Through many rounds of discussion to amend the Law on Value Added Tax, the plan to change fertilizer from non-taxable to taxable at 5% is still between two streams of opinion.

|

| Full-time National Assembly Delegate gives comments on the Draft Law on Value Added Tax Amendment |

Still leave two options

Preparing to submit to the National Assembly for approval at the 8th Session next October, the Draft Law on Value Added Tax (Draft) has just been commented on by full-time National Assembly deputies at the Conference of Full-time National Assembly deputies on August 29.

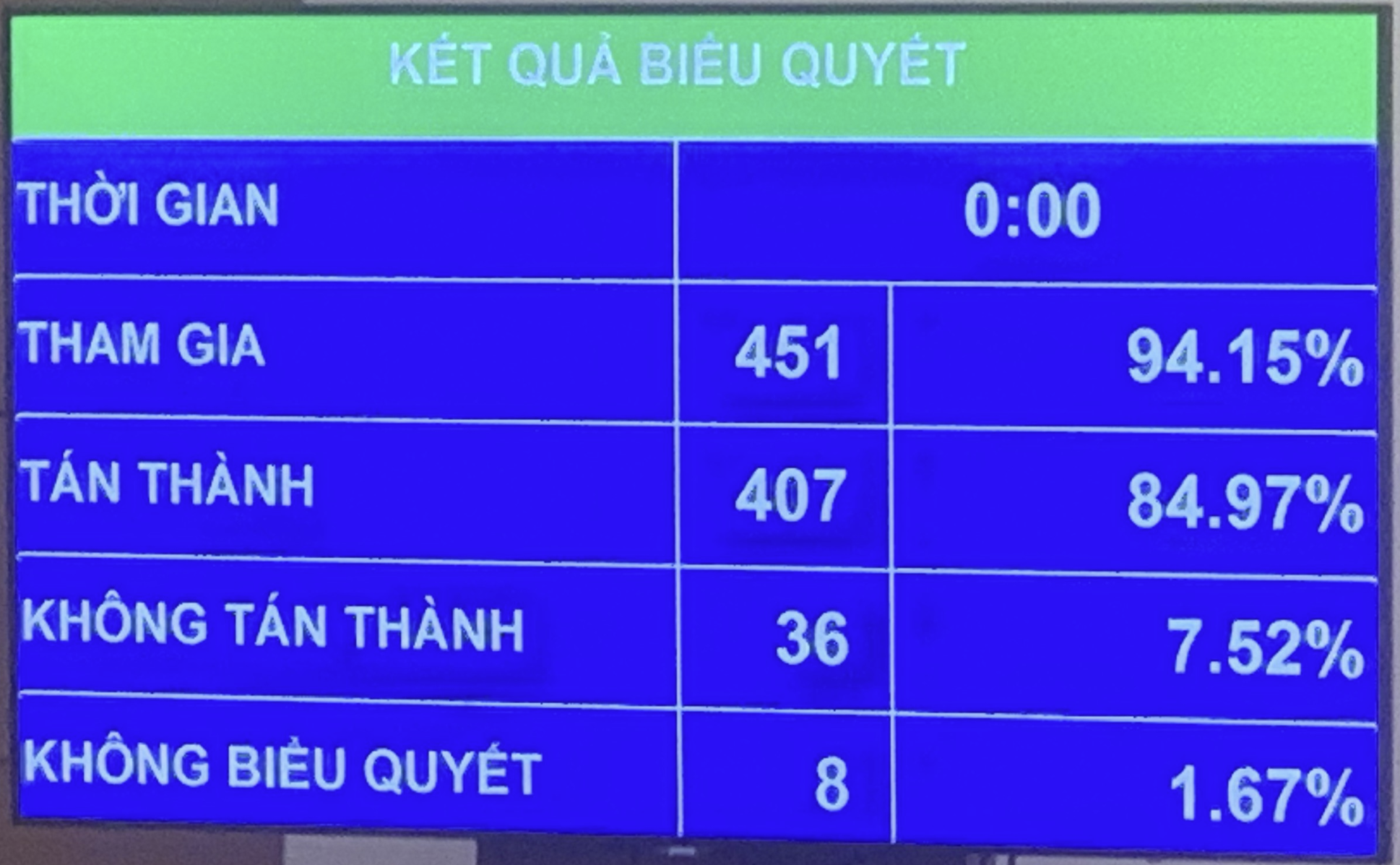

Reporting on some major issues in explaining, accepting and revising the Draft, the Standing Committee of the National Assembly's Finance and Budget Committee (the examining agency) said that there are still two viewpoints on transferring fertilizers, machinery, specialized equipment for agricultural production, and fishing vessels from non-taxable to 5% taxable (expressed in two options in the Draft).

The first viewpoint suggests keeping fertilizers, machinery, specialized equipment for agricultural production, and fishing vessels as not subject to value added tax (VAT) as currently regulated. Because VAT is an indirect tax, the VAT payer is the final consumer. Switching fertilizers to a 5% tax rate will greatly impact farmers because fertilizer prices will increase when VAT is applied, leading to an increase in the cost of agricultural products.

The second viewpoint agrees with the drafting agency, moving this group of products to the 5% VAT rate. Applying the 5% VAT rate will increase the cost of imported fertilizers (currently accounting for only 26.7% of the market share), while reducing the cost of domestically produced fertilizers (currently accounting for 73.% of the market share), because all input VAT of production will not be accounted for in costs, but deducted from output tax. Fertilizer production enterprises will be refunded because the output tax (5%) is lower than the input tax (10%) and the state budget will not increase due to the need to offset the increase in revenue from imports with the tax refund for domestic production.

With this option, domestic manufacturers have room to reduce selling prices if the prices of fertilizers and input materials on the international market remain unchanged. In addition, the actual selling price on the domestic market also depends on the world fertilizer price - which is on a downward trend due to the gradual recovery of world supply.

