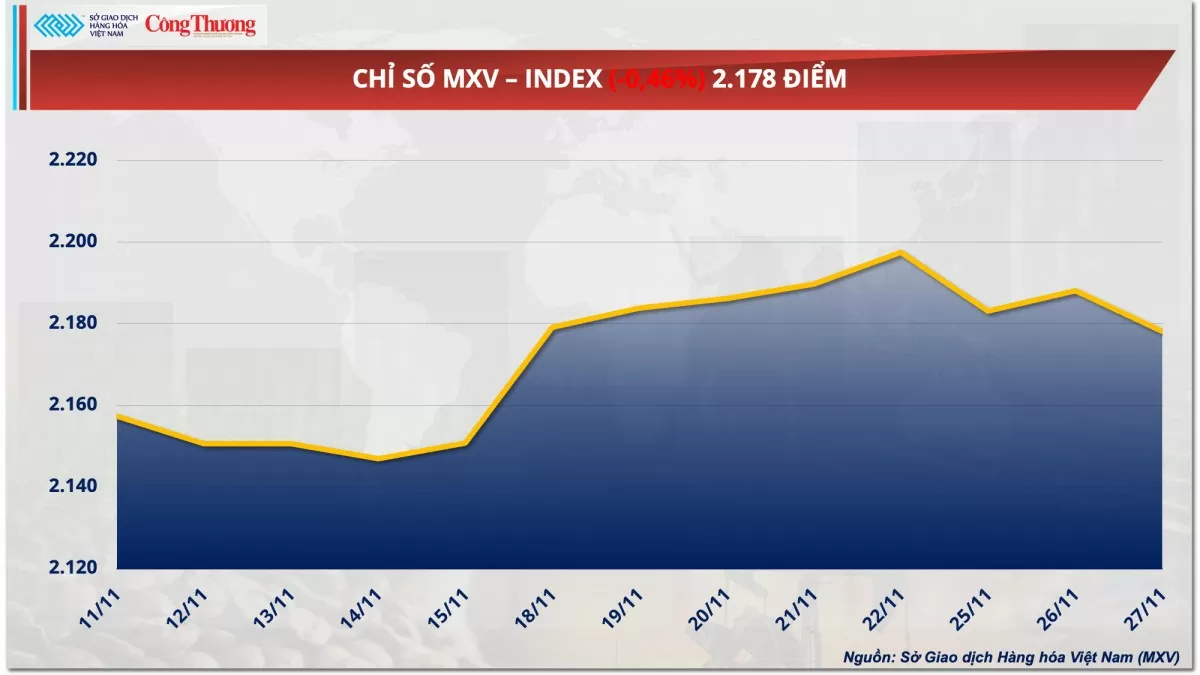

The Vietnam Commodity Exchange (MXV) said that red returned to the world raw material market in yesterday's trading day (November 27).

Closing, the MXV-Index decreased by 0.46% to 2,178 points. Going against the general market trend, before the US Thanksgiving holiday, trading on the industrial raw materials market. On the contrary, in the energy market, the prices of two oil products decreased slightly in the context of a sharp increase in US gasoline inventories and the possibility of the FED narrowing interest rates next year.

