- Update the latest gold price details on April 16, 2025 in the domestic market

- Update the latest gold price on April 16, 2025 on the world market

- Gold price forecast today April 17, 2025 Domestic gold price and world gold price both set new records

Update the latest gold price details on April 16, 2025 in the domestic market

Gold prices on April 16, 2025 continued to maintain a spectacular increase, conquering new record prices, creating a vibrant atmosphere in the domestic gold market. Major brands such as SJC, PNJ, DOJI, Mi Hong, Phu Quy, Bao Tin Minh Chau and Vietinbank Gold all adjusted gold prices to increase sharply, bringing excitement to investors. Let's explore the details of gold prices on April 16, 2025 to grasp the gold market situation quickly and easily!

In Hanoi, the price of SJC gold listed by Saigon Jewelry Company reached 113 million VND/tael (buy) and 115.5 million VND/tael (sell), a sharp increase of 7.5 million VND/tael in both directions compared to the previous day. The same situation occurred in Ho Chi Minh City, Da Nang and the Western region, with PNJ announcing the price of SJC gold at 113 - 115.5 million VND/tael, an increase of 7.5 million VND/tael, while PNJ gold reached 110.5 - 113.6 million VND/tael, an increase of 7.7 million VND/tael and 7.6 million VND/tael, respectively. DOJI Group also recorded an impressive increase, listing the price of AVPL/SJC gold in Hanoi, Ho Chi Minh City and Da Nang at 113 - 115.5 million VND/tael, an increase of 7.5 million VND/tael, showing that the gold price on April 16, 2025 is anchored at a high level across all regions.

Not only gold bars, jewelry gold and plain rings also witnessed a strong increase. At PNJ, the price of 999.9 jewelry gold reached 110.5 million VND/tael (buy) and 113.6 million VND/tael (sell), up 7.7 million VND/tael and 7.6 million VND/tael. PNJ 999.9 plain rings, Kim Bao gold and Phuc Loc Tai 999.9 traded at 110.5 - 113.6 million VND/tael, up 7.7 million VND/tael and 7.6 million VND/tael respectively. 18K jewelry gold (750) at PNJ reached 82.4 - 84.9 million VND/tael, up 5.77 million VND/tael, while 14K gold (585) was at 63.76 - 66.26 million VND/tael, up 4.51 million VND/tael. Lower gold types such as 10K (44.66 - 47.16 million VND/tael, up 3.2 million VND/tael) and 9K (40.03 - 42.53 million VND/tael, up 2.89 million VND/tael) also broke out simultaneously, affirming that the gold price on April 16, 2025 is shining in all segments.

Other brands are also not out of the strong upward trend. Mi Hong listed the price of SJC gold at 112 - 116.5 million VND/tael, an increase of 500 thousand VND/tael for buying. Phu Quy adjusted the price to 111 - 114 million VND/tael, an increase of 6.2 million VND/tael and 6 million VND/tael respectively. Bao Tin Minh Chau announced the price at 112.5 - 115.5 million VND/tael, an increase of 7 million VND/tael (buying) and 7.5 million VND/tael (selling). Vietinbank Gold kept the selling price at 115.5 million VND/tael, an increase of 7.5 million VND/tael. At DOJI, 9999 raw gold in Hanoi increased to 110 - 112.6 million VND/tael, up 730 thousand VND/tael and 700 thousand VND/tael respectively, continuing to consolidate the position of gold price on April 16, 2025 at a new peak.

With the gold price today, April 16, 2025, continuously conquering records, the market is opening up attractive opportunities for those who want to invest or accumulate gold. However, this strong increase also makes many people curious about whether the gold price will continue to maintain its form. If you are interested in the gold price today, April 16, 2025, this is a great time to closely monitor market developments. The gold price tomorrow, April 17, 2025, is forecasted to continue to break out, when the world gold price reaches a peak of 3,350.04 USD/ounce and the domestic price is anchored at 113 - 116.0 million VND/tael. The opportunity to invest in gold is wide open!

Detailed domestic gold price list on April 16, 2025:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 113.0 | ▲7500 | 115.5 | ▲7500 |

| DOJI Group | 113.0 | ▲7500 | 115.5 | ▲7500 |

| Red Eyelashes | 112.0 | ▲500 | 116.5 | - |

| PNJ | 110.5 | ▲7700 | 113.6 | ▲7600 |

| Vietinbank Gold | 115.5 | ▲7500 | ||

| Bao Tin Minh Chau | 112.5 | ▲7000 | 115.5 | ▲7500 |

| Phu Quy | 111.0 | ▲6200 | 114.0 | ▲6000 |

| 1. DOJI - Updated: April 16, 2025 18:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 113,000 ▲7500 | 115,500 ▲7500 |

