Minh Phu Seafood is about to spend more than 300 billion VND to pay the next dividend. Meanwhile, another seafood company, Vinh Hoan (VHC), is also paying an interim cash dividend for 2024 at a rate of up to 20%.

Mr. Le Van Quang - founder of Minh Phu Seafood Corporation - Photo: MPC

"Shrimp King" is about to spend hundreds of billions of dong to pay dividends

Minh Phu Seafood Corporation (MPC) has just announced the last registration date to receive 2023 cash dividends.

Accordingly, MPC will pay at a rate of 7.5%, meaning each shareholder will receive 750 VND on January 9, 2025. The last registration date to receive dividends is December 10.

Minh Phu Seafood currently has 401 million shares in circulation. Thus, this seafood company will have to spend more than 300 billion VND to pay dividends this time. The source of money is from undistributed consolidated after-tax profits.

According to the 2023 annual report, Mr. Le Van Quang - General Director of MPC - holds more than 64.28 million shares, equivalent to 16.07% of the company's capital.

Ms. Chu Thi Binh - Mr. Quang's wife and chairwoman of the board of directors and deputy general director of the company - holds more than 70.22 million shares, equivalent to 17.56% of capital.

Thus, it is estimated that in this dividend payment, Mr. Quang and Mrs. Binh alone will receive more than 100 billion VND.

According to the resolution of the 2024 shareholders' meeting, MPC has decided to pay 2023 cash dividends at a rate of 0 to 10% per share. Last year, PMC's undistributed consolidated profit after tax was more than VND775 billion.

Data: Financial statements

As the largest shrimp exporter in Vietnam, Minh Phu Seafood has a history of effective business operations, continuously reporting high profits. Before reporting a loss in 2023, PMC reported a profit after tax of more than VND832 billion in 2022 and the highest recorded net profit was up to VND921 billion in 2014.

In the first 9 months of this year, the "shrimp king"'s revenue reached more than 10,851 billion VND, an increase of 43% over the same period, while the loss after tax was more than 44.4 billion VND, a decrease compared to the loss of 114 billion VND in the same period.

"Pangasius Queen" advances dividends after reaching profit target

Another seafood company that also set the highest dividend payout ratio this week is Vinh Hoan Joint Stock Company (VHC).

Accordingly, VHC will pay an interim cash dividend of 20% for 2024, meaning each share will receive VND2,000. With more than 224 million shares in circulation, it is estimated that VHC will need to spend nearly VND449 billion for this dividend payment.

VHC is also one of the companies with a tradition of paying quite high cash dividends for many years.

The interim dividend payment took place after the seafood company known as the "queen of pangasius" recorded positive business results.

According to the financial report for the third quarter of 2024, VHC's net revenue in the third quarter reached VND 3,293 billion, up 22% over the same period, and profit after tax reached VND 341 billion, up 70%.

Accumulated in the first 9 months of this year, VHC's revenue reached VND9,329 billion, up 22% over the same period and after-tax profit reached VND870 billion, down slightly over the same period.

In 2024, VHC builds a revenue and profit plan with two scenarios. In the basic scenario, the company's consolidated revenue will only reach VND10,700 billion, while in the high scenario it will be VND11,500 billion.

Similarly, with the parent company's after-tax profit, VHC set a basic target of VND800 billion, and a high target of VND1,000 billion. Thus, after the first 9 months of the year, Vinh Hoan has exceeded the basic target set for profit.

Source: https://tuoitre.vn/hai-dai-gia-thuy-san-tra-co-tuc-vua-tom-lo-ki-luc-van-chi-vai-tram-ti-20241204214738301.htm

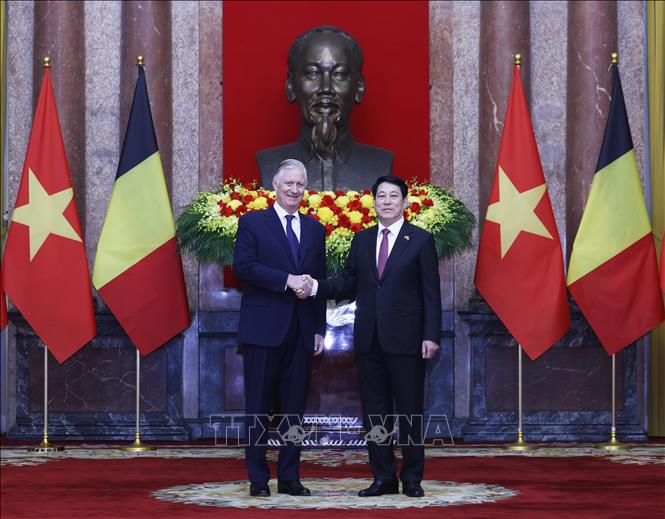

![[Photo] National Assembly Chairman Tran Thanh Man meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/c6fb3ef1d4504726a738406fb7e6273f)

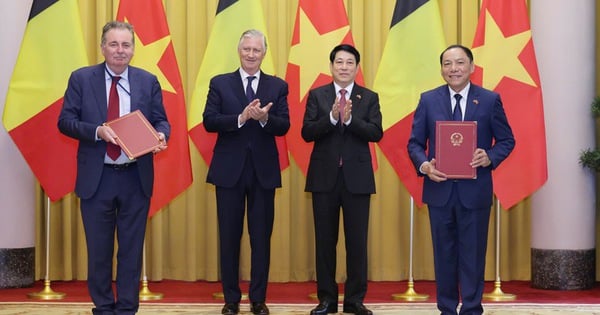

![[Photo] President Luong Cuong and the King of Belgium witness the Vietnam-Belgium document exchange ceremony](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/df43237b0d2d4f1997892fe485bd05a2)

![[Photo] President Luong Cuong meets with King Philippe of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/1ce6351a31734a1a833f595a89648faf)

![[Photo] Queen of the Kingdom of Belgium and the wife of President Luong Cuong visit Uncle Ho's Stilt House](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9752eee556e54ac481c172c1130520cd)

![[Photo] Official welcoming ceremony for the King and Queen of the Kingdom of Belgium](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/1/9e1e23e54fad482aa7680fa5d11a1480)

Comment (0)