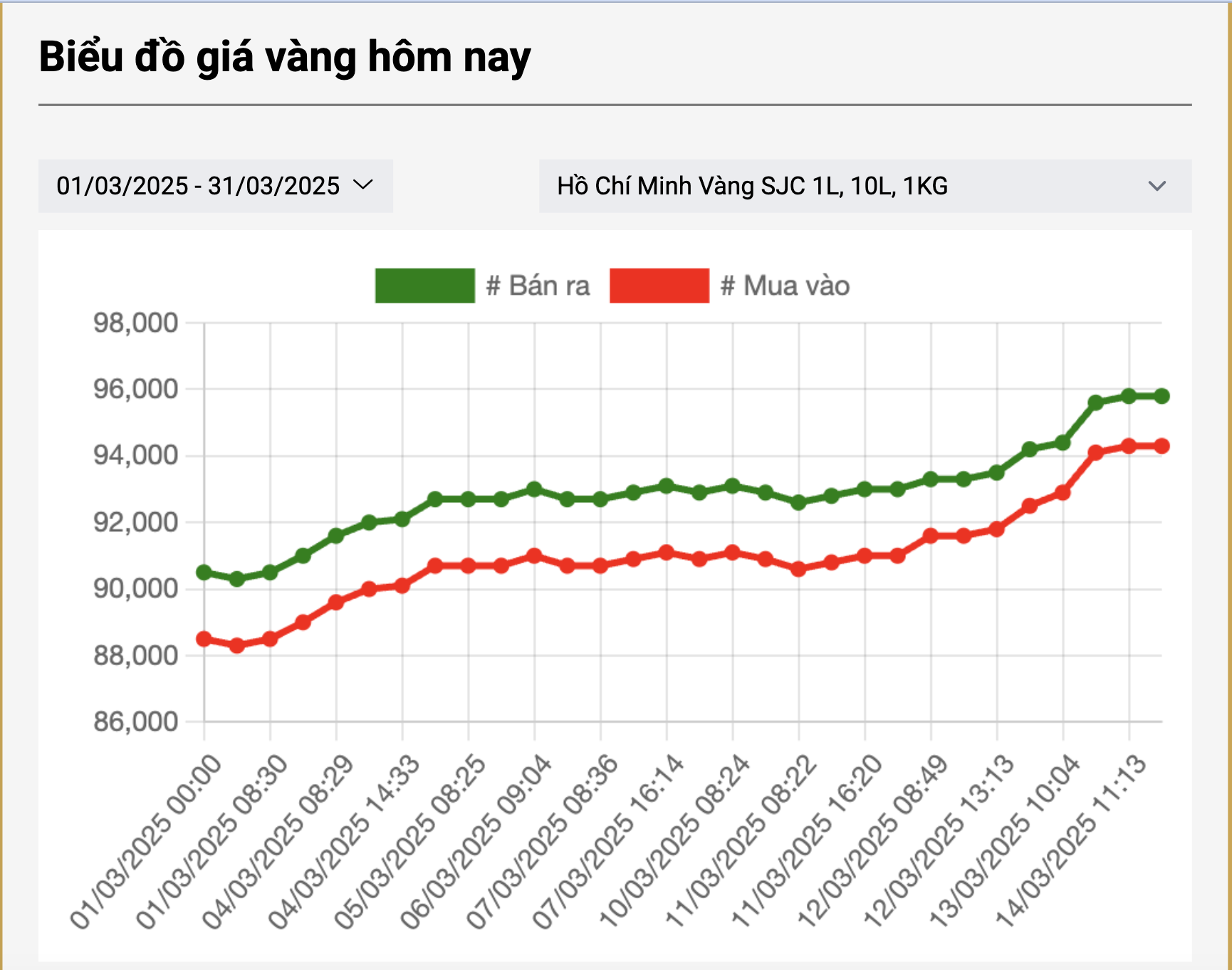

(NLDO) – In just one week, the price of SJC gold bars and gold rings continuously broke all records, increasing by more than 3 million VND, stimulating trading demand in the market.

At the end of the week, March 15, the price of SJC gold bars was listed by businesses at 94.3 million VND/tael for buying and 95.8 million VND/tael for selling. The highest price of gold bars exceeded 96 million VND/tael. In just 1 week, the price of gold bars increased by a total of more than 3 million VND/tael.

The price of 99.99 plain gold rings is bought by trading companies at 94.2 million VND/tael, sold at 95.8 million VND/tael, an increase of about 3 million VND/tael in the past week. The highest price of plain gold rings is up to 96.5 million VND/tael.

Domestic gold prices increased as world prices hit an all-time high, surpassing the $3,004/ounce mark before closing at $2,985/ounce at the end of the week. In just one week, world gold prices also increased by $74/ounce (equivalent to VND2.3 million/tael).

According to a reporter from Nguoi Lao Dong Newspaper, the increase in gold prices has boosted demand for transactions in the market. Besides those who sell gold when prices continuously hit new peaks, many people buy in the hope that prices will continue to increase.

Customers trading gold at SJC Company on the afternoon of March 14 when gold price set a new record high.

Gold expert Phan Dung Khanh commented that domestic gold prices are affected by world prices, so they could set new records if world prices continue to increase sharply. However, the level of impact on gold bars and gold rings will be different. Because the price of SJC gold bars is more strictly managed in the State Bank's roadmap to stabilize and control the gold market. Therefore, the level of impact from policies is higher than that of gold rings or jewelry gold. And this creates a phenomenon where gold bars were always higher than gold rings in the past, but now the price of gold rings is increasing faster.

On the contrary, if the world gold price decreases, the price of gold rings may also decrease more strongly than SJC gold bars.

If calculated from the beginning of 2025 until now, the price of SJC gold bars and gold rings has increased by about 11 million VND/tael, an increase of nearly 13%. Some opinions are wondering whether to withdraw savings to buy gold at this time?

According to Mr. Phan Dung Khanh, investors should allocate their asset portfolio reasonably, especially for those who are completely new to gold (do not own gold yet). In case investors want to participate in the gold market at the moment, they should not hold more than 50% of their asset portfolio in gold at this time, they should only keep about 10% -20% of their assets in gold. "You should not borrow money or withdraw savings to buy gold. Because with the price continuously reaching peaks, the short-term risks are getting greater. If the gold price reverses and goes down, the loss will be very large, you should not withdraw all your savings to move to gold" - Mr. Phan Dung Khanh said.

In many conversations with reporters of Nguoi Lao Dong Newspaper, gold expert Tran Duy Phuong also recommended that if buying gold, you should only allocate a ratio of 6/4, or 60% of the investment budget to gold, and the rest to savings. Do not put all your capital into gold at this time.

SJC gold bar price has increased continuously over the past month.

Source: https://nld.com.vn/gia-vang-lap-dinh-co-nen-rut-tiet-kiem-mua-vang-mieng-sjc-vang-nhan-196250315121854844.htm

Comment (0)