Domestic gold price today April 1, 2025

At the time of survey at 10:30 a.m. on April 1, 2025, the domestic gold price today, April 1, 2025, continued to increase strongly, officially setting a new record when reaching the threshold of more than 102 million VND/tael. The gold market is hotter than ever with simultaneous price increases from major brands, promising to bring many opportunities and challenges to investors. Let's take a look at the detailed gold prices at reputable units today!

The price of SJC gold in Hanoi is listed by PNJ Company at 100.3 - 102.6 million VND/tael (buy - sell). Compared to yesterday, the gold price increased by 800 thousand VND/tael in both buying and selling directions, showing the constant heat of this type of gold bar.

At the same time, DOJI Group also updated the gold price today, April 1, 2025, at 100.3 - 102.6 million VND/tael (buy - sell), increasing by 800 thousand VND/tael in both directions. This is a clear signal that SJC gold is maintaining its leading position in the market.

Meanwhile, at Mi Hong Jewelry Company, SJC gold price is listed at 99.5 - 101.0 million VND/tael (buy - sell). Compared to yesterday, the buying price increased slightly by 30 thousand VND/tael, while the selling price remained the same, reflecting the caution of this unit in the face of market fluctuations.

Bao Tin Minh Chau Company Limited recorded the gold price today, April 1, 2025 at 100.4 - 102.7 million VND/tael (buy - sell). The increase was 800 thousand VND/tael for buying and 800 thousand VND/tael for selling compared to yesterday, showing the strong breakthrough of SJC gold here.

In Phu Quy, the price of SJC gold was recorded at 100.2 - 102.6 million VND/tael (buy - sell). Notably, the buying price increased by 1 million VND/tael, while the selling price increased by 800 thousand VND/tael compared to the previous day, confirming the upward trend of the gold market.

Not only gold bars, today's gold price on April 1, 2025 for jewelry gold also recorded an impressive increase. At PNJ, the price of 999.9 jewelry gold reached 99.5 - 102.0 million VND/tael, an increase of 300 thousand VND/tael in both directions. Meanwhile, 916 gold (22K) was traded at 91.03 - 93.53 million VND/tael, an increase of 270 thousand VND/tael, continuing to be an attractive choice for jewelry buyers.

DOJI Group also updated the price of 9999 raw materials in Hanoi at 100.1 - 101.7 million VND/tael, increasing by 1.4 million VND/tael for buying and 1.2 million VND/tael for selling - an astonishing figure, reflecting the increasing demand for raw gold.

As of 10:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 100.3-102.6 million VND/tael (buy - sell); an increase of 1.1 million VND/tael in the buying direction - an increase of 900 thousand VND/tael in the selling direction compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 100.4-102.7 million VND/tael (buy - sell); increased by 800 thousand VND/tael for buying - increased by 800 thousand VND/tael for selling.

The latest gold price list today, April 1, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 100.3 | ▲800 | 102.6 | ▲800 |

| DOJI Group | 100.3 | ▲800 | 102.6 | ▲800 |

| Red Eyelashes | 99.5 | ▲30 | 101.0 | - |

| PNJ | 100.3 | ▲800 | 102.6 | ▲800 |

| Vietinbank Gold | 102.6 | ▲800 | ||

| Bao Tin Minh Chau | 100.4 | ▲800 | 102.7 | ▲800 |

| Phu Quy | 100.2 | ▲1000 | 102.6 | ▲800 |

| 1. DOJI - Updated: April 1, 2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 100,300 ▲800K | 102,600 ▲800K |

| AVPL/SJC HCM | 100,300 ▲800K | 102,600 ▲800K |

| AVPL/SJC DN | 100,300 ▲800K | 102,600 ▲800K |

| Raw material 9999 - HN | 100.100 ▲1400K | 101,700 ▲1200K |

| Raw material 999 - HN | 100,000 ▲1300K | 101,600 ▲1100K |

| 2. PNJ - Updated: April 1, 2025 10:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 99,700 ▲200K | 102,100 ▲300K |

| HCMC - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Hanoi - PNJ | 99,700 ▲200K | 102,100 ▲300K |

| Hanoi - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Da Nang - PNJ | 99,700 ▲200K | 102,100 ▲300K |

