An Binh Commercial Joint Stock Bank (ABBank) has reduced its deposit interest rates for the second time in March, with interest rates reduced for most deposit terms starting today. Previously, on March 21, ABBank had just reduced its deposit interest rates.

According to the online deposit interest rate table just announced by ABBank, the interest rate for 1-month term deposits remains at 3%/year. Interest rates for the remaining terms are adjusted down.

Specifically, the 2-month bank interest rate decreased by 0.1 percentage point to 3%/year. The interest rate for 3-5 month terms also decreased by 0.2 percentage point to 3%/year.

ABBank reduced the interest rate for 6-month term deposits by 0.3 percentage points, down to 4.3%/year. This is also the highest mobilization interest rate at ABBank at the present time.

Interest rates for the remaining terms, from 7-60 months, have all decreased to 4.1%/year. To reduce to this level, interest rates for 7-8 month terms have dropped sharply by 0.4 percentage points, 9-12 month terms have dropped by 0.1 percentage points, and 13-60 month terms have dropped by 0.3 percentage points.

ABBank is also the only bank to adjust deposit interest rates today. Since the beginning of March, 25 commercial banks have reduced deposit interest rates, including: PGBank, BVBank, BaoViet Bank, GPBank, ACB, Agribank, VPBank, PVCombank, Dong A Bank, MB, Techcombank, NCB, KienLong Bank, Agribank, SCB, Saigonbank, BIDV, Sacombank, ABBank, SeABank, CBBank, OceanBank, TPBank, VietinBank, VIB.

Of which, BaoViet Bank, GPBank, PGBank, Techcombank, ACB, ABBank have reduced deposit interest rates twice since the beginning of the month. BVBank has reduced interest rates three times in March.

On the contrary, 5 banks increased deposit interest rates at some terms: SHB, Techcombank, Saigonbank, Eximbank, VPBank.

