A series of steel companies reported losses in the third quarter of 2024, leading to a decline in many steel stocks. However, according to experts' forecasts, the difficult period of the steel industry will soon pass.

A series of steel companies reported losses in the third quarter of 2024, leading to a decline in many steel stocks. However, according to experts' forecasts, the difficult period of the steel industry will soon pass.

|

Steel industry stocks fall sharply

Immediately after the third quarter 2024 reports of steel companies were announced, with slowing growth and even losses, a series of steel stocks turned to decline sharply. Statistics from July 8 to the end of November 2024, the group of 5 listed steel stocks decreased by an average of 39.5%, while in the same period, the VN30 index decreased by only 1.3% and the VN-Index decreased by only 3.2%.

The decline in steel stocks occurred in both commercial enterprises, such as SMC Investment and Trading Joint Stock Company (code SMC) down 66.4%; Tien Len Steel Group Joint Stock Company (code TLH) down 48.4%... and manufacturing enterprises, such as Hoa Sen Group (code HSG) down 25%, Nam Kim Steel Joint Stock Company (code NKG) down 23%, Vietnam Steel Corporation - JSC (code TVN) down 34.5%...

For example, in the case of Hoa Sen Group, in the fourth quarter of the 2023-2024 fiscal year (from July 1, 2024 to September 30, 2024), revenue reached VND 10,108.7 billion, an increase of 24.7% over the same period; profit after tax recorded a loss of VND 185.89 billion over the same period; gross profit margin decreased sharply from 13.2% to only 8.4%.

Accumulated in the 2023 - 2024 fiscal year (from October 1, 2023 to September 30, 2024), Hoa Sen Group achieved revenue of VND 39,271.89 billion, an increase of 24.1% over the same period; after-tax profit recorded a profit of VND 510.12 billion, an increase of 15.97 times over the same period.

Also a large-scale steel manufacturing enterprise, Pomina Steel Joint Stock Company (code POM) lost an additional VND 285.82 billion in the third quarter of 2024, bringing the total loss in the first 9 months of 2024 to VND 790.7 billion compared to the same period last year with a loss of VND 646.98 billion, an increase of VND 143.73 billion.

Although not losing money like Hoa Sen Group and Pomina Steel, Nam Kim Steel Company's business results also grew more slowly. Specifically, in the third quarter of 2024, Nam Kim Steel recorded a profit increase of 174.1%, up to VND 64.85 billion; accumulated in the first 9 months of 2024, the profit increased by 296%, up to VND 434.59 billion.

In the group of commercial enterprises, SMC Investment and Trading Company recorded a loss of VND 82.42 billion in the third quarter of 2024. Previously, in the first 6 months of 2024, this company escaped losses thanks to the sale of investments and liquidation of assets. By the third quarter, when there was no more profit from other activities, SMC Investment and Trading Company suffered losses again.

Similarly, Tien Len Steel Company lost 120.22 billion VND in the third quarter; accumulated loss in the first 9 months of 2024 was up to 269.24 billion VND.

Steel prices expected to rise again soon

The steel industry's trading group reported a loss in business results in the first 9 months of 2024 due to continued decline in steel prices amid difficult sales, forcing them to operate below cost. Therefore, this group only maintains a certain amount of inventory.

On the contrary, although the growth of manufacturing enterprises has slowed down, there are still signs of increasing inventory accumulation. In the first 9 months of 2024, Hoa Sen Group increased its inventory by VND 2,073.6 billion, up to VND 9,702.2 billion, accounting for 49.6% of total assets; Nam Kim Steel increased its inventory by VND 858.1 billion, up to VND 6,576.8 billion, accounting for 47.7% of total assets; Vietnam Steel increased its inventory by VND 467.3 billion, up to VND 4,514.2 billion, accounting for 18.6% of total assets...

With the inventory accumulation strategy, if steel prices do not rebound soon, steel manufacturing enterprises will be at risk. However, according to experts' forecasts, the difficult period of the steel industry will soon end and steel prices will increase again.

Vietcombank Securities Company (VCBS) expects that steel prices will maintain a recovery trend due to the improvement in construction demand in the US, Europe and China thanks to the loose monetary policy globally; increased global production demand will cause input material prices such as iron ore and coking coal to increase, leading to a rebound in selling prices; China's steel production output will decline sharply, while inventories will remain low at the end of 2024.

Similarly, BIDV Securities Company (BSC) forecasts that steel prices have entered the end of the price reduction cycle, forming a bottom in the short and medium term (next 3-6 months). In June 2024, China introduced new quality standards for steel bars; at the same time, a number of countries initiated anti-dumping investigations on Chinese steel. This created a wave of inventory clearance, creating downward pressure on prices. This adjustment mainly comes from inventory pressure in society, not in factories, so it is a short-term adjustment.

Source: https://baodautu.vn/loat-co-phieu-nganh-thep-lao-doc-d231584.html

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

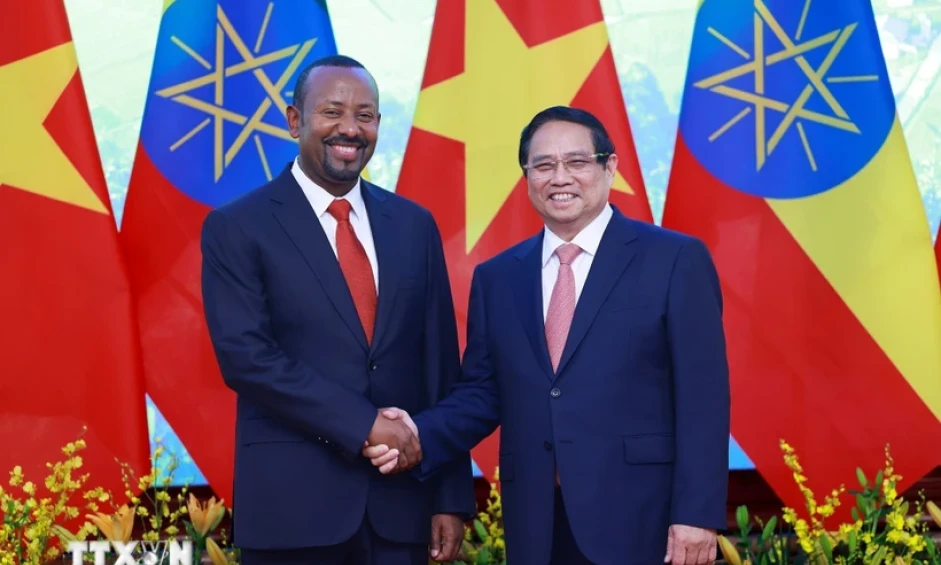

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)