Supply is running low

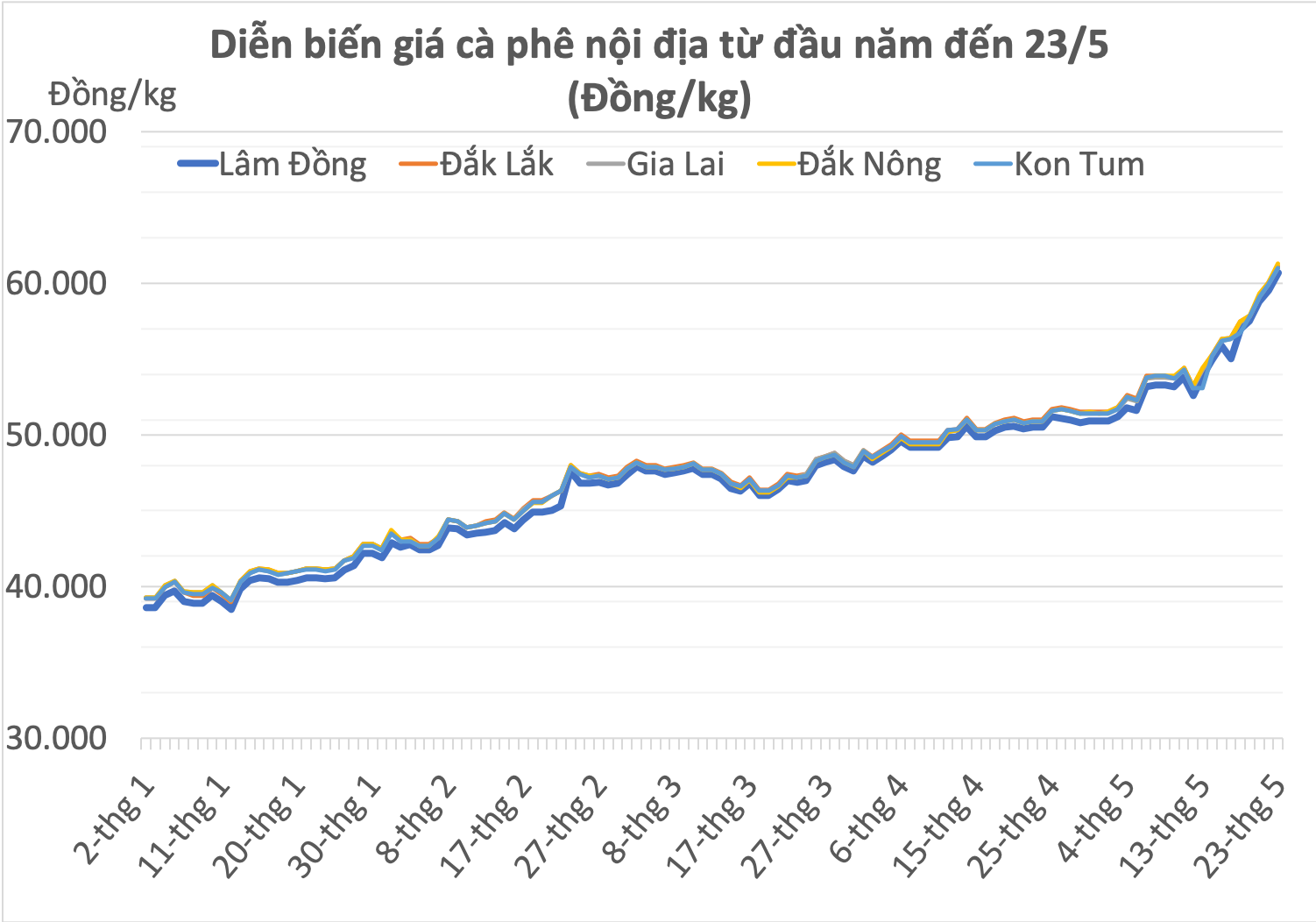

On the morning of May 23, the average price of robusta coffee in the provinces was trading at an unprecedented high of VND61,000/kg. However, by the afternoon, some localities reported prices had increased to VND64,000/kg. Thus, compared to the beginning of the year, the current coffee price has increased by about 40%.

H. My synthesis

“The coffee market has never fluctuated so strongly, even in August last year, when coffee prices first reached VND52,000/kg but collapsed very quickly afterwards. VND64,000/kg is a price that no coffee exporting enterprise could have imagined,” Mr. Thai Nhu Hiep, Chairman of the Board of Directors and Director of Vinh Hiep Company Limited - one of the largest coffee exporting enterprises in Vietnam, told the writer. Mr. Hiep is also Vice Chairman of the Vietnam Coffee and Cocoa Association (VICOFA).