| Da Nang - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Western Region - PNJ | 99,700 ▲200K | 102,100 ▲300K |

| Western Region - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Jewelry gold price - PNJ | 99,700 ▲200K | 102,100 ▲300K |

| Jewelry gold price - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Jewelry gold price - Southeast | PNJ | 99,700 ▲200K |

| Jewelry gold price - SJC | 100,300 ▲800K | 102,600 ▲800K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 99,700 ▲200K |

| Jewelry gold price - Jewelry gold 999.9 | 99,500 ▲300K | 102,000 ▲300K |

| Jewelry gold price - Jewelry gold 999 | 99,400 ▲300K | 101,900 ▲300K |

| Jewelry gold price - Jewelry gold 99 | 98,580 ▲300K | 101,080 ▲300K |

| Jewelry gold price - 916 gold (22K) | 91,030 ▲270K | 93,530 ▲270K |

| Jewelry gold price - 750 gold (18K) | 74,150 ▲220K | 76,650 ▲220K |

| Jewelry gold price - 680 gold (16.3K) | 67,010 ▲200K | 69,510 ▲200K |

| Jewelry gold price - 650 gold (15.6K) | 63,950 ▲190K | 66,450 ▲190K |

| Jewelry gold price - 610 gold (14.6K) | 59,870 ▲180K | 62,370 ▲180K |

| Jewelry gold price - 585 gold (14K) | 57,320 ▲170K | 59,820 ▲170K |

| Jewelry gold price - 416 gold (10K) | 40,080 ▲120K | 42,580 ▲120K |

| Jewelry gold price - 375 gold (9K) | 35,900 ▲110K | 38,400 ▲110K |

| Jewelry gold price - 333 gold (8K) | 31,310 ▲100K | 33,810 ▲100K |

| 3. SJC - Updated: 04/01/2025 10:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 100,300 ▲800K | 102,600 ▲800K |

| SJC gold 5 chi | 100,300 ▲800K | 102,620 ▲800K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 100,300 ▲800K | 102,630 ▲800K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 99,700 ▲900K | 101,900 ▲1100K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 99,700 ▲900K | 102,000 ▲1100K |

| Jewelry 99.99% | 99,700 ▲900K | 101,600 ▲1100K |

| Jewelry 99% | 97,594 ▲1090K | 100,594 ▲1090K |

| Jewelry 68% | 66,244 ▲476K | 69,244 ▲476K |

| Jewelry 41.7% | 39,521 ▲291K | 42,521 ▲291K |

World gold price today April 1, 2025 and world gold price fluctuation chart in the past 24 hours

At the time of trading at 10:30 a.m. on April 1, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,142.54 USD/ounce. Converted according to the USD exchange rate on the free market (25,960 VND/USD), the world gold price is equivalent to about 99.42 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (100.3-102.6 million VND/tael), the SJC gold price is currently about 0.88 million VND/tael higher than the international gold price.

On April 1, 2025, the Asian financial market has many notable fluctuations, and one of the important factors affecting people is interest rates - which you can simply understand as the "price of money" when borrowing or saving. When interest rates change, it directly affects our wallets, even if you are not familiar with economics. Let's see what is happening in an easy-to-understand way!

First of all, in the US, the interest rate on government bonds (a type of debt issued by the government) is reduced on this day. Specifically, the interest rate on 10-year bonds is reduced to 4.2072%, slightly lower than before. This means that if you buy this bond, the amount of interest you receive will be less. But why is the interest rate reduced? The reason is that many people are rushing to buy bonds because they see them as a “safe haven” during times of market turmoil. When more people buy, the price of bonds increases, and the interest rate – which is the opposite of price – will decrease. This is related to people's worries about the new tax policy that US President Donald Trump is about to announce on April 2, which he calls “Liberation Day”. This policy could shake the US economy, so people are looking for less risky things like bonds.

Interestingly, falling interest rates have also affected the US dollar. When interest rates are low, the dollar is less attractive to those who want to save money and earn interest, causing its value to fall against the Japanese yen, which is considered a “safer” currency. On April 1, it cost about 149.70 yen to buy a dollar, a little less than before. In contrast, the dollar has gained slightly against the Canadian and Mexican currencies, because both countries’ economies are heavily dependent on the US. For ordinary people, this means that if you plan to buy something from the US, it may be a little cheaper in yen, but more expensive in Mexican pesos.