| AVPL/SJC HCM | 113,000 ▲7500 | 115,500 ▲7500 |

| AVPL/SJC DN | 113,000 ▲7500 | 115,500 ▲7500 |

| Raw material 9999 - HN | 110,000 ▲730 | 112,600 ▲700 |

| Raw material 999 - HN | 109,900 ▲730 | 112,500 ▲700 |

| 2. PNJ - Updated: April 16, 2025 18:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| HCMC - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Hanoi - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Hanoi - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Da Nang - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Da Nang - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Western Region - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Western Region - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - PNJ | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - Southeast PNJ | 110,500 ▲7700K | |

| Jewelry gold price - SJC | 113,000 ▲7500K | 115,500 ▲7500K |

| Jewelry gold price - PNJ 999.9 Plain Ring | 110,500 ▲7700K | |

| Jewelry gold price - Kim Bao Gold 999.9 | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 110,500 ▲7700K | 113,600 ▲7600K |

| Jewelry gold price - Jewelry gold 999.9 | 110,500 ▲7700K | 113,000 ▲7700K |

| Jewelry gold price - Jewelry gold 999 | 110,390 ▲7690K | 112,890 ▲7690K |

| Jewelry gold price - Jewelry gold 9920 | 109,700 ▲7640K | 112,200 ▲7640K |

| Jewelry gold price - Jewelry gold 99 | 109,470 ▲7620K | 111,970 ▲7620K |

| Jewelry gold price - 750 gold (18K) | 82,400 ▲5770K | 84,900 ▲5770K |

| Jewelry gold price - 585 gold (14K) | 63,760 ▲4510K | 66,260 ▲4510K |

| Jewelry gold price - 416 gold (10K) | 44,660 ▲3200K | 47,160 ▲3200K |

| Jewelry gold price - 916 gold (22K) | 101,110 ▲7050K | 103,610 ▲7050K |

| Jewelry gold price - 610 gold (14.6K) | 66,580 ▲4700K | 69,080 ▲4700K |

| Jewelry gold price - 650 gold (15.6K) | 71,100 ▲5000K | 73,600Delivered ▲5000K |

| Jewelry gold price - 680 gold (16.3K) | 74,490 ▲5240K | 76,990 ▲5240K |

| Jewelry gold price - 375 gold (9K) | 40,030 ▲2890K | 42,530 ▲2890K |

| Jewelry gold price - 333 gold (8K) | 34,940 ▲2540K | 37,440 ▲2540K |

| 3. SJC - Updated: April 16, 2025 18:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 113,000 ▲7500 | 115,500 ▲7500 |

| SJC gold 5 chi | 113,000 ▲7500 | 115,520 ▲7500 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 113,000 ▲7500 | 115,530 ▲7500 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 110,800 ▲7800 | 113,500 ▲7500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 110,800 ▲7800 | 113,600 ▲7500 |

| Jewelry 99.99% | 110,800 ▲7800 | 112,900 ▲7400 |

| Jewelry 99% | 107,282 ▲6626 | 111,782 ▲6626 |

| Jewelry 68% | 71,929 ▲3832 | 76,929 ▲3832 |

| Jewelry 41.7% | 42,234 ▲1886 | 47,234 ▲1886 |

Update the latest gold price on April 16, 2025 on the world market

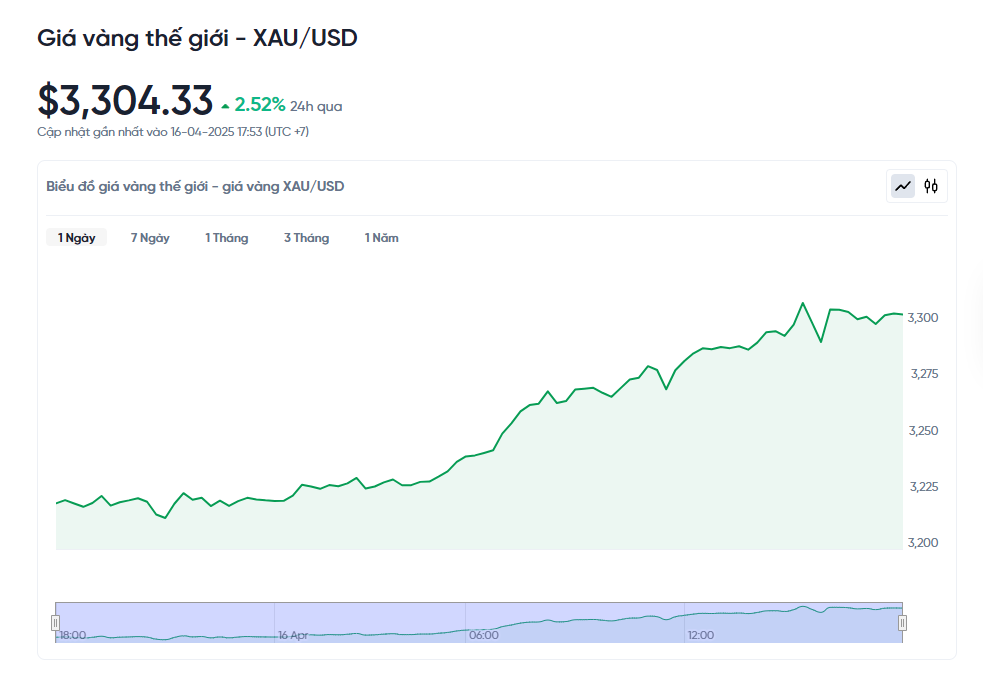

At the time of trading at 6:00 p.m. on April 16, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,304.33 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 104.55 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (113.0-115.5 million VND/tael), the SJC gold price is currently about 10.9 million higher than the international gold price.

