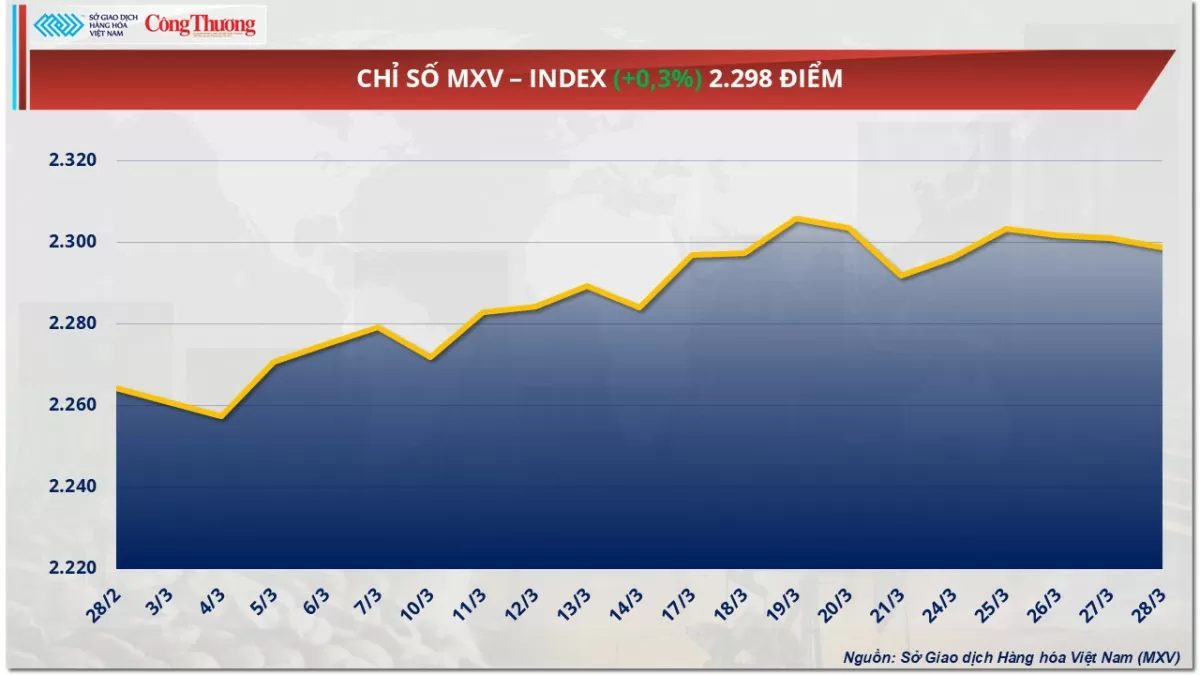

The Vietnam Commodity Exchange (MXV) said that the world raw material market continued to fluctuate in the past trading week (March 24-30). Cautious sentiment continued to overshadow the entire market before the US announced the imposition of reciprocal tariffs. Notably, in the energy market, the prices of two crude oil products increased for the third consecutive week. On the contrary, the positive weather in Brazil eased the concerns of coffee traders around the world, boosting selling pressure in the market. At the close, the dominant buying pressure supported the MXV-Index to increase by 0.3% to 2,298 points.