Meanwhile, in Australia, the Australian dollar fell slightly to $0.6238. The reason is that retail sales in Australia are not good, making people worried about the country's economy. When the economy is weak, the Australian central bank can keep interest rates low to encourage people to spend money instead of saving. For you, if interest rates are low, saving money will be less profitable, but borrowing money to buy a house or car will be cheaper. However, the official decision of the Australian bank will be announced later in the day, and people are waiting to see if interest rates will change.

In general, interest rates reflect the anxiety of global markets. When people fear a recession – when jobs are scarce and businesses are struggling – they go for safe havens like bonds or gold, causing interest rates to fall. Gold alone has skyrocketed to a record $3,139.78 an ounce, as many believe it holds its value better than paper money in times of economic uncertainty. For those unfamiliar with economics, just remember: low interest rates make borrowing easier, but saving money is less attractive. And if you want to keep your money safe, gold is a hot choice right now!

Forecast of domestic and world gold prices on April 1, 2025

Gold prices are expected to continue to rise sharply in the coming time. Adrian Day, chairman of Adrian Day Asset Management, said that gold is still on the rise thanks to strong demand from central banks, Chinese consumers and North American investors. This makes the precious metal the center of attention.

Rich Checkan, head of Asset Strategies International, said that gold has just easily surpassed the $3,000/ounce mark after the recent sell-off. He believes that the strength of gold is still very strong and shows no signs of stopping. Meanwhile, Alex Kuptsikevich of FxPro predicts that gold will hit $3,180/ounce in the next few weeks and could reach $3,400/ounce by the end of the summer, despite entering unprecedented price territory.

Experts at CPM Group are equally optimistic, predicting that gold prices will reach $3,200 an ounce. They advise investors to hold gold for the long term or buy more to take advantage of the opportunity. Goldman Sachs even gave an even more impressive figure, saying that gold prices could soar to $4,500 an ounce this year.

Source: https://baodaknong.vn/gia-vang-hom-nay-1-4-2025-gia-vang-trong-nuoc-hon-gia-vang-the-gioi-0-88-trieu-qua-moc-102-trieu-247901.html

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Standard Chartered Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/125507ba412d4ebfb091fa7ddb936b3b)

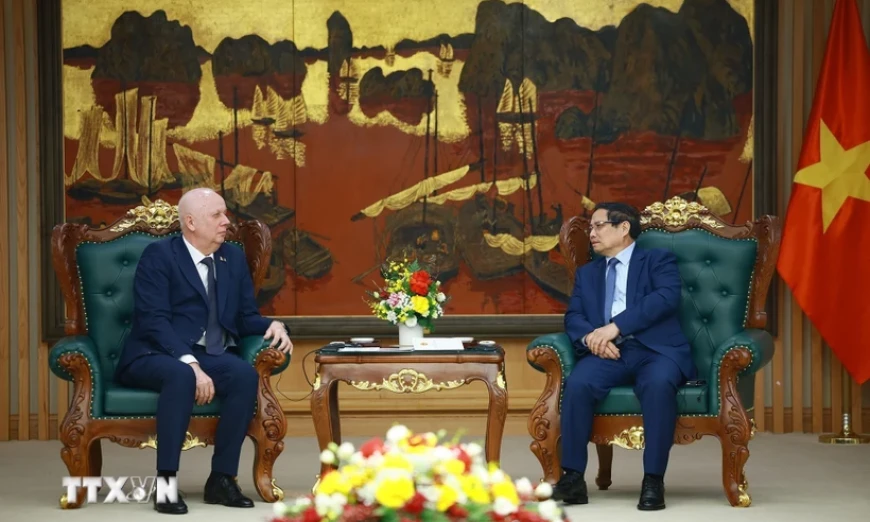

![[Photo] Prime Minister Pham Minh Chinh receives Deputy Prime Minister of the Republic of Belarus Anatoly Sivak](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/79cdb685820a45868602e2fa576977a0)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Comrade Khamtay Siphandone - a leader who contributed to fostering Vietnam-Laos relations](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/3/3d83ed2d26e2426fabd41862661dfff2)

Comment (0)