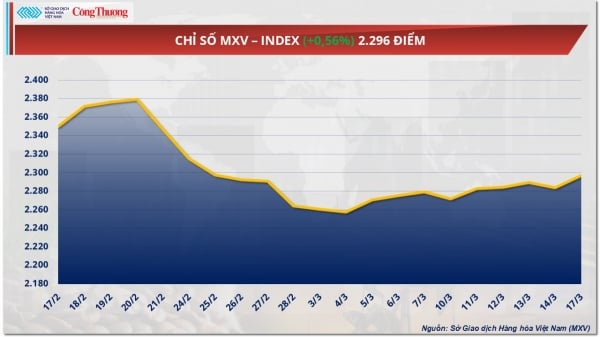

|

| MXV-Index |

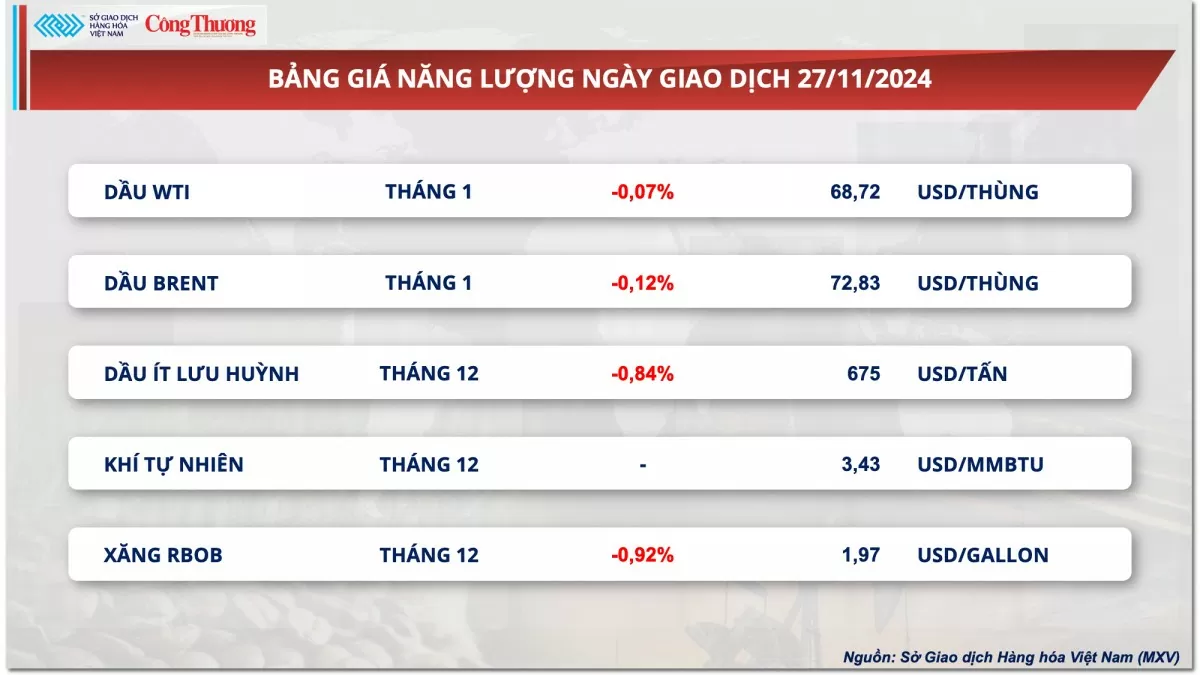

World oil prices extended their decline to the third consecutive session.

At the end of yesterday's trading session, oil prices fell slightly by about 0.1%, marking the third consecutive decline, amid a sudden increase in US gasoline inventories and the possibility that the US Federal Reserve (FED) will scale back interest rate cuts.

|

| Energy price list |

Closing, WTI crude oil price decreased 0.07%, down to nearly 69 USD/barrel. In parallel, Brent crude oil price decreased 0.12% to nearly 73 USD/barrel.

According to newly released data from the US Energy Information Administration (EIA), US gasoline inventories jumped 3.3 million barrels per day to 212.2 million barrels in the week ending November 22, far from the forecast of a decrease of 46,000 barrels in a previous Reuters survey. Notably, before the Thanksgiving holiday, the unexpected increase in gasoline inventories raised concerns about weakening energy demand, thereby putting pressure on oil prices.

In addition, in the US, the Personal Consumption Expenditures (PCE) index in October increased 0.2%, equivalent to the unadjusted increase in September. In the 12 months to October, the PCE index increased 2.3% after increasing 2.1% in the previous month. This shows that although inflation in the US is cooling, the trend is gradually slowing, leading to the possibility that the Fed will narrow the scope for interest rate cuts in 2025.

In addition, according to the FedWatch tool, the market is betting that the Fed will cut interest rates by 25 basis points at its December 17-18 meeting, but will leave rates unchanged at its January and March meetings. This slower rate cut will keep borrowing costs high, thereby slowing economic activity, raising concerns about shrinking oil demand and putting pressure on oil prices.