From the above facts, it can be seen that the impact of VAT adjustment on the possibility of increasing fertilizer prices in the domestic market is not large. Moreover, fertilizer is a price-stabilizing product, so if necessary, when there are large fluctuations in prices in the market, state management agencies can implement management measures such as checking price-forming factors, controlling inventories and other financial and monetary measures, etc., to be able to handle appropriately, ensuring that fertilizer prices are stabilized at a reasonable level.

The Standing Committee of the Appraisal Agency said that, with different opinions between the two viewpoints and inadequacies in data assessing the impact of the policy on the ability to increase state budget revenue and the actual impact on the price level in the domestic market, at the August 2024 legal session, the National Assembly Standing Committee concluded.

Specifically, "the Government is assigned to provide additional data to fully and convincingly explain and clearly analyze the price impacts on fertilizers in the case of applying a 5% tax rate, to serve the purpose of collecting opinions at the Conference of full-time National Assembly deputies and reporting to the National Assembly Standing Committee, submitting to the National Assembly for consideration and decision."

Based on the opinions of the specialized delegates, the Standing Committee of the National Assembly's Finance and Budget Committee said that it will continue to coordinate with the drafting agency to absorb, revise and specifically express this content in the Draft.

Need convincing data

Discussing at the Conference of specialized National Assembly deputies, the first four deputies to speak all proposed choosing the option of not imposing VAT on fertilizer products.

Deputy Head of the Thanh Hoa National Assembly Delegation, Mai Van Hai, acknowledged that not imposing VAT on fertilizers could affect some businesses, but imposing a 5% tax would affect farmers. “Currently, many families are still abandoning their fields due to low income, so at this time, fertilizers should not be taxed,” Hai said.

Incorporating the opinions of the Standing Committee of the National Assembly, the majority of opinions in the Standing Committee of the National Assembly's Finance and Budget Committee and the Drafting Agency agreed to revise and stipulate the level of revenue from the sale of tax-exempt goods and services of households and individuals with annual revenue of VND 200 million or less. In case the Consumer Price Index (CPI) fluctuates by more than 20% compared to the time this Law takes effect, or the time of the most recent adjustment, the Government shall submit to the Standing Committee of the National Assembly to adjust the revenue level in accordance with the socio-economic development situation of each period.