Today, April 16, 2025, the price of gold on the world market surpassed the $3,300 per ounce mark for the first time. Specifically, the spot gold price increased by 2.3%, reaching $3,301.78/ounce, even reaching a record peak of $3,317.90/ounce. The gold futures price in the US also increased by 2.4%, to $3,317.70/ounce. The main reason for the sharp increase in gold prices is that investors are looking for safe assets, in the context of US President Donald Trump requesting to consider imposing new taxes on important minerals imported into the US. This increases trade tensions, especially with China - the leading country in mineral production.

Gold prices have risen nearly 26% since the start of 2025. There are several reasons for this trend. First, tariff disputes between countries have made gold a safe-haven option. Second, central banks around the world are buying large amounts of gold for their reserves. Third, expectations of lower interest rates in the future have also made gold, a non-yielding asset, more attractive. Finally, money flowing into gold investment funds has also helped push prices up. ANZ Bank even predicts that gold prices could reach $3,600 an ounce by the end of this year and $3,500 an ounce in the next six months.

Despite the strong rise in gold prices, some experts warn that the market may face temporary price corrections. Gold's relative strength index (RSI) is currently above 70, indicating that gold is "overbought", meaning that prices may fall slightly in the short term. However, fundamental factors such as economic uncertainty and high demand for gold still make many analysts believe that gold prices will continue to rise in the long term. Ricardo Evangelista of ActivTrades said that current conditions are too favorable for gold, and the possibility of further price increases is very high.

Alongside gold, silver also rose 1.8% to $32.88 an ounce. Meanwhile, platinum and palladium were virtually unchanged at $960.30 an ounce and $971.50 an ounce, respectively. Although not as strong as gold, these precious metals still attracted attention amid market volatility.

Gold price forecast today April 17, 2025 Domestic gold price and world gold price both set new records

The gold price on April 17, 2025 is predicted to continue to increase, based on the recent strong fluctuations in the world market. As of the afternoon of April 16, 2025, the world gold price reached a record of 3,304.33 USD per ounce, an increase of more than 42 USD compared to the previous day. If converted according to the exchange rate at Vietcombank, the world gold price is equivalent to about 104.55 million VND per tael, excluding costs such as taxes or fees. With this trend, the gold price on April 17, 2025 is likely to maintain its upward momentum, especially when the global economic situation is unstable.

A big reason why gold prices are expected to increase on April 17, 2025 is the trade tensions between the US and other countries, especially China. US President Donald Trump has just ordered an investigation into imposing new tariffs on important minerals imported into the US. This has made many investors worried about disruptions in the global supply chain, thereby seeking gold as a safe place to protect assets. When other markets such as stocks or currencies fluctuate, gold is often chosen because of its stable value.

In addition, the US dollar is weakening, losing 0.7% of its value against other major currencies. When the US dollar weakens, gold becomes cheaper for people using other currencies, increasing demand for gold. This is an important factor supporting gold prices on April 17, 2025. Not only that, major banks such as ANZ also predict that gold prices could reach $3,600 per ounce by the end of this year, showing strong confidence in the upward trend of gold.

Domestically, the gold price on April 17, 2025 is also forecast to increase following the world market. The price of SJC gold is currently about VND11 million per tael higher than the world gold price. Since domestic gold often follows international trends, investors can expect the price of SJC gold to increase in the morning trading session on April 17. Factors such as the demand for gold to protect assets in China and expectations of lower interest rates from central banks also contributed to the increase in gold prices.

However, experts also advise that although the gold price on April 17, 2025 is likely to increase, investors should be cautious. The gold market can be volatile due to major economic events, such as the speech of the Chairman of the US Federal Reserve (Fed) or the decision on interest rates. If you are thinking of buying gold, consider allocating a small portion of your assets to gold to reduce risk, especially in these unpredictable economic times.

Source: https://baoquangnam.vn/tin-tuc-du-bao-gia-vang-gia-vang-gia-vai ...

![[Photo] President Luong Cuong attends the inauguration of the international container port in Hai Phong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/9544c01a03e241fdadb6f9708e1c0b65)

![[Photo] Many people in Hanoi welcome Buddha's relics to Quan Su Pagoda](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/3e93a7303e1d4d98b6a65e64be57e870)

![[Photo] Prime Minister Pham Minh Chinh receives Ambassador of the French Republic to Vietnam Olivier Brochet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/f5441496fa4a456abf47c8c747d2fe92)

![[Photo] President Luong Cuong awarded the title "Heroic City" to Hai Phong city](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/13/d1921aa358994c0f97435a490b3d5065)

Comment (0)