| HIGHEST DEPOSIT INTEREST RATES AT BANKS ON MARCH 28 (%/year) | ||||||

| BANK | 1 MONTH | 3 MONTHS | 6 MONTHS | 9 MONTHS | 12 MONTHS | 18 MONTHS |

| VIETBANK | 3.1 | 3.5 | 4.6 | 4.8 | 5.3 | 5.8 |

| OCB | 3 | 3.2 | 4.6 | 4.7 | 4.9 | 5.4 |

| HDBANK | 2.95 | 2.95 | 4.6 | 4.4 | 4.8 | 5.7 |

| NCB | 3.3 | 3.5 | 4.55 | 4.65 | 5 | 5.5 |

| NAM A BANK | 2.9 | 3.4 | 4.5 | 4.8 | 5.3 | 5.7 |

| VIET A BANK | 3.1 | 3.4 | 4.5 | 4.5 | 5 | 5.3 |

| ABBANK | 3 | 3 | 4.3 | 4.1 | 4.1 | 4.1 |

| BAOVIETBANK | 3 | 3.25 | 4.3 | 4.4 | 4.7 | 5.5 |

| PVCOMBANK | 2.85 | 2.85 | 4.3 | 4.3 | 4.8 | 5.1 |

| DONG A BANK | 3.3 | 3.3 | 4.3 | 4.5 | 4.8 | 5 |

| SHB | 2.8 | 3 | 4.2 | 4.4 | 4.9 | 5.2 |

| KIENLONGBANK | 3 | 3 | 4.2 | 4.6 | 4.8 | 5.3 |

| BAC A BANK | 2.8 | 3 | 4.2 | 4.3 | 4.6 | 5.1 |

| VPBANK | 2.4 | 2.7 | 4.2 | 4.2 | 4.5 | 4.5 |

| BVBANK | 2.85 | 3.05 | 4.05 | 4.35 | 4.65 | 5.25 |

| LPBANK | 2.6 | 2.7 | 4 | 4.1 | 5 | 5.6 |

| PGBANK | 2.6 | 3 | 4 | 4 | 4.3 | 4.8 |

| VIB | 2.5 | 2.8 | 4 | 4 | 4.8 | |

| CBBANK | 3.1 | 3.3 | 4 | 3.95 | 4.15 | 4.4 |

| GPBANK | 2.3 | 2.82 | 3.95 | 4.2 | 4.65 | 4.75 |

| OCEANBANK | 2.6 | 3.1 | 3.9 | 4.1 | 4.9 | 5.2 |

| EXIMBANK | 3.1 | 3.4 | 3.9 | 3.9 | 4.9 | 5.1 |

| MSB | 3.5 | 3.5 | 3.9 | 3.9 | 4.3 | 4.3 |

| SAIGONBANK | 2.3 | 2.5 | 3.8 | 4.1 | 5 | 5.6 |

| TPBANK | 2.5 | 2.8 | 3.8 | 4.7 | 5 | |

| SACOMBANK | 2.3 | 2.7 | 3.7 | 3.8 | 4.7 | 4.9 |

| TECHCOMBANK | 2.25 | 2.55 | 3.65 | 3.7 | 4.55 | 4.55 |

| MB | 2.2 | 2.6 | 3.6 | 3.7 | 4.6 | 4.7 |

| ACB | 2.3 | 2.7 | 3.5 | 3.8 | 4.5 | |

| SEABANK | 2.7 | 2.9 | 3.2 | 3.4 | 3.75 | 4.6 |

| BIDV | 1.8 | 2.1 | 3.1 | 3.1 | 4.7 | 4.7 |

| SCB | 1.65 | 1.95 | 3.05 | 3.05 | 4.05 | 4.05 |

| VIETINBANK | 1.7 | 2 | 3 | 3 | 4.7 | 4.7 |

| VIETCOMBANK | 1.7 | 2 | 3 | 3 | 4.7 | 4.7 |

| AGRIBANK | 1.6 | 1.9 | 3 | 3 | 4.7 | 4.7 |

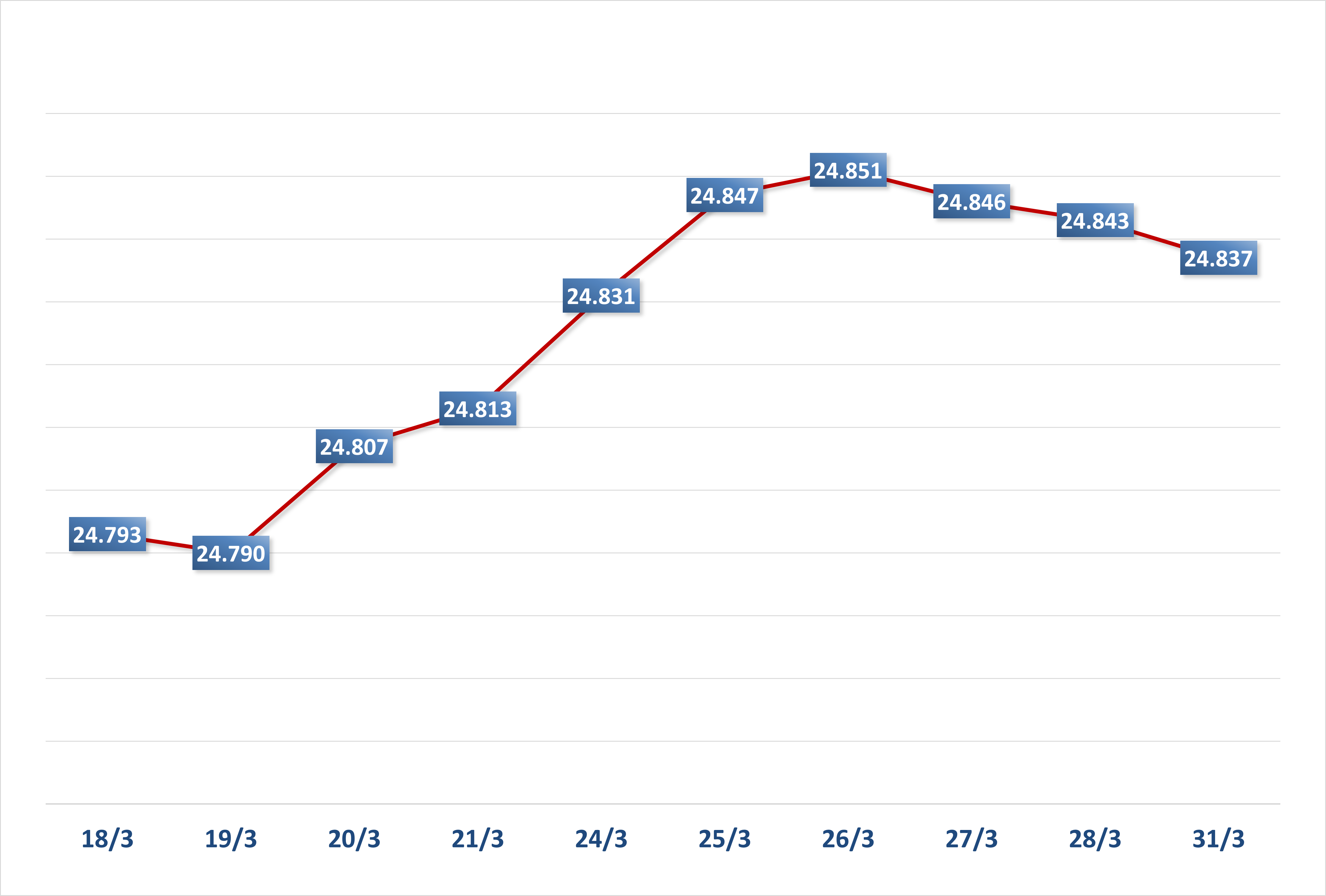

Last week, the SBV withdrew a net VND69,700 billion in the open market through treasury bills (28-day term, average interest rate 1.43%). Since the SBV resumed selling treasury bills in the open market, the SBV has withdrawn a net VND144,697 billion.

Also last week, interbank interest rates for overnight, 1-week, and 2-week terms decreased by 0.66%; 0.62%; 0.25% to 0.13%; 0.48%; and 1.18%, respectively.

However, according to the latest data from the State Bank of Vietnam, interbank interest rates have rebounded. At the overnight term, the interest rate increased to 0.32%/year.

Along with that, interbank interest rates for other key terms also increased sharply. The 1-week term increased from 0.48% to 1.38%; the 2-week term increased from 1.18% to 1.87%; and the 1-month term increased from 1.58% to 2.29%.

Source

![[Photo] Ministry of Defense sees off relief forces to the airport to Myanmar for mission](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/245629fab9d644fd909ecd67f1749123)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting to remove difficulties for projects](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/30/7d354a396d4e4699adc2ccc0d44fbd4f)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)