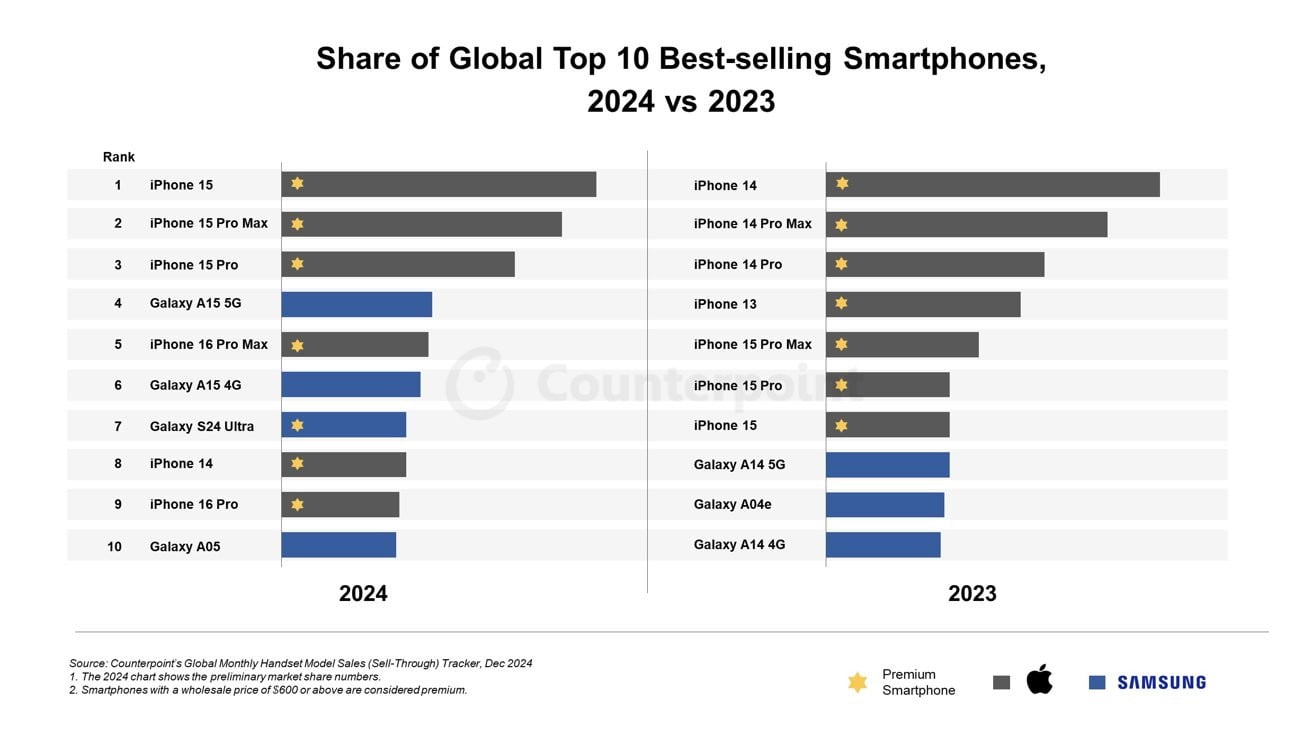

iPhone 15 to lead global smartphone sales in 2024, followed by iPhone 15 Pro Max and iPhone 15 Pro models.

According to research firm Counterpoint, global smartphone revenue in 2024 will increase by 5% compared to 2023, with the average selling price (ASP) reaching an all-time high of $356.

Despite economic challenges in recent years, improved consumer sentiment and demand for high-end smartphones have revived the market.

Global smartphone shipments also rose 4%, marking the first annual increase since 2021. Analysts said this was due to wider adoption of 5G, better cameras, and faster chips, which helped entice users to upgrade.

Apple dominates the list of best-selling smartphones with the iPhone 15 taking the top spot. The iPhone 15 Pro Max and iPhone 15 Pro follow closely.

Meanwhile, the iPhone 16 Pro series beat the iPhone 16 series in the first quarter of its availability on the market, showing users' preference for the expensive device from the "bitten apple".

The dominance of the Pro lines reflects the buying habits of Apple’s most loyal users, who rush to buy the latest Pro models as soon as they hit shelves, helping to boost holiday sales.

Despite a 3% decline in iPhone shipments, Apple’s revenue remained strong as ASPs topped $900 for the first time. The company also expanded its presence in emerging markets, with shipments in Latin America up 44%.

Samsung remains the world's largest smartphone brand by shipments. The Galaxy S24 outperformed its predecessor thanks to its AI features.

Among the top mobile brands, Vivo recorded the fastest revenue growth, at 20%, while Xiaomi recorded the strongest shipment growth, at 16%, thanks to its low-cost 5G models and accelerated expansion in Latin America and the Middle East.

The smartphone industry is expected to maintain average growth through 2025, with AI devices being a major differentiator. The Galaxy S24 Ultra is the first S series to enter the global top 10 best-selling phones since 2018, underscoring the appeal of AI features.

Low-end and mid-range 5G devices are expected to continue to expand their market share, especially in regions such as India, Southeast Asia, and Africa.

As competition intensifies, brands will focus on integrating AI features, improving cameras and battery life to attract buyers.

The global smartphone market is maturing, but 2024 shows that demand for innovation – especially at the high end – remains strong. If manufacturers push AI and premium experiences, revenue growth could return in the coming years.

(According to Apple Insider)

Source: https://vietnamnet.vn/iphone-15-ban-chay-nhat-nam-2024-2368222.html

Comment (0)