(NLDO) – In an upward trend, today's interest rates for 6-month terms are listed by many banks at over 5%/year.

An Binh Bank (ABBANK) has just applied the latest online mobilization interest rate schedule with an increasing trend for some terms.

Accordingly, customers who deposit online for a 3-month term are 4.1%/year; 6-month is up to 5.5%/year, 0.9% higher than at the counter and a significant increase compared to the previous interest rate table. Currently, the highest interest rate at ABBANK is 6.2%/year when customers deposit for a 15-18 month term.

Notably, if you deposit online at this bank, the 5-month term is only 4.3%, but if you deposit for 6 months, the interest rate will be much higher, up to 5.5%/year (1.2 percentage points higher).

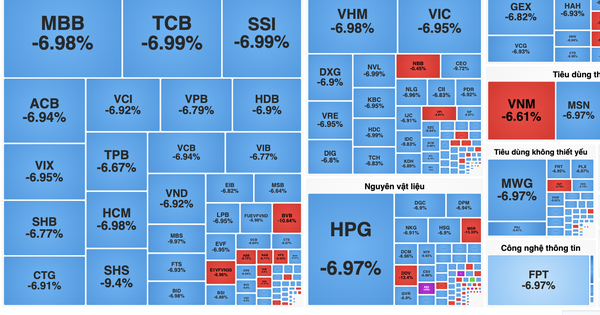

6-month savings interest rates at many banks exceed 5%/year

According to the reporter's records, many commercial banks are currently mobilizing interest rates for 6-month terms exceeding 5%/year, much higher than lower terms.

For example, with the same 6-month deposit term, BVBank mobilizes interest at 5.1%/year; Vietbank, OCB and PGBank mobilize interest at 5%/year; NCB has interest at 5.25%/year and Oceanbank has higher interest at 5.3%/year...

The highest interest rate for a 6-month term at DongABank is up to 5.47%/year and at BacABank is 5.4%/year.

With a deposit interest rate of 5%/year, if the customer has idle money of 500 million VND, the interest received at the end of the term will be 12.5 million VND (average monthly interest of more than 2 million VND).

For the state-owned commercial banking sector, the 6-month interest rate at Vietcombank is 2.9%/year; BIDV and VietinBank are 3%/year and Agribank is higher, 3.5%/year.

According to statistics from MBS Securities Company, if the interest rate increase trend slowed down in October, in the first half of November, interest rates increased today when up to 9 banks adjusted input interest rates with an increase of 0.1 - 0.7 percentage points.

This upward trend is expected to continue until the end of this year in the context of credit growth increasing nearly twice as fast as capital mobilization growth.

According to data from the State Bank, credit growth as of October 31 increased by 10.08% compared to the end of last year.

Source: https://nld.com.vn/lai-suat-hom-nay-21-11-gui-tiet-kiem-6-thang-lai-cao-nhat-tai-ngan-hang-nao-19624112110152798.htm

![[Photo] Prime Minister Pham Minh Chinh chairs meeting after US announces reciprocal tariffs](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/ee90a2786c0a45d7868de039cef4a712)

![[Photo] Special relics at the Vietnam Military History Museum associated with the heroic April 30th](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/a49d65b17b804e398de42bc2caba8368)

![[Photo] Moment of love: Myanmar people are moved to thank Vietnamese soldiers](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/9b2e07196eb14aa5aacb1bc9e067ae6f)

![[Photo] General Secretary To Lam receives Japanese Ambassador to Vietnam Ito Naoki](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3a5d233bc09d4928ac9bfed97674be98)

Comment (0)