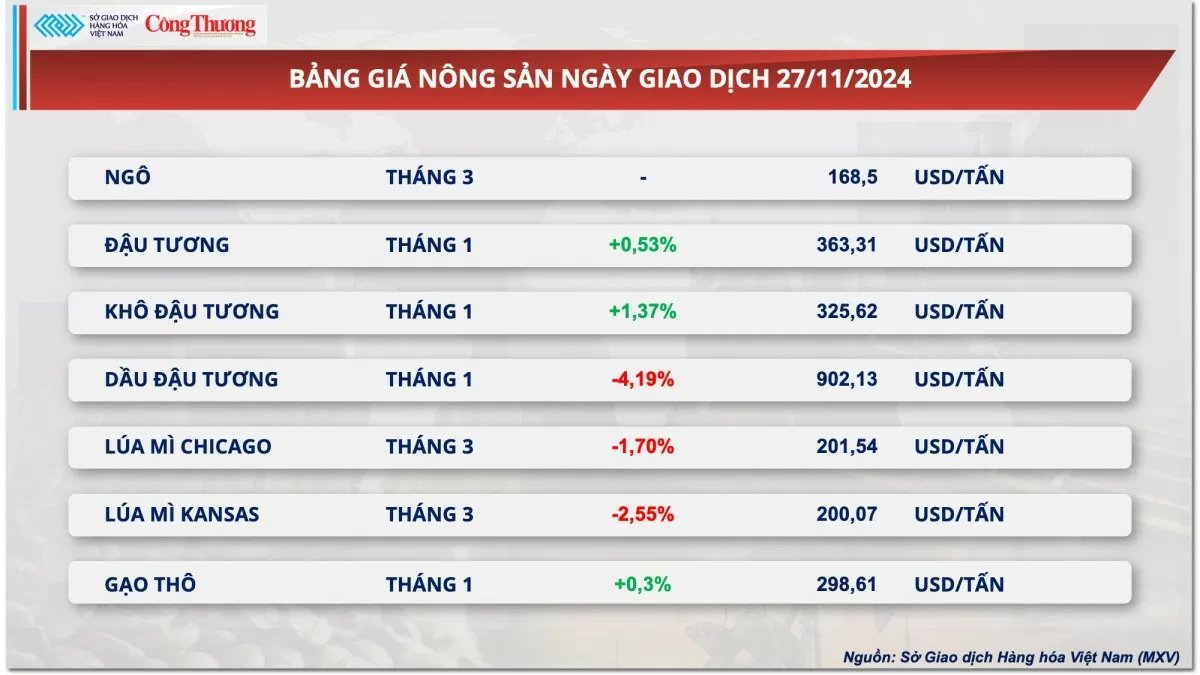

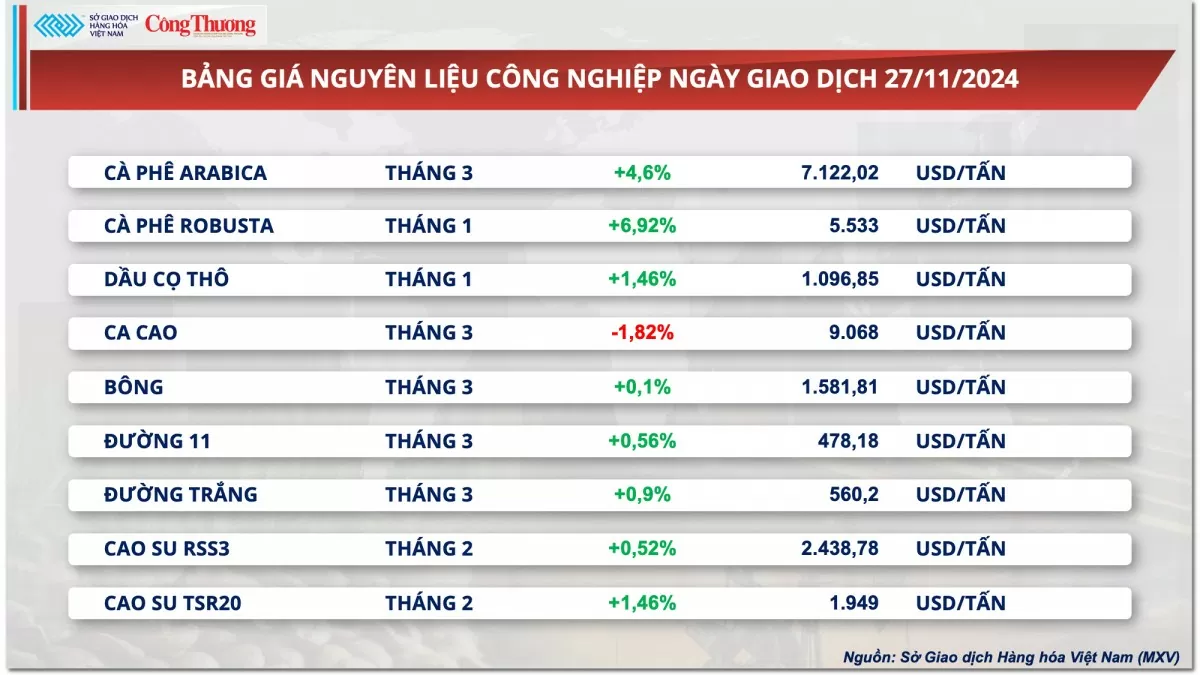

Prices of some other goods

|

| Agricultural product price list |

|

| Industrial raw material price list |

|

| Metal price list |

Source: https://congthuong.vn/thi-truong-hang-hoa-hom-nay-2811-gia-dau-the-gioi-keo-dai-da-giam-sang-phien-thu-ba-lien-tiep-361294.html

![[Photo] Third meeting of the Organizing Subcommittee serving the 14th National Party Congress](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/3f342a185e714df58aad8c0fc08e4af2)

![[Photo] General Secretary To Lam receives Russian Ambassador to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/b486192404d54058b15165174ea36c4e)

![[Photo] Relatives of victims of the earthquake in Myanmar were moved and grateful to the rescue team of the Vietnamese Ministry of National Defense.](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/2/aa6a37e9b59543dfb0ddc7f44162a7a7)

Comment (0)