According to MXV, Robusta coffee prices on the European Intercontinental Exchange have broken the old historical peak, at one point even surpassing the 5,700 USD/ton mark.

After a surge to near historic peaks, Vietnamese coffee prices are facing a sharp decline. At this time of volatility, the Vietnam Commodity Exchange (MXV) believes that coffee market participants, especially exporters, should pay more attention to price hedging through the coffee derivatives market. This is an effective risk prevention tool when prices fluctuate, especially when our country's 2024-2025 coffee crop is in the main supply phase to the world.

Coffee prices turn around and “fall freely” after nearly reaching the peak

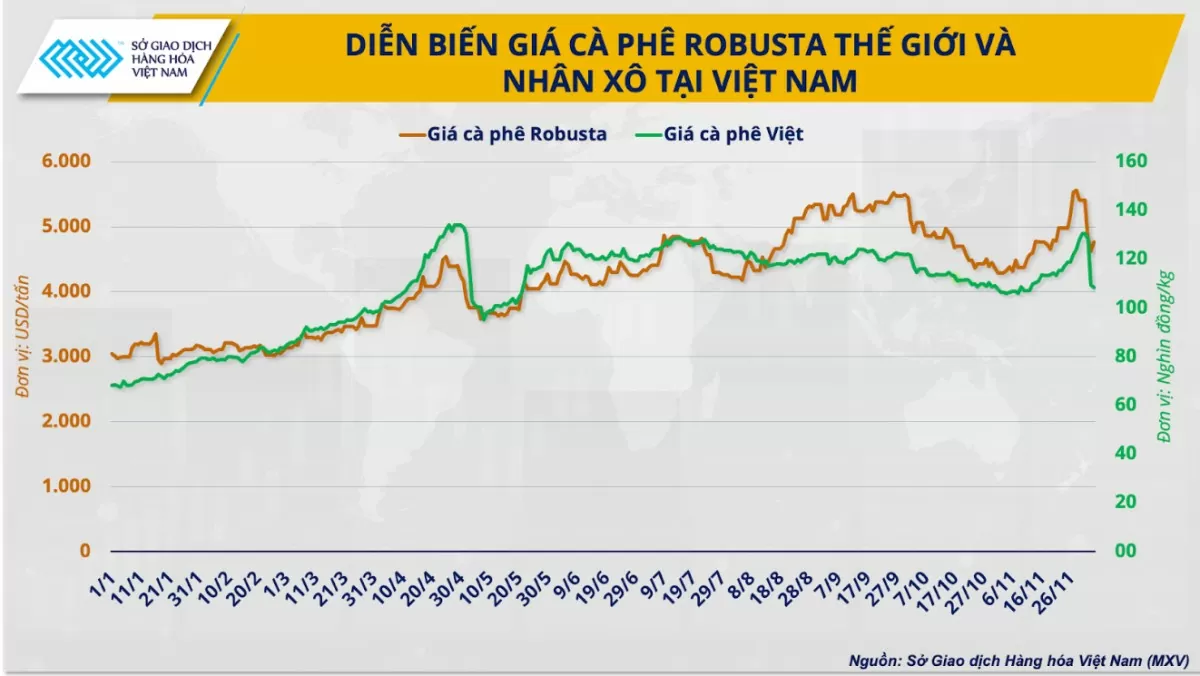

This November, both world and domestic coffee prices recorded a historic increase. According to MXV, Robusta coffee prices on the Intercontinental European Exchange (ICE-EU) broke the old historical peak, even surpassing the 5,700 USD/ton mark at one point. By the end of the trading session on November 30, Robusta coffee prices were double that of the same period in 2023 and increased by about 30% compared to the beginning of the month. In line with world prices, the price of green coffee beans in the Central Highlands and the Southern provinces as of November 30 was at 130,000 VND/kg, more than twice as high as the same period last year and increasingly close to the old historical peak in April, when it stopped at 134,400 VND/kg.

|

| Robusta and Vietnamese coffee price developments |

MXV believes that speculation - a characteristic factor of the coffee derivatives market - is an important reason for the continuous sharp increase in coffee prices over the past month, in addition to concerns about persistent shortages since the beginning of 2024.

Since Donald Trump won the 2024 US presidential election, the market has seen a shift in cash flow from safe havens such as gold and precious metals to high-yield investment channels such as coffee and cocoa. Combined with concerns about supply shortages, the market has increased expectations that coffee prices will continue to rise, prompting speculators to increase their buying positions.

On the supply-demand side, rain has returned to Brazil's main coffee growing regions since October, but rainfall has been consistently below historical averages, combined with many previous record-breaking dry months, making the market increasingly confident that the country's coffee output in the 2024-2025 and 2025-2026 crop years will be low. The Brazilian government's Crop Supply Agency (CONAB) has lowered its 2024-2025 production forecast to 54.8 million bags, down 7% from the previous forecast and about 300,000 bags lower than the previous crop. At the same time, consulting firm StoneX predicts that coffee output in the 2025-2026 crop year will decrease by 0.4% compared to the 2024-2025 crop year, to 65.6 million 60kg bags.

In Vietnam, November is usually the time when new crop coffee supplies begin to hit the market and exports gradually increase. But this year, farmers are not in a hurry to sell, making new crop exports still gloomy. According to the General Department of Customs, in the first half of November, our country exported only 20,933 tons of coffee, a sharp decrease of 45% compared to the same period in 2023, and even 3% lower than the first 15 days of October.

|

| Mr. Nguyen Ngoc Quynh - Deputy General Director of Vietnam Commodity Exchange (MXV) |

Commenting on the developments in the coffee market based on historical lessons, Mr. Nguyen Ngoc Quynh - Deputy General Director of MXV - said that after a sharp increase due to speculative factors, coffee prices are likely to form a sharp decline to bring prices back to the correct price level determined by the principle of supply and demand. In particular, Vietnam is in the stage of pushing the supply of new crop coffee to the market, prices are likely to fall more sharply than world prices.

