|

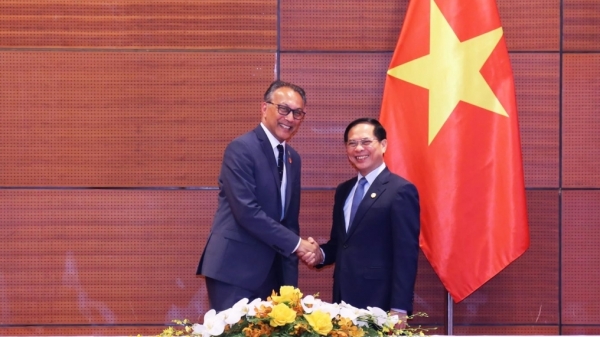

| Policymakers have made proposals to stimulate consumption, contributing to economic growth. (Source: VNA) |

In the context of economic difficulties and people tightening their spending, the National Assembly has just agreed to reduce value-added tax by 2% from January 1 to June 30, 2024. This decision is expected to stimulate consumption, one of the three important pillars contributing to economic growth.

Recently, the business community has faced many difficulties, especially in terms of market, capital, legal issues, administrative procedures... The government has issued many policies to support businesses, but the impact has not been much, and people tend to cut back on spending.

Therefore, the solution to stimulate demand and reduce value added tax (VAT) in the coming time will reduce the tax burden between businesses and consumers.

Recently, the National Assembly agreed to reduce value added tax (VAT) by 2% from January 1 to June 30, 2024. The 2% reduction in VAT rate will be applied to groups of goods and services currently subject to a VAT rate of 10% (to 8%), except for the following groups of goods and services: Telecommunications, information technology, financial activities, banking, securities, insurance, real estate business, metals, prefabricated metal products, mining products (excluding coal mining), coke, refined petroleum, chemical products, goods and services subject to special consumption tax.

Thus, VAT reduction is still only applied to a number of industries and fields, not really satisfying many previous proposals of experts.

Minister of Finance Ho Duc Phoc explained: Not expanding the subjects eligible for VAT reduction is to ensure consistency in policy; at the same time, reduce pressure on the budget.

“If VAT is reduced for all types of goods and services, budget revenue in the first 6 months of 2024 will decrease by about VND37,100 billion. If it is only applied to some groups of goods and services, the budget will lose about VND25,000 billion. To grow the economy, it is necessary to remove obstacles in production, business, market, capital sources, administration, application of science and technology, and increase labor productivity,” the Minister of Finance emphasized.

After a period of decline, since the end of the second quarter of 2023, purchasing power has increased again, bringing expectations of a prosperous year-end shopping season and the 2024 Lunar New Year.

According to Chairman of the Vietnam Retailers Association Nguyen Anh Duc, the above recovery process is the result of stimulus policies such as: 2% VAT reduction, tax payment extension, land use fee reduction, loan interest rate reduction and "open door" tourist visa policy... These policies have had a positive impact on the retail sector, helping the overall revenue of the whole market in general and retail businesses in particular to grow positively.

For the modern retail system, Mr. Dinh Quang Khoi, Director of Marketing MM Mega Market, said: The continued reduction of VAT in 2024 is a very positive signal to stimulate consumer demand. In the third quarter of 2023, the number of shoppers at the company's retail system improved, revenue increased by nearly 20% over the same period last year, in which there was a significant contribution from the 2% VAT reduction.

“In 2024, reducing VAT by 2%, along with reducing environmental protection tax (EPT) on gasoline will help businesses develop stably and have better economic growth. However, the Government needs to consider specifically to support businesses in both fiscal and monetary policy. I think that stabilizing the macro economy and exchange rates is very important, helping import and export and domestic production and business to stabilize supply and demand, as well as boost economic growth rate for the whole year of 2024,” economic expert, Associate Professor, Dr. Dinh Trong Thinh proposed.

According to Dr. Nguyen Quoc Viet, Deputy Director of the Vietnam Institute for Economic and Policy Research (VEPR), the VAT reduction policy not only supports businesses in maintaining production and business activities, but also helps workers find jobs, avoid unemployment, and at the same time foster a more sustainable, long-term source of income in the future.

“This ensures that businesses survive and people feel secure in investing when the money-goods cycle is maintained. If we let inventories accumulate, prices increase, and inflationary pressure escalate, we will not be able to stimulate consumer demand, causing many production, service, and business sectors to face difficulties,” said Dr. Nguyen Quoc Viet.

Source

![[Photo] Closing of the 4th Summit of the Partnership for Green Growth and the Global Goals](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/c0a0df9852c84e58be0a8b939189c85a)

![[Photo] General Secretary To Lam receives French Ambassador to Vietnam Olivier Brochet](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/49224f0f12e84b66a73b17eb251f7278)

![[Photo] National Assembly Chairman Tran Thanh Man meets with outstanding workers in the oil and gas industry](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/1d0de4026b75434ab34279624db7ee4a)

![[Photo] Nhan Dan Newspaper announces the project "Love Vietnam so much"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/362f882012d3432783fc92fab1b3e980)

![[Photo] Promoting friendship, solidarity and cooperation between the armies and people of the two countries](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/0c4d087864f14092aed77252590b6bae)

![[Photo] Welcoming ceremony for Chinese Defense Minister and delegation for friendship exchange](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/fadd533046594e5cacbb28de4c4d5655)

![[Video] Viettel officially puts into operation the largest submarine optical cable line in Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/17/f19008c6010c4a538cc422cb791ca0a1)

Comment (0)