Masan Consumer Corporation (Masan Consumer, stock code MCH) announced the closing of the shareholder list on February 12 to issue more than 326.8 million shares. The offering price for existing shareholders is VND10,000/share while MCH's trading price on the UPCoM exchange is around VND219,000.

Masan Consumer offers new shares to shareholders at VND10,000/share

Masan Consumer shareholders will be able to buy new shares at a ratio of 1,000:451, meaning that for every 1,000 shares a shareholder can buy 451 new shares. Shareholders can transfer their purchase rights from February 18 to March 4, while the time to pay for new shares is from February 18 to March 10. If the offering is successful, Masan Consumer will earn a total of about VND3,268 billion. The entire amount will be used to repay loans and pay for office rent. Masan Consumer's charter capital after this round will increase to VND10,623 billion.

In 2024, MCH stock price increased sharply from 75,000 VND at the beginning of the year to nearly 260,000 VND at the end of the year thanks to the "huge" dividend payment. At the same time, this stock is also of interest to investors with information that it will be transferred from UPCoM to listing on HOSE after this stock offering.

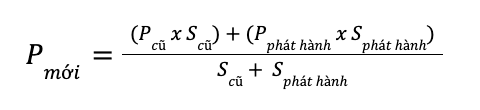

The sky-high stock price brings Masan Consumer's current capitalization to nearly VND160,000 billion, ranking 11th in the list of enterprises with the largest capitalization on the Vietnamese stock market. However, not all shareholders who buy new shares at VND10,000 will benefit from being far from the trading price on the stock exchange. According to regulations, the stock price on the stock exchange will be adjusted down accordingly when the company pays dividends or issues additional shares. For example, on December 19, 2024, the ex-rights trading day when MCH pays a cash dividend of VND9,500/share, the MCH stock price on the stock exchange will be immediately deducted by VND9,500, from VND229,000 of the previous session to the reference price of VND219,500. In the case of issuing additional new shares, the reference price of shares traded on the ex-rights day is determined by the formula:

- P( new) : Average stock price after issuance.

- P( old) : Stock price before issuance.

- S( old) : Number of shares before issuance.

- P( issue ): Additional issue price of shares.

- S( issued ): Number of newly issued shares.

Therefore, there is still a phenomenon where many investors do not like to wait until the closing date for the right to buy new shares but can sell before the issuance date...

Source: https://thanhnien.vn/gia-co-phieu-gan-220000-dong-masan-consumer-chao-ban-cho-co-dong-10000-dong-185250204153125343.htm

Comment (0)