According to delegate Duong Khac Mai, Deputy Head of the National Assembly Delegation of Dak Nong Province, if fertilizers are subject to a 5% tax, it will address the problem of tax refunds for businesses, but it will certainly increase fertilizer prices, affecting farmers. "Imposing VAT does not guarantee whether fertilizers will be discounted or not, because the State does not force businesses to reduce prices," Mr. Mai stated the reason for choosing the option that fertilizers should not be subject to VAT.

However, delegate Mai also said that the harmonious solution is to apply a 0% tax rate to both process tax refunds for businesses and not affect farmers.

Agreeing with the option of not imposing tax on fertilizers, delegate Nguyen Thanh Nam (Phu Tho) said that if fertilizers are subject to a 5% tax, it will increase costs for agricultural production.

Deputy Chairman of the National Assembly's Law Committee Nguyen Truong Giang said that he had looked back at the records of previous amendments to the Law on Value Added Tax and found that when proposing not to impose VAT on fertilizers, the drafting agency explained that if the rate was kept at 5%, it would still be a burden for agricultural producers, increasing output prices. But this amendment stated the reason that if the tax was not imposed, input VAT would not be deductible.

Mr. Giang cited data from the Ministry of Finance, in the period 2015-2022, fertilizer manufacturing enterprises were not allowed to deduct about 1,500 billion VND of input VAT. If a 5% tax is applied to fertilizers, the output VAT will be about 5,700 billion VND, after deducting the input tax of about 1,500 billion VND, the budget will collect an additional 4,200 billion VND.

Thus, if the tax rate on fertilizers is 5%, the State will increase its budget revenue by 4,200 billion VND. Fertilizer manufacturing enterprises will be able to deduct 1,500 billion VND of input tax, thereby creating conditions to reduce product costs corresponding to the deducted VAT amount, increase competitiveness with imported fertilizers, and ensure fairness in implementing VAT policies between imported fertilizers and domestically produced fertilizers.

According to delegate Giang, the data that fertilizer manufacturing enterprises will be able to deduct 1,500 billion VND in input tax is not really accurate. Mr. Giang suggested that the drafting agency needs to accurately assess how much tax will be refunded to enterprises if the tax rate is 5%, how much revenue will be collected for the budget and how will it affect the people.

"Recently, the National Assembly tried to reduce VAT by 2% to stimulate consumption, but now they are saying to impose a 5% tax on fertilizer, which I find unconvincing," said Mr. Giang.

Standing member of the National Assembly's Finance and Budget Committee, delegate Le Minh Nam also said that the figure of VND1,500 billion that fertilizer manufacturing enterprises will be deducted if the 5% tax rate is applied is "not quite correct", if looking at the data on fertilizer manufacturing enterprises. "It is recommended to provide data, fully quantify, and convince which option brings more optimal efficiency, then the National Assembly will decide", Mr. Nam said.

According to delegate Trinh Xuan An, Standing Member of the National Assembly's Committee on National Defense and Security, it is necessary to make a truly objective assessment and not just base it on whether fertilizer prices have increased or not to decide on the option of imposing VAT on this item. "An agricultural country like Vietnam is not stable without a modern fertilizer production industry. If the fertilizer production industry improves, the people will also benefit," said Mr. An.

In addition to the above opinions, some other delegates proposed applying a 0% VAT rate to domestic fertilizer production enterprises, so that enterprises would be refunded tax. However, delegate Trinh Xuan An said that this option should be carefully considered, because the 0% rate only applies to exported goods, which is international practice.

Vice Chairman of the National Assembly Nguyen Duc Hai requested the drafting agency and the verification agency to absorb the delegates' opinions and continue to perfect the Draft to submit to the National Assembly at the 8th Session next October.

Source: https://baodautu.vn/giang-co-phuong-an-ap-thue-vat-5-voi-phan-bon-d223619.html

![[Photo] Looking back at the impressive moments of the Vietnamese rescue team in Myanmar](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/5623ca902a934e19b604c718265249d0)

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

![[Photo] Summary of parade practice in preparation for the April 30th celebration](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/78cfee0f2cc045b387ff1a4362b5950f)

Comment (0)