In recent years, private equity funds have taken over long-standing, large-scale, market-leading businesses in specific business segments, providing growth capital, technology, management expertise, and operational expansion.

This trend is expected to continue as more and more foreign investors recognize the potential opportunities in the Vietnamese market.

ESG (environmental – social – corporate governance) strategies will remain a priority. ESG prioritizes green growth, including energy transition, decarbonization, circular economy and social impact…

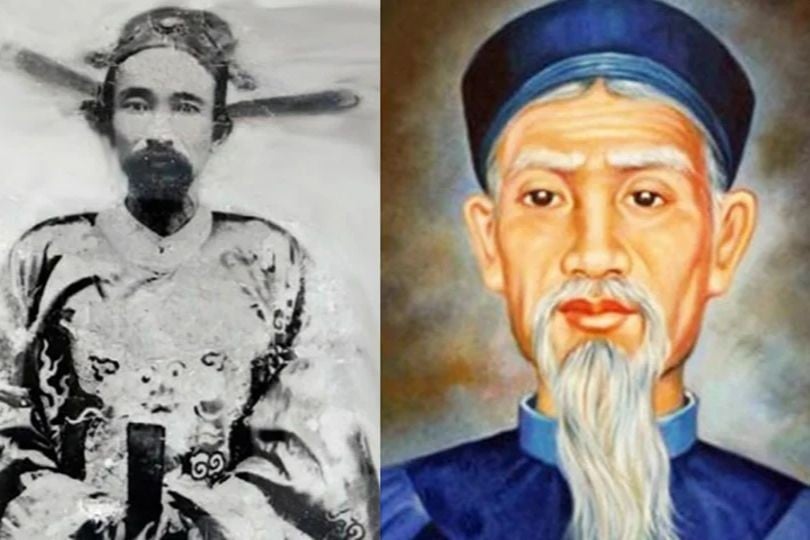

Mr. Luu Quang Vu - Chairman of M&A Partners talks about the M&A market.

ESG also prioritizes increasing digitalization in various fields, businesses in Vietnam embrace technology and digitalization such as: Access to AL, Fintech and other emerging technologies. These businesses are becoming attractive targets for M&A deals.

Mr. Luu Quang Vu - Chairman of M&A Partners - Head of the M&A Vietnam Investment Promotion and Connection Board shared: " We also received many "orders" in which investors will target businesses with stable and long-term product investment strategies such as agriculture and food, with the basic foundation of the economy - food production and distribution ".

Besides, according to Mr. Vu, investors also want to "close" deals in areas that can take advantage of cheap valuations such as: real estate (especially industrial real estate), infrastructure construction, logistics or medical and health care businesses.

In addition, the M&A trend in the education sector is taking place vigorously. A series of deals have been announced such as: Vietravel Tourism Company announced to own 66% of shares of Kent International College, Hutech Education Investment and Development Joint Stock Company acquired Ho Chi Minh City University of Economics and Finance (UEF), Hung Hau Development Joint Stock Company acquired Van Hien University...

In 2025, the M&A market in Vietnam will still face many challenges due to the trend of being more cautious in identifying transactions and assets that can bring assets and value to investors in a more strategic direction, not just simply immediate financial profits. This is a challenge and also an opportunity for Vietnamese enterprises, investors as well as consulting units and organizations participating in the M&A market.

Source: https://vtcnews.vn/ma-viet-nam-van-con-nhieu-thach-thuc-ar903204.html

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] The capital of Binh Phuoc province enters the political season](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c91c1540a5744f1a80970655929f4596)

Comment (0)