Investors' hesitation caused the VN-Index to continuously fluctuate around the reference level right from the opening.

The retail sector contributed the most to the index's growth at the end of this morning's session. Foreign investors' return to net buying helped MWG increase by 2.95% at the end of the morning session, although the dominant selling pressure caused MWG's growth to narrow from 4% at the opening.

At the end of the morning session on December 20, VN-Index decreased by 2.18 points, equivalent to 0.2% to 1,094.12 points. The entire floor had 222 stocks increasing and 216 stocks decreasing. HNX-Index increased by 0.18 points to 227.45 points. UPCoM-Index decreased by 0.03 points, equivalent to 0.04% to 85.06 points.

VN-Index performance on December 20 (Source: FireAnt).

Entering the afternoon session, investors were still cautious with mixed increases and decreases along with low liquidity. By mid-afternoon, strong demand caused the VN-Index to suddenly increase.

At the end of the trading session on December 20, VN-Index increased by 4.46 points, equivalent to 0.41% to 1,100.76 points. The entire floor had 318 stocks increasing, 151 stocks decreasing, and 121 stocks remaining unchanged.

The HNX-Index increased by 0.89 points, equivalent to 0.39% to 228.16 points. The entire floor had 100 stocks increasing, 54 stocks decreasing and 68 stocks remaining unchanged. The UPCoM-Index increased by 0.39 points to 85.48 points.

In the VN30 basket alone, 19 stocks increased in price, notably MWG, MSN, VNM, VHM, VRE, STB, GVR, ACB, PLX, contributing 3.25 points to the general market.

Green covered most of the codes in the retail group, notably MWG up 4.3%, PET up 4.6%, DGW up 1.5%, FRT up 1.8%, CEN up 3.5%, LMH up 3.4%, SFC and VTJ hit the ceiling.

Notably, after 3 months of continuous net selling, foreign investors have tended to buy back MWG shares when in yesterday's session, foreign investors net bought nearly 11 billion VND, and in today's session, they net bought up to 105.7 billion VND. This is also one of the factors that caused this code to end the session up 4.31% to 42,400 VND/share, recovering 21% compared to early November.

Green also covered the entire insurance group with PTI increasing by 8.23%, PGI increasing by 6.76%, BMI increasing by 0.48%, ABI increasing by 1.59%, PRE increasing by 2.72%, BHI increasing by 3.13%, MIG increasing by 0.56%,...

In addition, the food and beverage industry also rose to make a positive contribution with the participation of two industry giants, VNM and MSN, which increased by 1.64% and 2.73% respectively, contributing 1.2 points to the general index. In addition, HAG increased by 0.81% and matched 27.7 million units, DBC increased by 1.58%, ANV increased by 0.83%, QNS increased by 2.49%, HNG increased by 3.21, ...

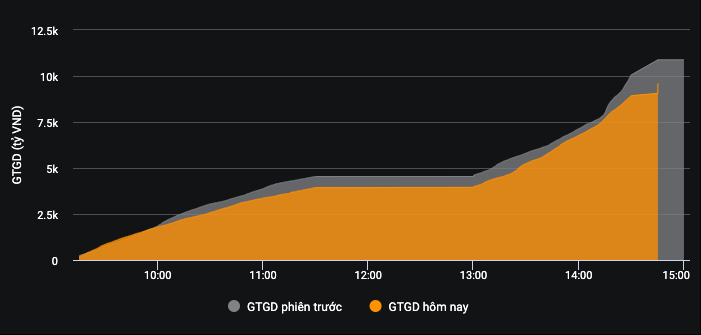

Liquidity today compared to previous session.

Despite the green color, liquidity is still a minus point, the total value of matched orders in today's session reached 14,883 billion VND, down 2% compared to the previous session, of which, the value of matched orders on HoSE reached 13,276 billion VND, up 4%. In the VN30 group, liquidity reached 6,188 billion VND.

Foreign investors continued to net sell with a value of 414.45 billion VND, of which this group disbursed 3,088 billion VND and sold 3,503 billion VND.

The codes that were sold strongly were HPG 109 billion VND, FUEVFVND 85 billion VND, HCM 54 billion VND, VCB 36 billion VND, EIB 35 billion VND,... On the contrary, the codes that were mainly bought were MWG 106 billion VND, KBC 33 billion VND, IDC 16 billion VND, HAG 16 billion VND, MSN 10.5 billion VND, ...

Source

Comment (0)