Hedging through coffee futures trading

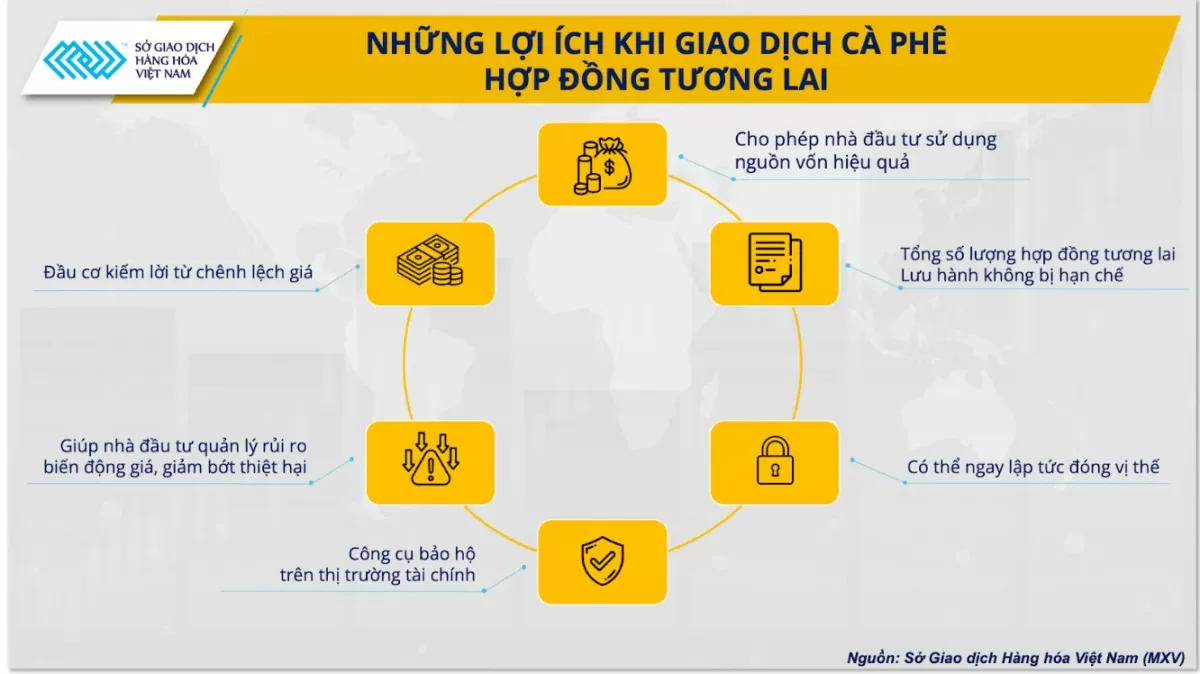

Faced with unprecedented fluctuations in the coffee market over the past year, Mr. Quynh said that coffee is a very sensitive commodity to supply and demand information as well as macro factors, so hedging prices through the coffee derivatives market, specifically futures contracts, is very necessary. In particular, Vietnam is currently the second largest coffee producing country in the world and in the last months of the year when the harvest is in the main season, export activities are boosted, price movements fluctuate strongly and tend to reverse.

In theory, hedging through coffee futures contracts is an important tool for coffee businesses to protect against unwanted price fluctuations, especially when coffee prices are likely to fall sharply in the future. A futures contract is an agreement between two parties, a buyer and a seller. In which, the buyer commits to buy a certain amount of coffee at a certain price at a certain time in the future, and the seller commits to sell coffee at that price. Using coffee futures contracts helps businesses ensure a stable price for their products, thereby minimizing the risk of price fluctuations.

|

| Benefits of trading coffee futures contracts |

For example, if a Vietnamese coffee exporter is concerned about a sharp drop in coffee prices next month, they can enter into a futures contract to sell coffee at a fixed price. This helps the business protect its profits even if the price of coffee on the market drops.

In addition, using coffee futures contracts is also a way to ensure the supply of goods for physical traders in case of "outage" of goods during real transactions. In fact, when prices fluctuate too quickly and strongly, the possibility of "breaking" the contract and gaining benefits for oneself is very likely to occur. At this time, conducting coffee transactions through the derivatives market with the form of physical delivery and receipt can help the parties ensure the supply of coffee for commercial activities.

There is a real example in the early 2024 period, Vietnamese coffee prices skyrocketed to a historical peak, many farmers did not execute transactions as previously agreed. At this time, export enterprises fell into a difficult situation, there was no coffee to supply to foreign partners as previously signed. Many enterprises even had to turn to the form of purchasing goods on the derivatives market to have real goods for export.

Hedging through coffee futures contracts is a useful tool for businesses in the coffee industry to protect themselves from large price fluctuations, especially when coffee prices can drop sharply. Using futures contracts helps to minimize risks, protect profits and create stability for businesses. However, to achieve maximum efficiency, businesses of course still need to have a clear strategy, a deep understanding of the market and factors affecting coffee prices.

Source: https://congthuong.vn/lam-cach-nao-de-phong-rui-ro-truoc-bien-dong-manh-cua-gia-ca-phe-362662-362662.html

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)