With new regulations, the Vietnamese stock market enters 2025 with the expectation of creating a transparent, safe and attractive investment environment to become a reliable destination for investors.

Vietnam Securities 2025: Expecting Breakthroughs from Innovation

With new regulations, the Vietnamese stock market enters 2025 with the expectation of creating a transparent, safe and attractive investment environment to become a reliable destination for investors.

|

| The new regulations will help investors feel more secure and promote market development in the future. Photo: D.T |

From new standards

After more than two years of applying the Rules for Building and Managing the HoSE-Index version 3.1, the Ho Chi Minh City Stock Exchange (HoSE) has just issued version 4.0 with many important changes.

Under the new rules, for the first time, the after-tax profit index is included when considering the VN30 basket's constituent stocks. Enterprises with negative after-tax profits will be removed from the list of consideration. HoSE also only considers financial statements with fully acceptable audit opinions. Enterprises with fully acceptable audit opinions but with content that needs to be emphasized, noted, or other issues that need to be considered must have consultation from the Index Council.

Even if a stock has been selected for the VN30 basket, if it falls under the warning list due to information disclosure violations before the official date of application of the basket, the stock will be replaced at the last minute. Business performance information or compliance with information disclosure regulations are also important inputs for decisions during the two portfolio rotation periods in January and July every year.

The “new wind” from policy changes not only affects the VN30 basket. Many amendments are stipulated in Law No. 56/2024/QH15 amending and supplementing 9 laws, including the Securities Law, effective from January 1, 2025, directly affecting the bond and stock markets in the coming time, especially the primary market between issuers and investors.

In the prospectus and related documents of nearly 1,200 pages that Vinpearl Joint Stock Company sent to the management agency and investors, the "giant" of the resort real estate industry has also included audited reports on owner's equity contributions in the period from 2011 to 2024. This organization is ready for the new regulations when it "opens" its public offering in the first month of 2025.

Along with the additional documents in the public offering dossier, Law No. 56/2024/QH15 also provides credit rating conditions for individual bonds that individual professional investors can buy, in addition to the provision of having collateral for the bonds or having a payment guarantee from a credit institution. In addition, the act of "manipulating the securities market" is included in the law, instead of only being regulated in the decree as before.

According to Mr. Dang Thanh Cong, Director of Northern Investment Banking Services, KB Securities Joint Stock Company (KBSV), although the changes in the law create significant pressure for businesses and consulting organizations, they will improve the quality of "goods" in the market. The new regulations will help investors feel more secure when investing and promote market development in the future.

To breakthrough expectations

At the gong-beating ceremony to open the first stock trading session of 2025, Minister of Finance Nguyen Van Thang pointed out 6 key tasks this year. The first task is to continue perfecting the legal framework, including decrees and documents guiding the amended and supplemented Securities Law; implementing the Stock Market Development Strategy to 2030, in which in 2025 the Vietnamese stock market will be upgraded from a frontier market to an emerging market.

- Mr. Nguyen Van Thang, Minister of Finance

The Ministry of Finance will coordinate with ministries and branches to direct the State Securities Commission, stock exchanges, and the Vietnam Securities Depository and Clearing Corporation (VSDC) to focus all efforts on developing the stock market in a sustainable manner.

Previously, the Ministry of Finance urgently announced to collect opinions on the Draft amending and supplementing a number of articles of Decree 155/2020/ND-CP. In particular, many notable proposals such as shortening the listing process from 90 days to 30 days; listing/transaction registration dossiers, changes to listing/transaction registration are removed "the adjusted securities registration certificate issued by the Vietnam Securities Depository and Clearing Corporation (VSDC)".

The permission for public companies to decide on a maximum foreign ownership ratio lower than the prescribed ratio when approved by the general meeting of shareholders and the provisions in the company charter were also removed. Instead, the drafting agency proposed that the "foreign room" lower than the prescribed ratio only be decided by a competent state agency, in order to reduce risks for foreign investors when they do not anticipate changes from the enterprise.

