The State Bank has just issued an official dispatch approving the proposed personnel appointment for the position of General Director of the Military Commercial Joint Stock Bank (MB, HoSE: MBB) for Mr. Pham Nhu Anh - Deputy General Director in charge of the Executive Board.

From today (May 18), Mr. Pham Nhu Anh officially became the General Director of MB. Previously, the Board of Directors of MB conducted procedures to appoint Mr. Pham Nhu Anh to the position of General Director in accordance with the law and regulations of MB.

Mr. Anh was assigned by MB's Board of Directors to hold the position of Deputy General Director in charge of MB's Executive Board and assumed the powers and duties of General Director from April 12, after Mr. Luu Trung Thai was elected Chairman of the Board of Directors.

Mr. Anh was born in 1980, introduced by the bank as a graduate of Master's degree in Business Administration - UBI Institute of Business Administration - Belgium and a Bachelor of Economics majoring in Business Administration, University of Economics and Business Administration, University of Danang, with nearly 20 years of experience working in the finance and banking industry.

At MB, Mr. Anh has held many professional and management positions in the bank such as Branch Director, Block Director, Member of the Executive Board...

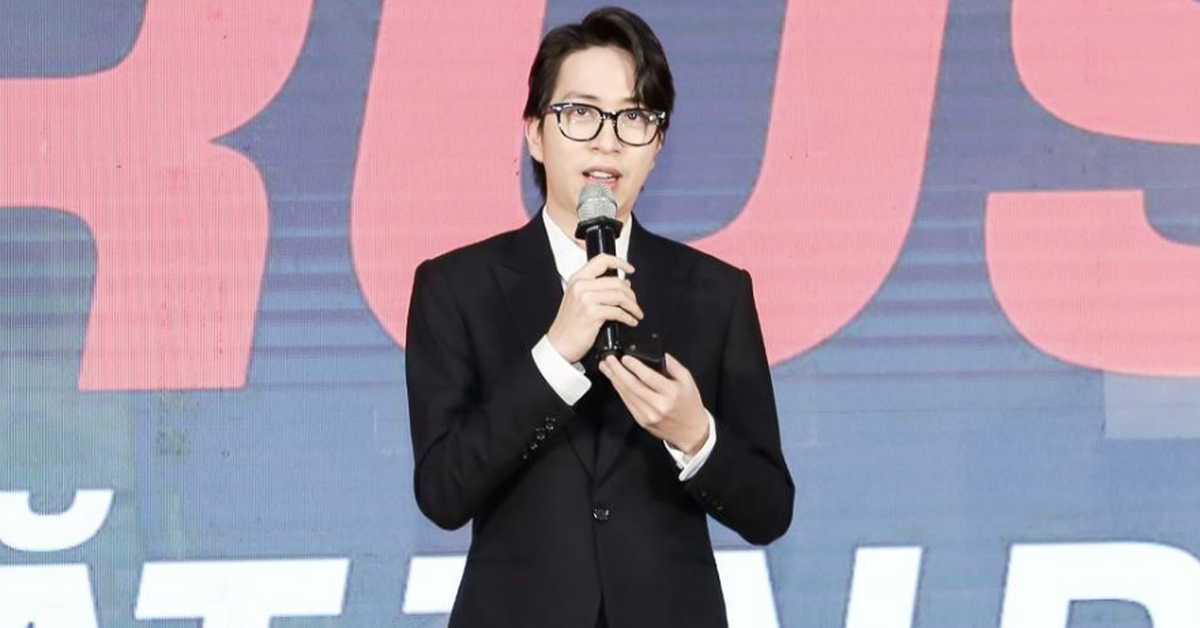

New General Director of MB Pham Nhu Anh.

Regarding MB's business situation under Mr. Anh's management, in the first quarter of 2023, the bank reported pre-tax profit of more than VND 6,512 billion, an increase of 10% over the same period last year thanks to a 13% reduction in credit risk provisioning costs.

Net profit from business activities was the only source of revenue growth in the first quarter of MB when it earned more than VND10,227 billion, up 22% over the same period last year.

On the other hand, most of the bank's non-interest income decreased. Accordingly, profit from service activities decreased by 38%, profit from foreign exchange trading decreased by 21%, profit from trading securities also decreased by 63% and profit from investment securities decreased by 87%.

By the end of the first quarter of 2023, the bank's total assets reached more than VND 760,761 billion, up 4% compared to the beginning of the year. Of which, cash decreased by 21% to VND 2,965 billion, deposits at the State Bank decreased by 52% to VND 19,077 billion, customer loans increased slightly by 5% to VND 481,386 billion.

Notably, total bad debt increased by 68% compared to the beginning of the year, recording more than VND 8,453 billion. Of which, substandard debt (group 3 debt) increased the most, pushing the ratio of bad debt to outstanding loans up from 1.09% at the beginning of the year to 1.76% .

Source

![[Photo] President Luong Cuong meets 100 typical examples of the Deeds of Kindness Program](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/ce8300edfa7e4afbb3d6da8f2172d580)

![[Photo] Many practical activities of the 9th Vietnam-China border defense friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/3016ed3ef51049219574230056ddb741)

![[Photo] Opening of the Exhibition on Green Growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/253372a4bb6e4138b6f308bc5c63fd51)

![[Photo] Opening of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/488550ff07ce4cd9b68a2a9572a6e035)

![[Photo] President Luong Cuong receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/504685cac833417284c88a786739119c)

![[Photo] National Assembly Chairman Tran Thanh Man meets with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/16/c196dbc1755d46e4ae7b506c5c15be55)

Comment (0)