American Semiconductor Sits on Fire Because of an "Urgent Notice"

The China Semiconductor Industry Association (CSIA) recently issued an “urgent notice” to change the way of determining the origin of integrated circuit (IC) products, amid increasing trade tensions with the US.

The move is expected to give a significant advantage to domestic semiconductor companies while undermining US President Donald Trump's efforts to re-industrialize.

Specifically, on April 11, the China Semiconductor Industry Association (CSIA) sent an "urgent notice" to members via the WeChat application.

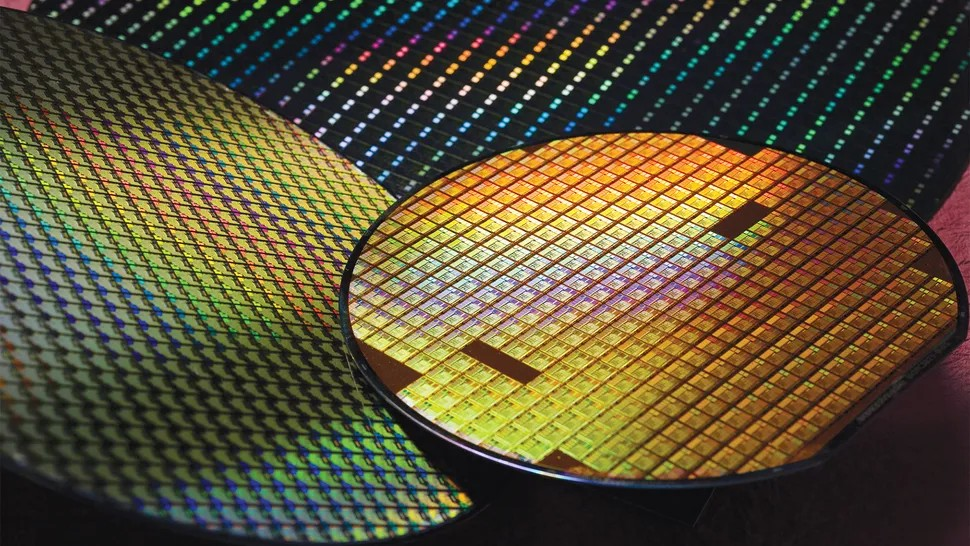

In it, CSIA cited new regulations from China's customs agency, stating that from now on, the origin of chips will be determined based on the "location of the wafer manufacturing plant".

This is an important step in the semiconductor supply chain, along with design, packaging and testing. Under the new regulations, regardless of whether the chip has been packaged or not, when carrying out import procedures, businesses must declare the wafer manufacturing location as the origin of the goods.

Previously, the method of determining origin was based on “final assembly or transformation,” meaning the country where the finished product was assembled would be recorded as the country of origin. The United States now applies this method of calculation.

China's adjustment of the product origin definition for semiconductor chips is expected to encourage semiconductor developers to prioritize processing products at domestic foundries such as SMIC, Hua Hong, or at facilities of TSMC - a major processing partner present in China.

According to a report from consulting firm ICWise, this change could have significant impacts on the US semiconductor industry, in the context that China - the world's largest IC consumer market - tends to limit the acceptance of products manufactured in the US.

This could prompt global semiconductor manufacturers to step up building factories outside the US to maintain access to the Chinese market.

As a result, President Donald Trump's goal of "making America great again" - with a focus on restoring domestic manufacturing - is at risk.

However, according to Mr. He Hui - Director of semiconductor research at Omdia - the actual impact of the tariff regulation may not be too serious, because the majority of chips imported into China are not currently manufactured or shipped directly from the US.

According to statistics from China's customs agency, in 2024, the country imported integrated circuits (ICs) worth 386 billion USD, up 10.4% over the same period last year.

Japan warns Google

The Japan Fair Trade Commission (JFTC) has just sent a suspension order to Google for anti-competitive behavior related to search services on Android devices.

In a statement, the JFTC said Google violated Japan's antitrust laws by requiring Android device makers to favor its apps and search services through licensing agreements.

Under Japan's anti-monopoly law, businesses are prohibited from implementing restrictive covenants that affect the business operations of their partners.

The JFTC first announced the launch of its investigation into Google on October 3, 2023. In April 2024, the Commission approved a commitment plan from Google to address some anticompetitive concerns.

The suspension represents a tougher stance by the Japanese government, and is the first time Japan has done so against an American tech giant.

Accordingly, Japan ordered Google to stop requiring partners to install and prioritize its services on smartphones. In addition, the company should relax the conditions for sharing advertising revenue, allowing manufacturers to choose from a variety of options.

Google is required to appoint an independent party to report on compliance to the JFTC for the next five years.

The JFTC said it has coordinated with other foreign authorities that have investigated Google.

US offers 'huge' price to drop Meta lawsuit

Meta and the US Federal Trade Commission are facing off in a historic lawsuit. However, few people know that the case could have been settled if Meta had agreed to pay $30 billion.

In late March, Mark Zuckerberg called the head of the Federal Trade Commission (FTC) with an offer of $450 million to settle an antitrust lawsuit that was about to go to trial.

The offer falls far short of the $30 billion the FTC was seeking. It’s also a fraction of the value of Instagram and WhatsApp, the two apps Meta acquired years ago.

The Wall Street Journal reported that Zuckerberg expressed confidence in the call that President Donald Trump would support him. The Facebook co-founder has been pressuring the president in recent weeks to intervene in the case.

FTC Chairman Andrew Ferguson found the offer untrustworthy and was unwilling to settle for less than $18 billion and a legal settlement.

As the trial approached, Meta increased its offer to nearly $1 billion. Zuckerberg personally led a frantic lobbying effort with the FTC to avoid a trial.

At one point, Trump seemed open to a deal with Meta and Zuckerberg, directing staff to research and ask how the deal would work, the source said.

But he also listened to the other side. On April 8, new FTC Chairman Ferguson met with the President in the Oval Office to discuss the issue.

Here, the group of officials asked Mr. Trump not to intervene in the case and to take the case to court. Mr. Trump agreed.

Meta proposed several policy changes when it saw the risks, the FTC countered with a $30 billion settlement, according to the source.

On April 14, the trial officially began. The FTC asked Zuckerberg to appear and testify for four hours.

(Synthetic)

Source: https://vietnamnet.vn/ban-dan-my-ngoi-tren-dong-lua-vi-1-thong-bao-khan-nhat-ban-canh-cao-google-2392744.html

![[Photo] Thousands of Buddhists wait to worship Buddha's relics in Binh Chanh district](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/3/e25a3fc76a6b41a5ac5ddb93627f4a7a)

![[Photo] Bustling construction at key national traffic construction sites](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/5/2/a99d56a8d6774aeab19bfccd372dc3e9)

Comment (0)