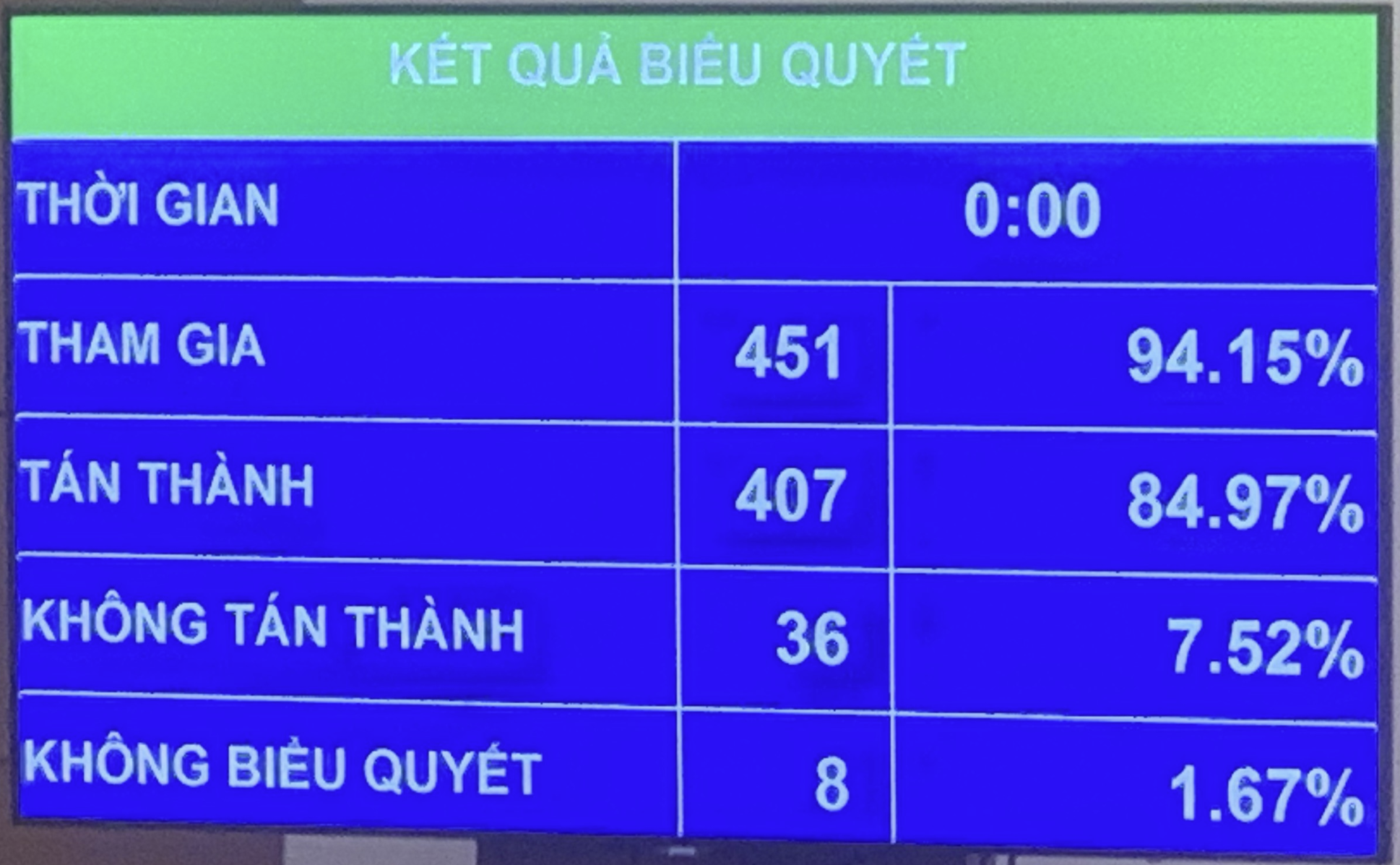

With the majority of delegates in favor, the National Assembly officially passed the Law on Value Added Tax (amended). The law will take effect from July 1, 2025.

|

On the afternoon of November 16, the National Assembly conducted an electronic vote to pass the revised Law on Value Added Tax (VAT). Of the 451 National Assembly deputies (NA deputies) participating in the vote (accounting for 94.15% of the total number of NA deputies), 407 deputies approved (accounting for 84.97% of the total number of NA deputies); 36 deputies did not approve (accounting for 7.52%); 8 deputies did not vote (accounting for 1.67%).

Remove the regulation that allows not paying output VAT but deducting input VAT

Before voting for approval, Member of the National Assembly Standing Committee (NASC), Chairman of the National Assembly's Finance and Budget Committee Le Quang Manh presented a Report explaining, accepting and revising the draft Law. Accordingly, regarding the provisions on non-taxable subjects (Article 5), there were opinions agreeing with Clause 1, Article 5 of the draft Law and stating that allowing non-payment of output VAT but deduction of input VAT is not in accordance with the principles of VAT. There were opinions suggesting keeping it as the draft Law that the Government submitted to the National Assembly at the 7th Session.

The Standing Committee of the National Assembly believes that, in reality, this policy is no longer appropriate and necessary because businesses have switched to using electronic invoices, overcoming the situation of invoice fraud. In particular, the draft Law has added provisions on the conditions for tax refunds, in which buyers are only entitled to tax refunds in the case that "the seller has declared and paid VAT according to regulations for invoices issued to the business establishment requesting tax refunds", creating a legal basis for the Tax Authority to only process tax refund dossiers when the seller has declared and paid money to the State budget. Therefore, there will be no cases of tax refunds for fake invoices when there is no transaction and no input tax has been paid to the budget.

