According to CNBC, harsh weather conditions due to the approaching El Nino are raising concerns that robusta coffee production in major producing countries such as Vietnam and Indonesia could be affected, leading to a spike in prices.

In a recent report, Fitch Solutions' BMI research unit said, "The El Nino weather phenomenon is forecast to spread in the third quarter of 2023, raising concerns about a sharp decline in robusta coffee production in Vietnam and Indonesia."

Robusta coffee beans are known for their higher bitterness and acidity, and contain more caffeine than arabica beans.

Brazil’s robusta crop has also been hit by drought, the report said, meaning prices for instant coffee and espresso, which are typically made with robusta beans, could come under pressure amid supply concerns and higher-than-normal demand for robusta as consumers switch to cheaper alternatives to arabica beans.

El Nino is a phenomenon of warmer and drier than normal weather in the central-eastern tropical Pacific Ocean. Climate scientists predict that this year's El Nino could occur in the second half of 2023.

Southeast Asia recently saw a record heatwave in mid-May. “Across Southeast Asia, the El Nino phenomenon with below-average rainfall and higher temperatures has reduced coffee production,” the BMI report said.

Vietnam, Indonesia and Brazil are the world’s largest producers of robusta coffee, according to the Food and Agriculture Organization. The US Department of Agriculture (USDA) forecasts robusta coffee production will decline by about 25%.

Carlos Mera, head of agricultural market analysis at Rabobank, forecasts robusta coffee production will fall 10% to 11.2 million bags in the upcoming harvest.

According to Rabobank, in 2016, water shortages caused by El Nino in both Vietnam and Indonesia caused global production to drop by nearly 10%. Shawn Hackett, president of commodities brokerage Hackett Financial Advisors, said it was no surprise that Vietnam and Indonesia saw robusta coffee production fall by 20% in a year with El Nino.

“That means a serious drop in robusta coffee production,” he said.

Demand is increasing

Robusta beans make up 40% of the world's coffee production, with the remainder being arabica beans - generally considered to be of higher quality and priced higher than robusta.

However, global economic pressures are increasing demand for robusta coffee, which is cheaper.

BMI's report said robusta coffee prices were supported as roasters, processors and consumers saw it as a cost-effective alternative to arabica during times of inflation.

Robusta coffee prices recently spiked to a 15-year high of $2,783 a tonne in late May. They last traded at $2,608 a tonne for July futures, according to data from the Intercontinental Exchange.

Data: Investing (US synthesis)

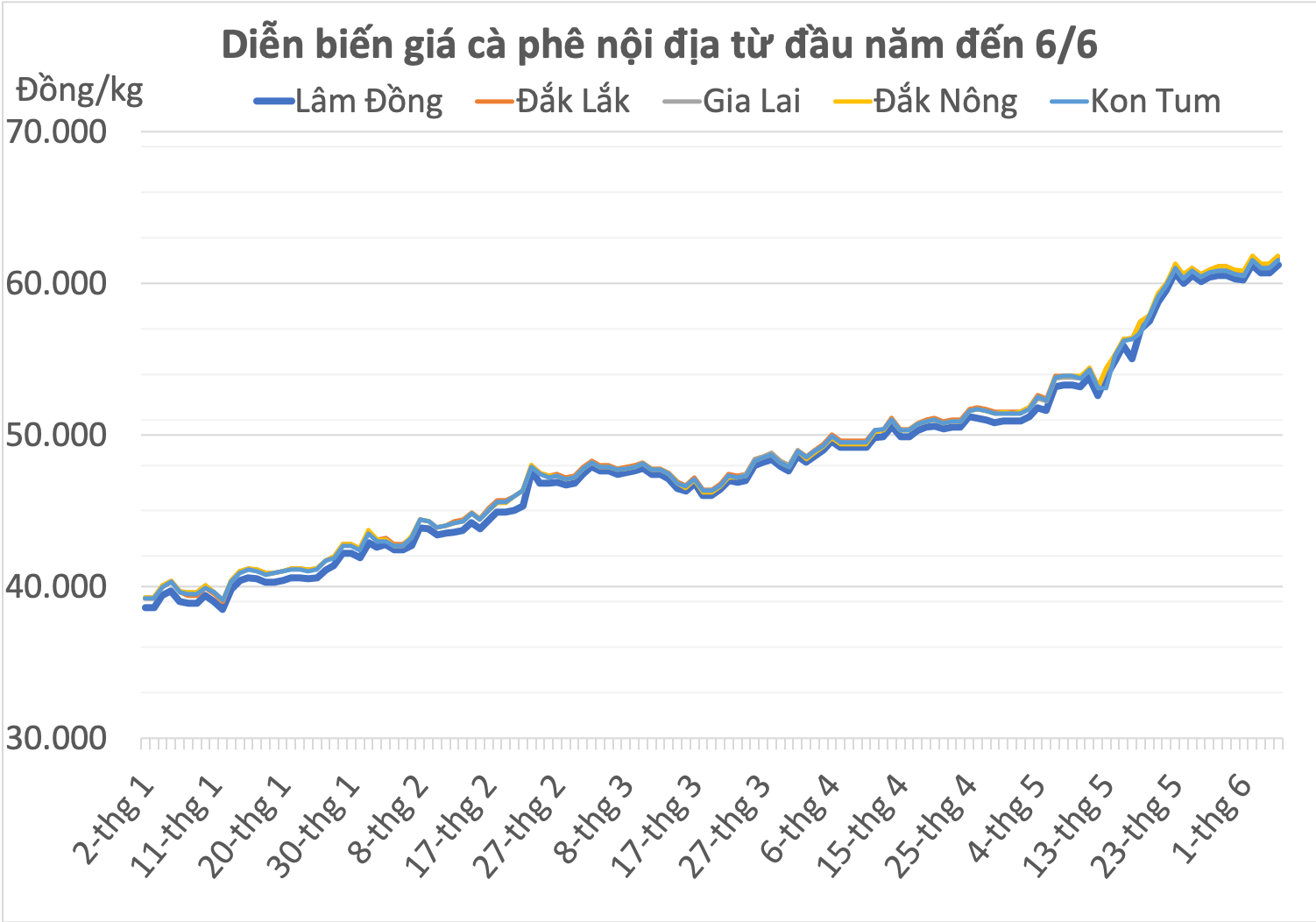

In the Vietnamese market, the price of robusta coffee has continuously set new records, reaching 64,000 VND/kg in some localities at the end of May, but has since quickly adjusted. Currently, the average price of coffee nationwide is close to 62,000 VND/kg.

H. My synthesis

In addition, the price gap between Arabica and Robusta coffee has narrowed to its lowest level since 2019. As of June 6, Arabica coffee prices were trading at 184 US cents/pound (equivalent to 4,088 USD/ton), up 10% compared to the beginning of the year.

Data: Investing (US synthesis)

“In general, Asia prefers robusta over arabica and so demand for robusta is growing much faster than arabica,” said Hackett.

Kopi, also known as Nanyang coffee, is a popular black coffee beverage in Southeast Asia traditionally brewed with robusta coffee beans.

But Asia is not the only region growing fondness for robusta coffee.

“While the drop in processed arabica imports is partly due to lower supplies… the shift to robusta suggests that cheaper coffee is gaining traction in the European market,” said Natalia Gandolphi, an analyst at HedgePoint Global Markets’ Intelligence.

She forecasts a deficit of 4.16 million bags of robusta coffee in the period October 2023 to September 2024.

Source

Comment (0)