MXV-Index |

Green covers the energy market

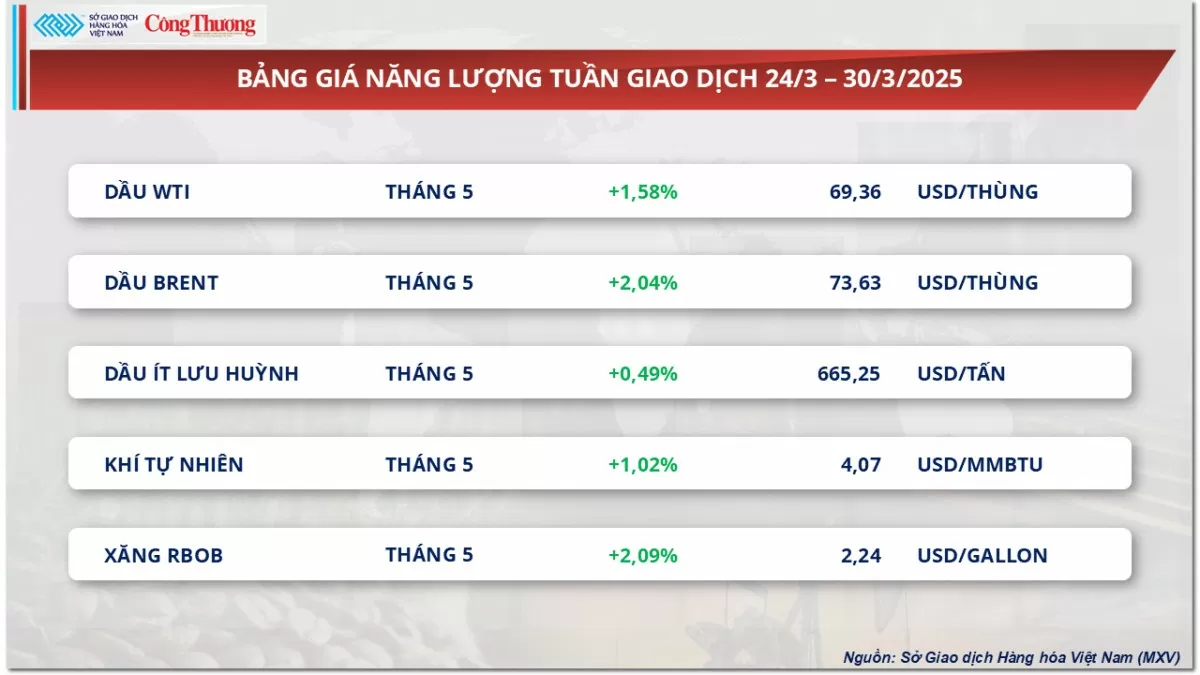

At the end of the last trading week, buying power dominated the energy market. In particular, world crude oil prices increased for the third consecutive week. The latest decisions from the White House continue to have a major impact on oil prices.

At the end of the week, Brent crude oil prices increased to 73.63 USD/barrel, an increase of 2.04%; WTI crude oil prices also increased by 1.58% this week; closing at 69.36 USD/barrel. Notably, at the end of the trading session on Thursday (March 27), the prices of the two crude oil products recorded their highest levels since early March.

Energy price list |

The global oil market got a big boost early this week when US President Donald Trump announced a 25% tariff on countries importing crude oil from Venezuela. The announcement came on March 24, just days after the White House implemented a new round of sanctions against Iran, aiming to reduce Iranian oil supplies to zero.

China, meanwhile, is said to be the country most affected by the new sanctions. As the largest customer of both Iranian and Venezuelan oil, Beijing now faces the challenge of finding alternative supplies. Notably, the latest sanctions on Iranian crude oil have directly named several Chinese entities, suggesting that the US is targeting buyers of oil from sanctioned countries as well.

In addition to China, the list of countries importing oil from Venezuela includes India, Spain, Italy and Cuba. All will have to adjust their oil purchasing strategies to avoid additional tariffs from the US.

This has forced the biggest buyers of both Iranian and Venezuelan crude to find new sources. Globally, among those looking for new sources is Reliance Industries, which operates the world’s largest refining complex in India. The company imports an average of 2 million barrels of oil a month from Venezuela, a significant portion of its production.

Concerns about a global oil supply shortage were further reinforced by the latest report from the US Energy Information Administration (EIA) released on March 26 local time. According to the EIA, US commercial crude oil inventories fell by 3.3 million barrels in the week ending March 21, to 433.6 million barrels. Previously, the American Petroleum Institute had a similar report on March 25 with a decrease of 4.6 million barrels.

The declines were much steeper than market expectations, with analysts pointing to increased refinery capacity ahead of the peak US travel season over the next two months.

On the other hand, the risk of rising global trade tensions is the main driver holding back the market’s rally. On March 26, US President Donald Trump announced that he would impose an additional 25% tariff on “all non-American cars” starting April 3.

Mr. Trump also warned Canada and the European Union (EU) that he could continue to apply stronger tariff measures if he saw Canada and the EU causing damage to the US economy.

Countries have reacted with dissatisfaction with President Trump's decision, with Canadian Prime Minister Mark Carney responding that Canada will also take action against this US tariff barrier.