Along with facilitating investors, reforming administrative procedures, creating the best conditions for listed organizations, trading registration, intermediary financial institutions and investors, the 2025 task set by the commander of the financial sector focuses especially on monitoring, inspecting, and strictly handling violations in the stock, derivatives, corporate bond markets and information disclosure obligations.

The Minister of Finance also requested the securities industry to focus on propaganda work, improve capacity for individual investors, provide timely information to investors, limit the psychological impact of bad news on the stock market, and promote the participation of domestic and international investors.

With 6 solutions and tasks set out, including perfecting the legal framework, Minister Nguyen Van Thang expects that the Vietnamese stock market will have a breakthrough development in both scale and quality in 2025. In particular, the Vietnamese stock industry needs to create a transparent, safe and attractive investment environment. From these changes, the stock market will become a reliable destination for domestic and foreign investors.

Source: https://baodautu.vn/chung-khoan-viet-nam-2025-ky-vong-dot-pha-tu-nhung-doi-moi-d238969.html

![[Photo] Welcoming ceremony for Prime Minister of the Federal Democratic Republic of Ethiopia Abiy Ahmed Ali and his wife](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/77c08dcbe52c42e2ac01c322fe86e78b)

![[Photo] The two Prime Ministers witnessed the signing ceremony of cooperation documents between Vietnam and Ethiopia.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/16e350289aec4a6ea74b93ee396ada21)

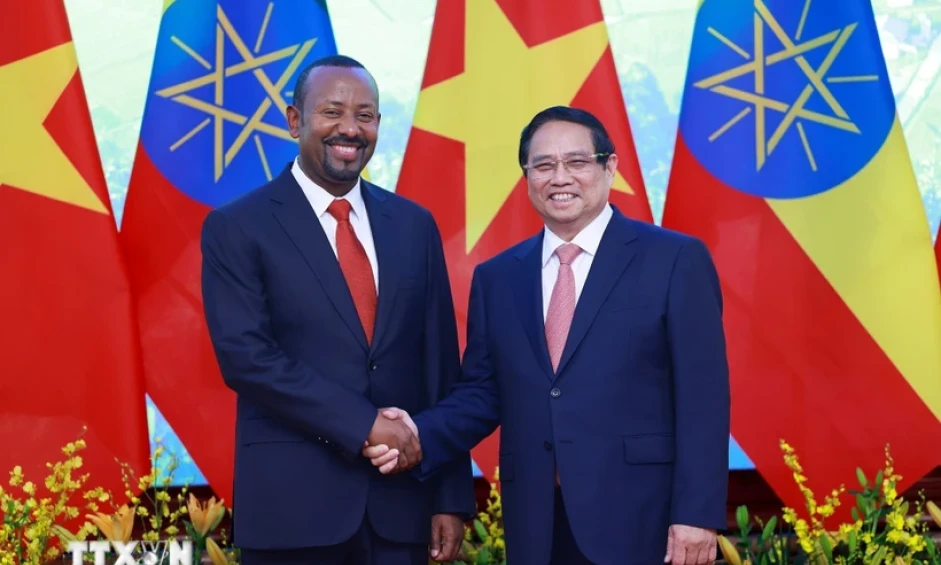

![[Photo] Prime Minister Pham Minh Chinh holds talks with Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/4f7ba52301694c32aac39eab11cf70a4)

![[Photo] General Secretary To Lam receives Ethiopian Prime Minister Abiy Ahmed Ali](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/086fa862ad6d4c8ca337d57208555715)

![[Photo] National Assembly Chairman Tran Thanh Man attends the summary of the organization of the Conference of the Executive Committee of the Francophone Parliamentary Union](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/fe022fef73d0431ab6cfc1570af598ac)

![[Photo] General Secretary To Lam meets with veteran revolutionary cadres, meritorious people, and exemplary policy families](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/15/7363ba75eb3c4a9e8241b65163176f63)

Comment (0)