12 covered warrants issued by VPBankS are based on 10 leading stocks, belonging to industries such as banking (ACB, MBB, SHB, STB, TCB), construction materials (HPG), information technology (FPT) and retail (MWG, MSN, VRE).

Covered Warrants - A Promising Investment Option

2025 promises to be a promising year for the warrant market in Vietnam, with many factors promoting development and creating attractive investment opportunities. First, the stability and recovery of the global economy, especially in major markets such as the US and Europe, will facilitate foreign investment flows into Vietnam.

The Government's policies to develop the stock market in general and warrants in particular are being promoted. The Government has approved the Stock Market Development Strategy until 2030, with the goal of upgrading the market from frontier to emerging by 2025.

FTSE Russell’s consideration to upgrade Vietnam to secondary emerging market status as early as September 2025 will be a big boost. This will not only increase investor confidence, market transparency and efficiency, but also attract ETF fund flows into the market, creating breakthrough investment opportunities for covered warrants (CW). Most of them predict that the VN-Index could surpass 1,400 points by 2025.

The above context is a good time for investors to consider leveraged products such as CW, which can both increase profits and effectively control risks.

CW is an investment product issued by a securities company, listed on the stock exchange, has its own trading code and has trading activities similar to the underlying securities. CW helps investors increase their profitability thanks to high leverage, but at the same time helps limit losses in case of unfavorable price movements. Investors can also easily access CW in both the primary and secondary markets, with good liquidity.

VPBankS accompanies investors in covered warrants

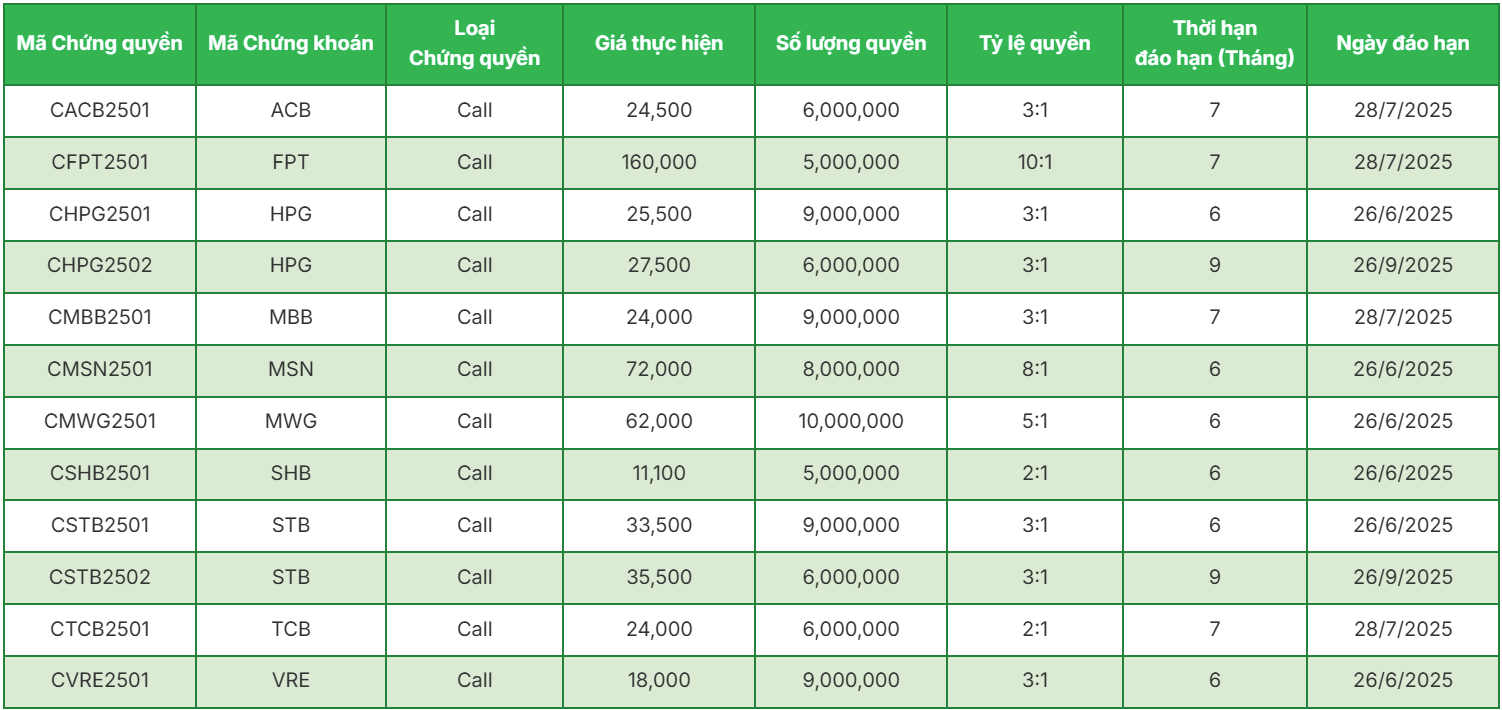

In order to meet the increasingly diverse needs of investors, on January 15, 2025, VPBank Securities Joint Stock Company (VPBankS) listed 12 CW codes with a total quantity of 88 million units.

These 12 CW codes are issued based on 10 leading stocks, belonging to industries such as banking (ACB, MBB, SHB, STB, TCB), construction materials (HPG), information technology (FPT) and retail (MWG, MSN, VRE).

According to VPBankS, these are all stocks in the industry group that securities companies and experts expect to achieve good growth by 2025 in the context of the economy maintaining growth momentum, accelerating public investment and recovering consumption.

The above CWs are listed with various terms such as 6 months, 7 months and 9 months. Particularly, the two CW codes of HPG and STB are issued with two terms of 6 months and 9 months, providing diverse options for investors.

VPBankS representative also emphasized that when investing in CW codes issued by VPBankS, investors will experience fast transactions, ensuring two-way liquidity. VPBankS always strives to stick closely to the underlying stocks, maximizing value for investors.

Since joining the CW market at the end of 2023, VPBankS has achieved many successes when CW codes were all traded with high liquidity, attracting great attention from investors. At the same time, many codes in the first issuance have expired in a profitable state, bringing profits to customers.

The issuance of 12 new CW codes is a testament to VPBankS' commitment, not only to providing products but also to accompanying investors on their journey to achieve financial goals. VPBankS' CW products aim to create long-term value for customers and contribute to the sustainable development of the Vietnamese stock market. At the same time, VPBankS is one of the few securities companies that provide a full range of products to investors including: trading in underlying securities, derivatives, warrants, fund certificates, etc.

In addition to listing new CW codes, VPBankS is implementing a series of incentive programs including a 7.9%/year margin interest rate incentive package, free underlying securities trading for newly opened accounts, and free VN30 index derivatives trading indefinitely for all accounts.

VPBankS also accompanies investors through weekly investment consulting livestream programs, VPBankS Talk seminars held twice a year, or products supporting passive investors such as sample ePortfolio investment portfolios on the NEO Invest application.

Thanks to its fast, accurate, highly secure trading experience, diverse financial products, and consulting services, VPBankS has received many prestigious awards such as "Most Innovative Stock Trading Application 2023" for NEO Invest by International Finance Magazine and "Best Model Portfolio Product 2024" for ePortfolio by Global Banking & Finance Review.

Detailed information about newly listed CW products: https://www.vpbanks.com.vn/chung-quyen

Phuong Dung

Source: https://vietnamnet.vn/vpbanks-niem-yet-12-ma-chung-quyen-dua-tren-cac-co-phieu-hot-2368377.html

Comment (0)