These reactions have forced the market to consider the prospect of a “trade war” that could negatively impact future oil demand. The Trump administration’s tariffs on imported cars could also indirectly pressure oil demand by pushing up vehicle prices, as imported cars still account for a large proportion of the US auto market.

Coffee and sugar prices plummet

According to MXV, selling pressure dominated the industrial raw material market last week. At the close, Arabica coffee prices fell by 2.93% to $8,376/ton, while Robusta prices also fell by 3.23% to $5,337/ton. Thus, compared to the record high price set in the middle of February, Arabica coffee prices have lost more than $1,000/ton; Robusta prices have also decreased by about $450/ton.

Industrial raw material price list |

There are many reasons for the decline in coffee prices last week. Regarding supply, according to Marex Solutions' forecast, Vietnam's Robusta coffee output in the 2025-2026 crop year could reach 28.8 million bags, up 7.9% year-on-year, while Brazil's Robusta output is expected to reach 25 million bags, up 13.6%. In addition, as of March 28, Arabica inventories according to ICE statistics had fallen to a 5-week low of nearly 771,600 bags. Robusta inventories fell slightly from a 7-week high of about 4,410 lots on March 25 to over 4,390 lots on March 28. Over the past month, dry Arabica coffee inventories have been on a downward trend.

Robusta coffee price dropped sharply by 3.23% to 5,337 USD/ton |

In the domestic market, last week, the price of green coffee beans in the Central Highlands region fluctuated from 132,300 VND/kg to 135,400 VND/kg. Recorded this morning (March 31), coffee prices ranged from 131,200 - 132,300 VND/kg, stable compared to yesterday but down 1,700 VND/kg compared to the beginning of last week.

Another notable development in the industrial raw material market is that the May raw sugar futures contract on the New York Stock Exchange fell sharply by 3.85% last week. The main reason is the weakening demand from China - one of the world's largest sugar consuming markets. The report shows that China's sugar imports in February fell sharply by 97% compared to the same period last year, to only 20,000 tons. This also affected Brazil's sugar exports in February, when they decreased slightly by 5.6%, to 39.822 million tons.

In contrast to coffee and sugar, cocoa prices ended the trading week with a strong increase of 3.57%, up to 8,042 USD/ton. After a sharp decline last Friday (down 3.29%), cocoa prices rebounded at the beginning of the week thanks to technical buying.

Despite this, the outlook for global cocoa supplies remains positive. According to the International Cocoa Organization (ICCO), the global cocoa surplus in the 2024-25 season is expected to reach 142,000 tonnes – the first surplus in four years – as global production surges by 7.8% to a new record of 4.84 million tonnes.

