Choose a reputable "companion"

In the context of bank interest rates now falling sharply, almost to the bottom with interest rates of less than 5.5%/year for a 12-month term, the bond market is gradually gaining attention again. Along with that, after the market purification period, investors have a clearer view of bond products, as well as the need for a reputable and dedicated consulting unit.

With this mentality, many investors choose to stick with TCBS even though the company's interest rates have recently been 0.5 - 1% lower than other organizations.

“Instead of choosing bonds with an interest rate of 14-15%/year but always worrying about whether the principal and interest will be paid on time or not, I choose bonds with a lower interest rate but in return, I get to pay interest and mature on time as committed. More importantly, once I buy bonds at TCBS, I always feel that information is shared transparently and I feel secure with my investment,” said Nguyen Quoc Minh, a customer of TCBS.

According to TCBS representative, for a bond to be offered to the public, these codes must undergo strict appraisal, screening, monitoring and risk management according to Techcombank's bond investment process.

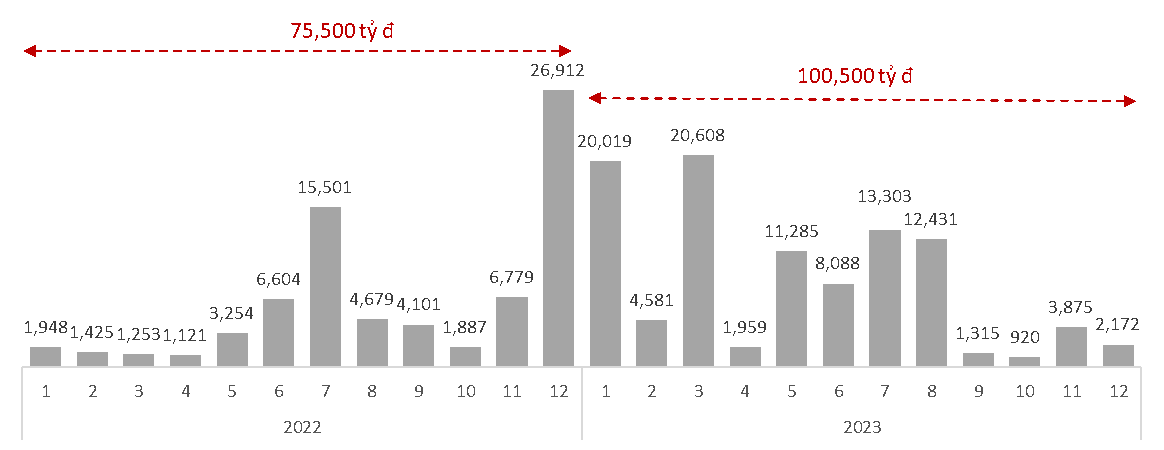

TCBS representative also affirmed that even in the difficult period of 2022, no bond advised by TCBS has been late in maturity and interest payment. More than 500 bond codes advised by TCBS have been fully paid on time in 2022 with an amount of more than 75,000 billion VND, and continue to pay more than 100,500 billion VND in principal and interest to investors from 2023.

Support investors to make informed decisions

TCBS also particularly emphasizes the transparency of market information.

“Investors need to have access to full information on individual corporate bonds and the financial situation of the issuer. This helps investors have enough data before deciding to invest, thereby helping to protect their legitimate rights and interests,” said a TCBS representative.

TCBS commits to providing full and transparent information in 3 stages for customers buying bonds on the TCInvest system. Specifically, before purchasing, investors are always provided with full offering documents with information on new bonds, analysis reports of the issuing organization, expected debt repayment cash flow reports, general information on the industry group of the offered bonds, reports on the corporate bond market, comparison of listed issuers, transaction history, market liquidity.

