shares on the stock exchange. However, in the next 5 years, with a target of a capitalization value of 3 billion USD, the bank will not only need to grow organically but also need to have incentives such as calling for foreign capital, having new shareholders or listing on the stock exchange.

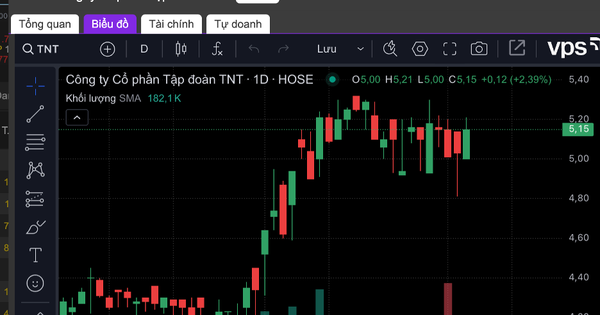

At the meeting, many shareholders also expressed their frustration when the stock price did not increase but decreased. However, Mr. Khang shared that ABBank could not control the stock price and did not increase it to benefit anyone .

Source

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

Comment (0)