Prices of some other goods

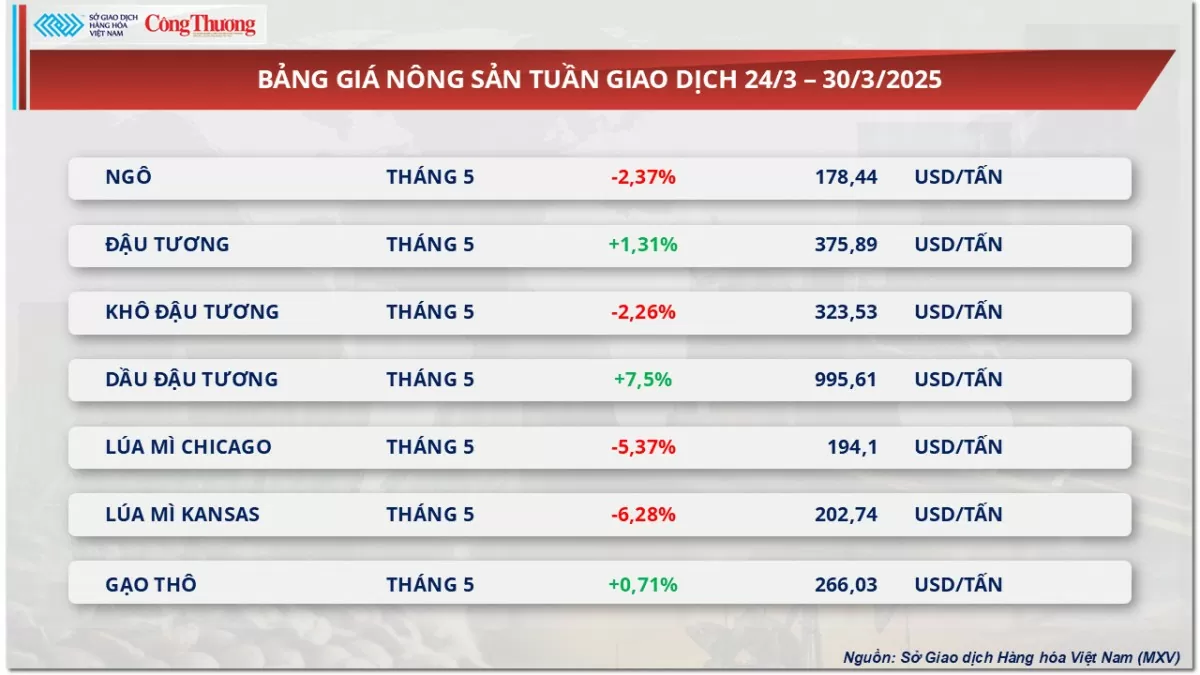

Agricultural product price list |

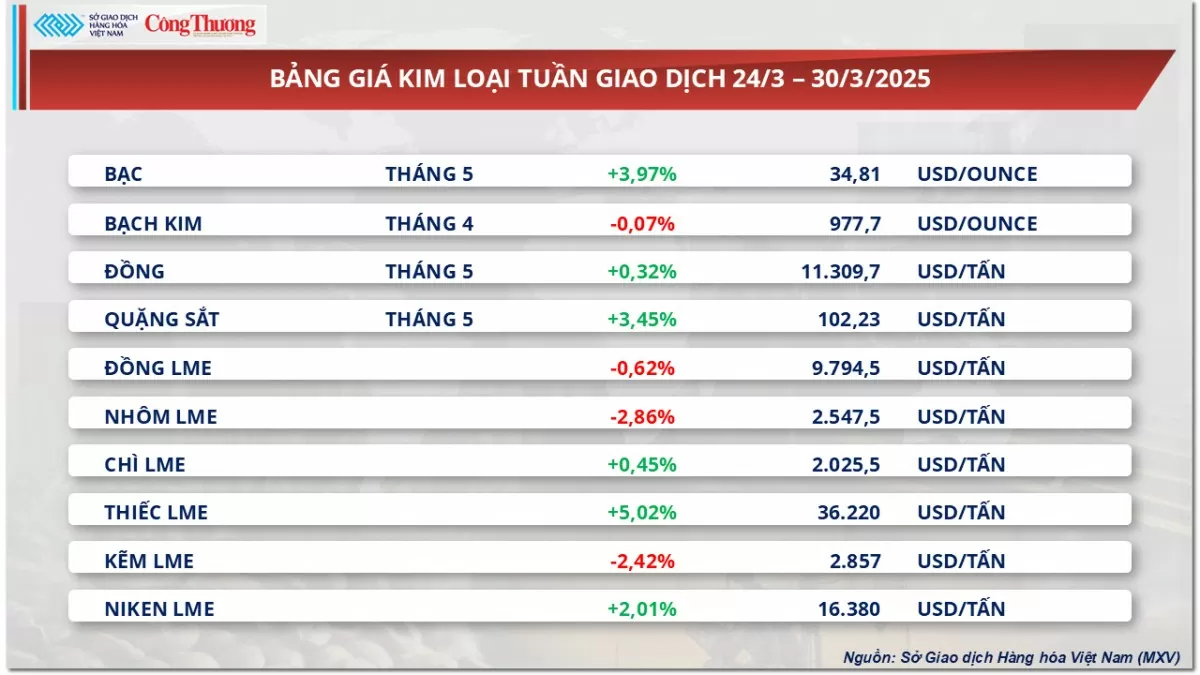

Metal price list |

Ngoc Ngan

Source: https://congthuong.vn/gia-ca-phe-robusta-giam-sau-ve-muc-5337-usdtan-380749.html

![[Photo] "Beauties" participate in the parade rehearsal at Bien Hoa airport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/11/155502af3384431e918de0e2e585d13a)

Comment (0)