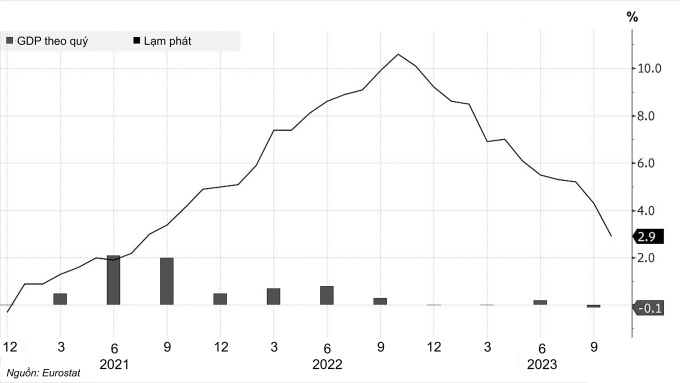

The growth in prices of goods and services in the euro zone fell to a two-year low, after 10 consecutive interest rate hikes.

Inflation in the euro zone fell to a two-year low of 2.9% in October. That was down from 4.3% the previous month and below the 3.1% estimate in a Reuters poll of economists.

Core inflation, which excludes food and energy prices, fell to 4.2% in September, down from 4.5% in September, according to Eurostat, the European Union's statistics agency.

“Looking at the main components of euro area inflation, food, alcohol and tobacco are expected to have the highest rate in October, followed by services, non-energy industrial products and energy,” Eurostat said.

The eurozone's GDP contracted by 0.1% in the third quarter, according to preliminary estimates from the agency. Previously, the parties predicted that the size of the region's economy would be unchanged from the second quarter. The European Central Bank (ECB) expected the 20-nation economy to grow by just 0.7% this year, 1% in 2024 and 1.5% in 2025.

Eurozone inflation slows but GDP falls. Source: Bloomberg

Europe's largest economy, Germany, reported a quarterly GDP decline of 0.1% in the third quarter, better than the 0.3% decline forecast in a Reuters poll of economists. On a price-adjusted basis, GDP fell 0.8% from a year earlier.

The growth and inflation picture across the eurozone also varied. Latvia posted the highest quarterly growth of 0.6%, followed by Belgium and Spain at 0.5% and 0.3% respectively. Ireland had the highest quarterly decline of 1.8%, followed by Austria at 0.6%.

The eurozone has been struggling with high inflation for the past 18 months, with consumer prices peaking at 10.6% in October 2022. The ECB responded by raising interest rates 10 times in a row, taking its benchmark to a record high of 4%, before deciding to pause last week despite the risk of rising energy prices due to the ongoing Israel-Hamas war.

The ECB Governing Council said inflation was expected to remain “too high for too long” as domestic price pressures remained strong. But it also observed that consumer price growth had so far slowed.

Experts say that cooling inflation will ease the ECB's nerves, but it's too early to bet on an imminent rate cut. Mark Wall, chief European economist at Deutsche Bank Research, noted that core inflation remains above 4%, double the target. "The ECB needs to see inflation slow down, and that could take another six months," he added.

Xiao Gu (according to CNBC )

Source link

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)