According to a report from S&P Global, the preliminary PMI index of the US service sector in March increased to 54.3 points, higher than the previous month's 51.0 and exceeding analysts' expectations. This is the highest level in the past three months, showing that service activities are gradually improving.

In contrast, the manufacturing sector saw a significant decline as the PMI fell to 49.8 points from 52.7 points in February. This figure was not only lower than forecast but also marked a three-month low, reflecting the difficult production situation.

Gold prices little changed on mixed news

The gold market has had little reaction to this conflicting information. Spot gold is currently trading at $3,019.90 an ounce, down just 0.12% on the day. Although the US economy is still considered stable, confidence in future growth is waning.

The report also warned of rising price pressures, raising concerns that inflation could persist. Chris Williamson, an economist at S&P Global Market Intelligence, said that despite the improvement in the service sector, overall growth remained sluggish.

Impact of tariff policy

One notable factor is the impact of President Donald Trump’s tariff policies. These measures not only affected business sentiment but also contributed to higher production costs. Many suppliers passed on the price increases due to import tariffs to US companies, causing production costs to increase the most in nearly two years.

Mr Williamson said the recovery in the service sector was partly due to better weather conditions after the first two months of the year were affected by bad weather. This may only be a temporary improvement, while the risk of economic recession remains.

In that context, gold continues to be considered a safe asset, remaining firmly above the important psychological threshold of $3,000 despite market fluctuations.

Source: https://baoquangnam.vn/gia-vang-giu-vung-tren-3-000-usd-bat-chap-tin-hieu-kinh-te-my-trai-chieu-3151317.html

![[Photo] Admiring orange cotton flowers on the first "Vietnam heritage tree" in Quang Binh](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7476a484f3394c328be4ac8f9c86278f)

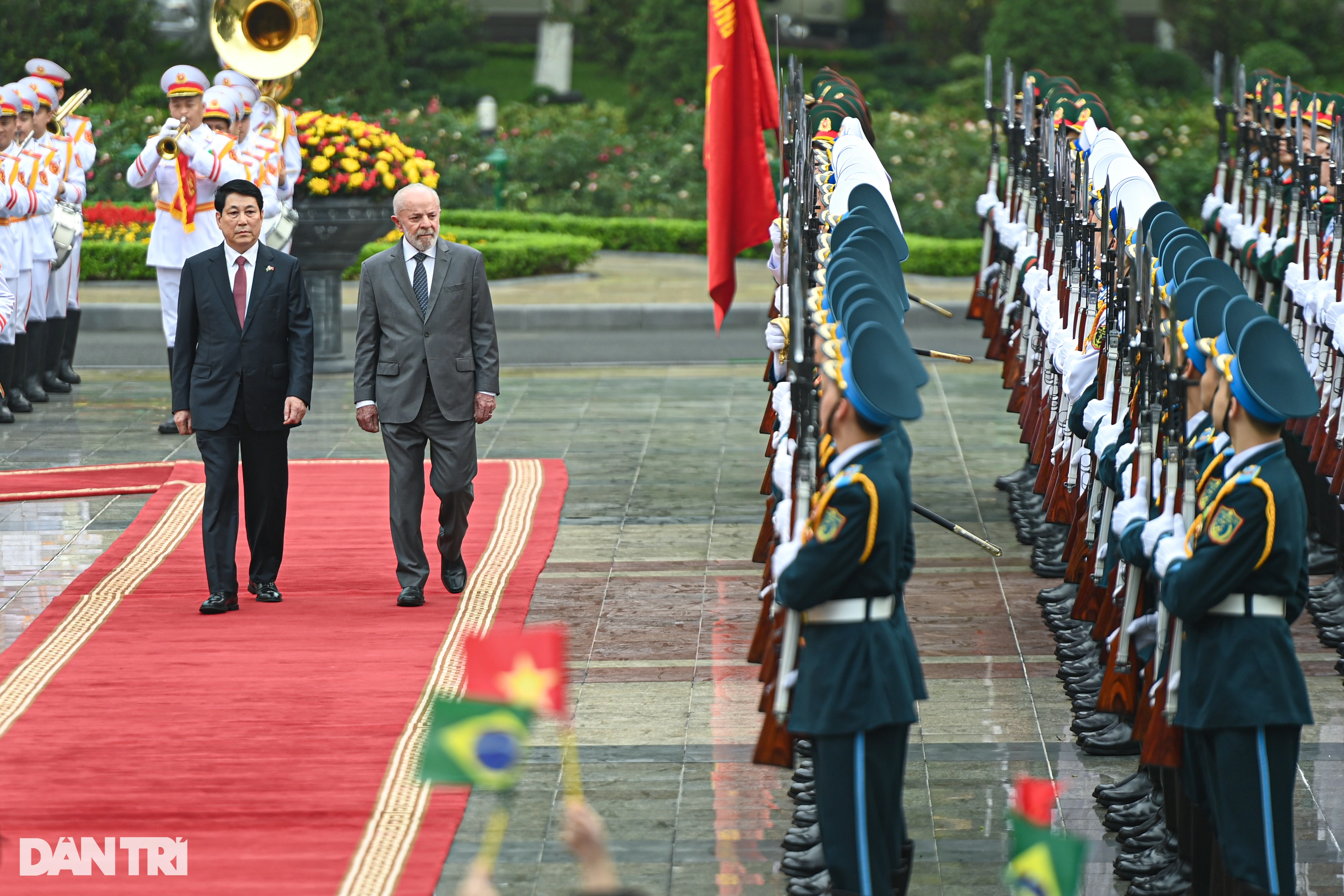

![[Photo] General Secretary To Lam receives Brazilian President Luiz Inácio Lula da Silva](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/7063dab9a0534269815360df80a9179e)

![[Photo] Vietnam and Brazil sign cooperation agreements in many important fields](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/28/a5603b27b5a54c00b9fdfca46720b47e)

Comment (0)