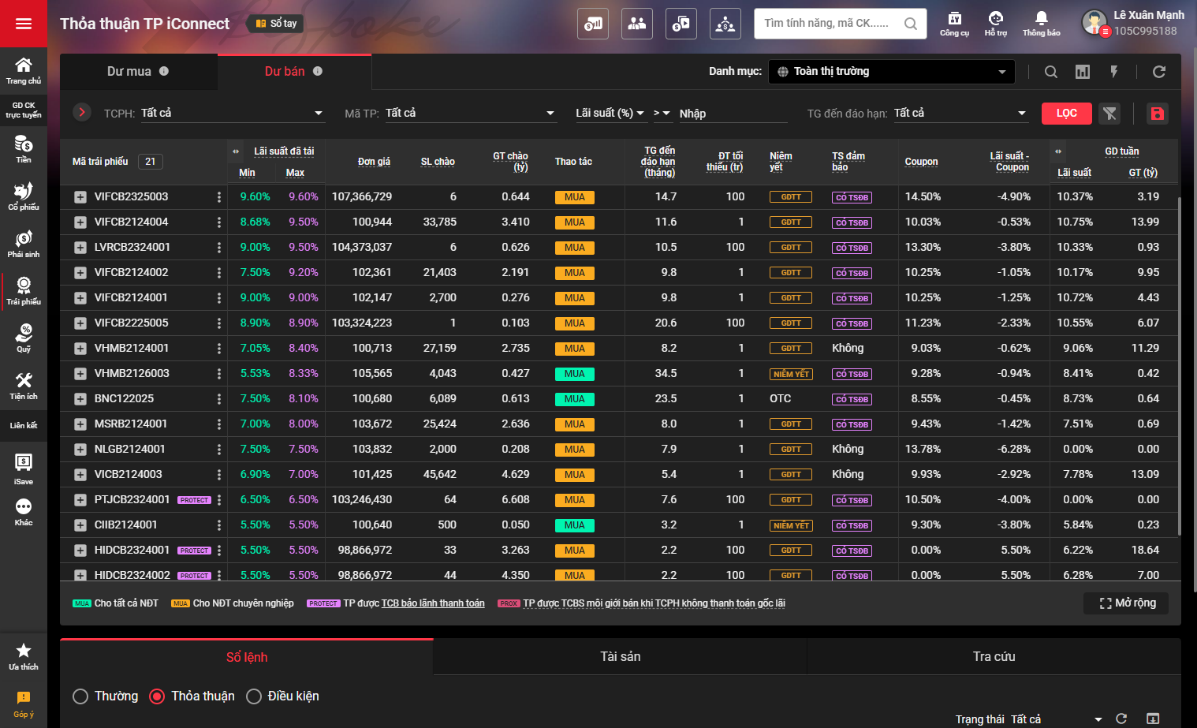

While participating in the purchase, investors receive a detailed quote of interest rates, bond cash flows, simulated early resale interest rates, and investment risk warnings on the TCInvest online trading system interface. The contract and risk identification are both sent to customers' emails for convenient and transparent tracking and saving.

After purchase, TCBS has an agency department responsible for monitoring the issuer's information to promptly provide all important information to bond buyers, always ensuring the interests of investors.

Notably, during the process of placing an order to buy bonds, investors are always informed by TCBS about the risks they may encounter when investing in bonds. Customers can try placing an order to preview the contract content on the TCInvest system.

In the contract, risk awareness is presented in a separate document, independent of the commercial terms and conditions and other contract information. TCBS also increases risk awareness for investors by displaying risk notes in the content of all transaction emails.

iConnect: Liquidity solution for investors at TCBS

TCBS representative shared that the iConnect Bond Agreement system helps customers solve two problems: First, manage and limit liquidity risks; Second, increase profits compared to the periodic interest rate of the bond when there is a need to resell before maturity.

Launched in Vietnam in 2018, iConnect at TCBS is a pioneering technology project in the market to digitize the buying and selling of corporate bonds, supporting customers to track and search for advertising orders (buying and selling) of bonds from individual and institutional customers. To date, iConnect has had nearly 79,000 investors using it with an average of nearly 13,000 customer visits per day.

In 2023 alone, investors traded VND 24,527 billion worth of bonds on iConnect and 29,000 customers successfully resold bonds with higher interest rates than when they bought them on this system.

Thanh Ha

Source

![[Photo] Prime Minister Pham Minh Chinh receives Mr. Jefferey Perlman, CEO of Warburg Pincus Group (USA)](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/c37781eeb50342f09d8fe6841db2426c)

![[UPDATE] April 30th parade rehearsal on Le Duan street in front of Independence Palace](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/18/8f2604c6bc5648d4b918bd6867d08396)

Comment (0)