At the same time, on November 26, 2024, the Secretary General of the National Assembly sent a request for opinions from National Assembly Deputies on 02 options for handling the above issue. Through synthesizing opinions, it shows that 70.50% of the total number of National Assembly Deputies agreed with the proposal of the Standing Committee of the National Assembly to remove the regulation allowing non-payment of output VAT but deduction of input VAT for unprocessed or pre-processed agricultural products at the commercial stage to ensure the principle of VAT is that input VAT can only be deducted when the output is subject to VAT. This content has been shown in Article 5 of the draft Law.

Regarding the threshold for non-VAT revenue, there are opinions suggesting to consider raising the threshold to over 200 million; there are opinions suggesting a threshold of over 300 million or 400 million VND for the coming years. According to calculations by the Ministry of Finance , if the non-taxable revenue is 200 million VND/year, the state budget revenue will decrease by about 2,630 billion VND (compared to the current VAT Law which stipulates the non-VAT revenue is 100 million VND/year); if the non-taxable revenue is 300 million VND/year, the state budget revenue will decrease by about 6,383 billion VND.

Therefore, to ensure a reasonable increase in the non-taxable revenue threshold, relatively consistent with the average GDP and CPI growth rate from 2013 to present, the draft Law stipulates a revenue threshold of VND 200 million/year.

72.67% of opinions agree with the 5% tax rate on fertilizer products.

Regarding tax rates (Article 9), many opinions agree with the proposal to apply a 5% tax rate on fertilizers. Some opinions suggest keeping it as the current regulations; others suggest applying a 0%, 1%, 2% tax rate...

According to the Standing Committee of the National Assembly, if fertilizers are subject to a 0% tax rate, it will ensure benefits for both domestic fertilizer producers and importers because they will be refunded the input VAT they have paid and will not have to pay output VAT. However, in this case, the State budget will have to spend every year to refund taxes to businesses. In addition to the inconvenience to the State budget, applying a 0% tax rate to fertilizers is contrary to the principles and practices of VAT, which is that a 0% tax rate only applies to exported goods and services, not to domestic consumption. Applying it in this direction will break the neutrality of tax policy, create a bad precedent and be unfair to other manufacturing industries.

In addition, according to the explanation of the drafting agency, the regulation of an additional tax rate of 1% or 2% will require restructuring the VAT Law, such as designing a separate clause on tax rates, and adding VAT refund regulations for this case. The regulation of a tax rate of 1% or 2% for fertilizers is also not consistent with the goal of VAT reform, which is to reduce the number of tax rates, not increase the number of tax rates compared to current regulations.

Based on the opinions of the National Assembly Deputies, the Government also issued Official Dispatch No. 692/CP-PL to supplement explanations and provide specific supporting data. To correctly reflect the National Assembly's viewpoint in handling the above issue, on November 26, 2024, the Secretary General of the National Assembly sent a request for opinions from the National Assembly Deputies on 02 options, one is to apply a tax rate of 5%, the other is to keep it as current regulations.

Through the synthesis of opinions, it is shown that 72.67% of the total number of National Assembly Deputies agreed with the proposal of the National Assembly Standing Committee and the Government to stipulate a tax rate of 5% for fertilizers, machinery, specialized equipment serving agricultural production, and fishing vessels. This content is shown in Clause 2, Article 9 of the draft Law.

No exemption from taxes on imported goods of small value

There are opinions suggesting not to exempt taxes on imported goods of small value via e-commerce platforms and to clearly stipulate the content in the General Resolution of the session on terminating Decision No. 78/2010/QD-TTg (regulations on the value of imported goods sent via express delivery services that are exempt from tax).

The Standing Committee of the National Assembly said that recently, a number of e-commerce platforms have appeared selling goods to Vietnam at very small, very low, very cheap and very competitive prices. The Standing Committee of the National Assembly highly appreciated the Government's timely proposal to supplement regulations on tax collection for e-commerce businesses in both the draft Law on Value Added Tax and the draft Law on Tax Administration to enhance the effectiveness of tax collection management.

However, if Decision No. 78/2010/QD-TTg has not yet expired, the amended contents of the Law on Value Added Tax and the Law on Tax Administration will not be able to take effect to ensure tax collection for e-commerce. Therefore, accepting the opinions of National Assembly Deputies, the Standing Committee of the National Assembly included this content in the Joint Resolution of the Session, requesting the Government to promptly issue a Decree on customs management of exported and imported goods traded via e-commerce channels, ensuring that no import tax exemption is allowed for small-value goods.

In the immediate future, immediately terminate the validity of Decision 78/2010/QD-TTg, creating a basis for tax authorities to have a legal basis and sanctions to manage tax collection for foreign e-commerce platforms selling goods to Vietnam.Source: https://thoibaonganhang.vn/quoc-hoi-thong-qua-luat-thue-gia-tri-gia-tang-sua-doi-158156.html

![[Photo] Dan Mountain Ginseng, a precious gift from nature to Kinh Bac land](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F30%2F1764493588163_ndo_br_anh-longform-jpg.webp&w=3840&q=75)

Comment (0)