According to him, the demand for robusta coffee beans is increasing because consumers around the world are having to “tighten their belts” due to the impact of inflation and economic recession. Meanwhile, drinking coffee every day is a habit that is difficult to give up but arabica beans are too expensive for them. Therefore, they look for cheaper robusta beans to mix with arabica beans to reduce costs.

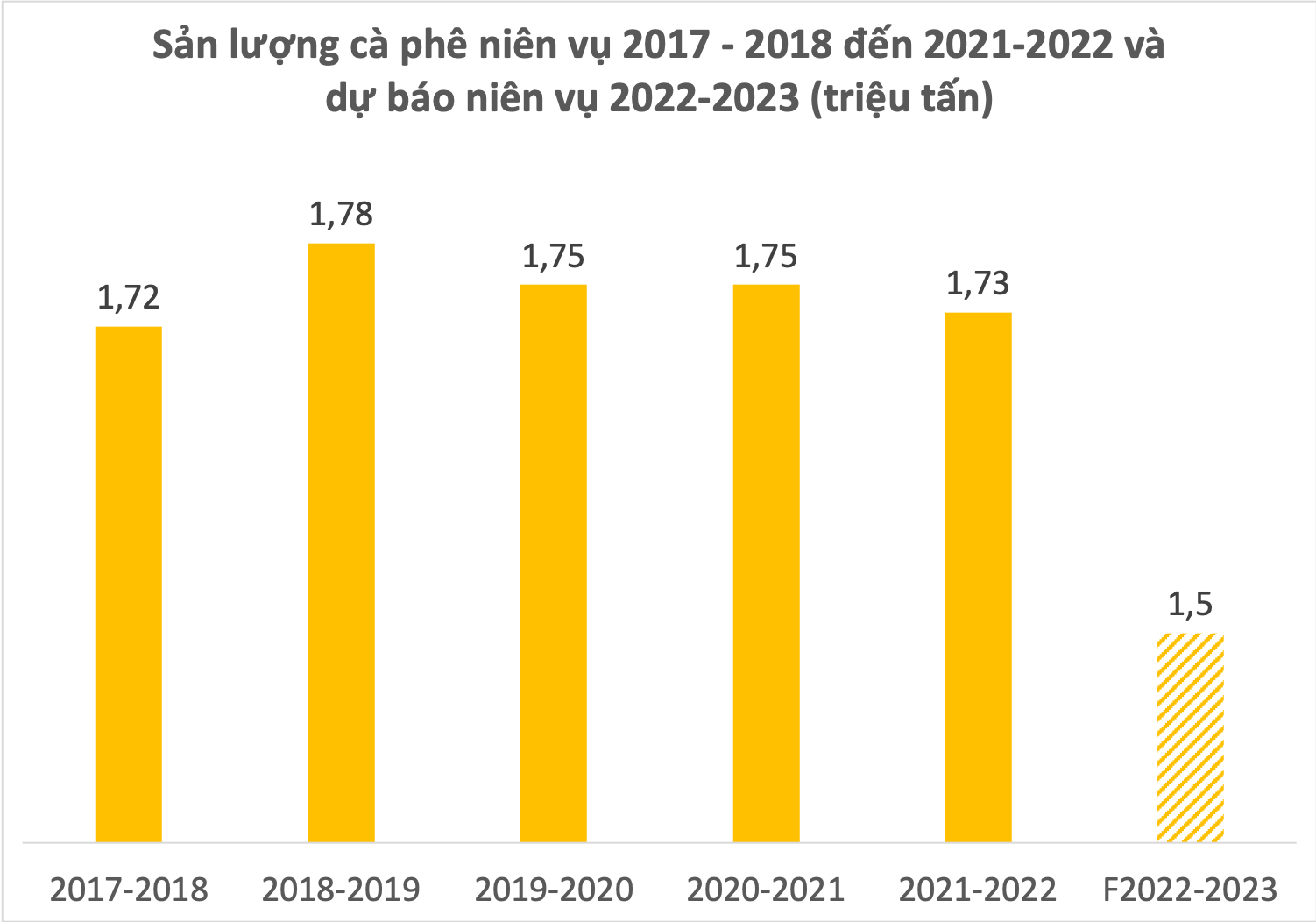

However, according to VICOFA data, Vietnam's robusta coffee output in the 2022-2023 crop year is estimated to decrease by 10-15% compared to the previous crop year to about 1.5 million tons due to the impact of unfavorable weather and the wave of crop shifting to fruit trees, especially durian, avocado and passion fruit.

There was a new crop in early October last year, but harvesting and drying were slow due to heavy, continuous rain during this period. The quality of the coffee beans may also be affected (many brown beans). The proportion of goods on the floor (floor 16,18) is estimated to be 60% or more.

Data: VICOFA (Compiled by H.M.)

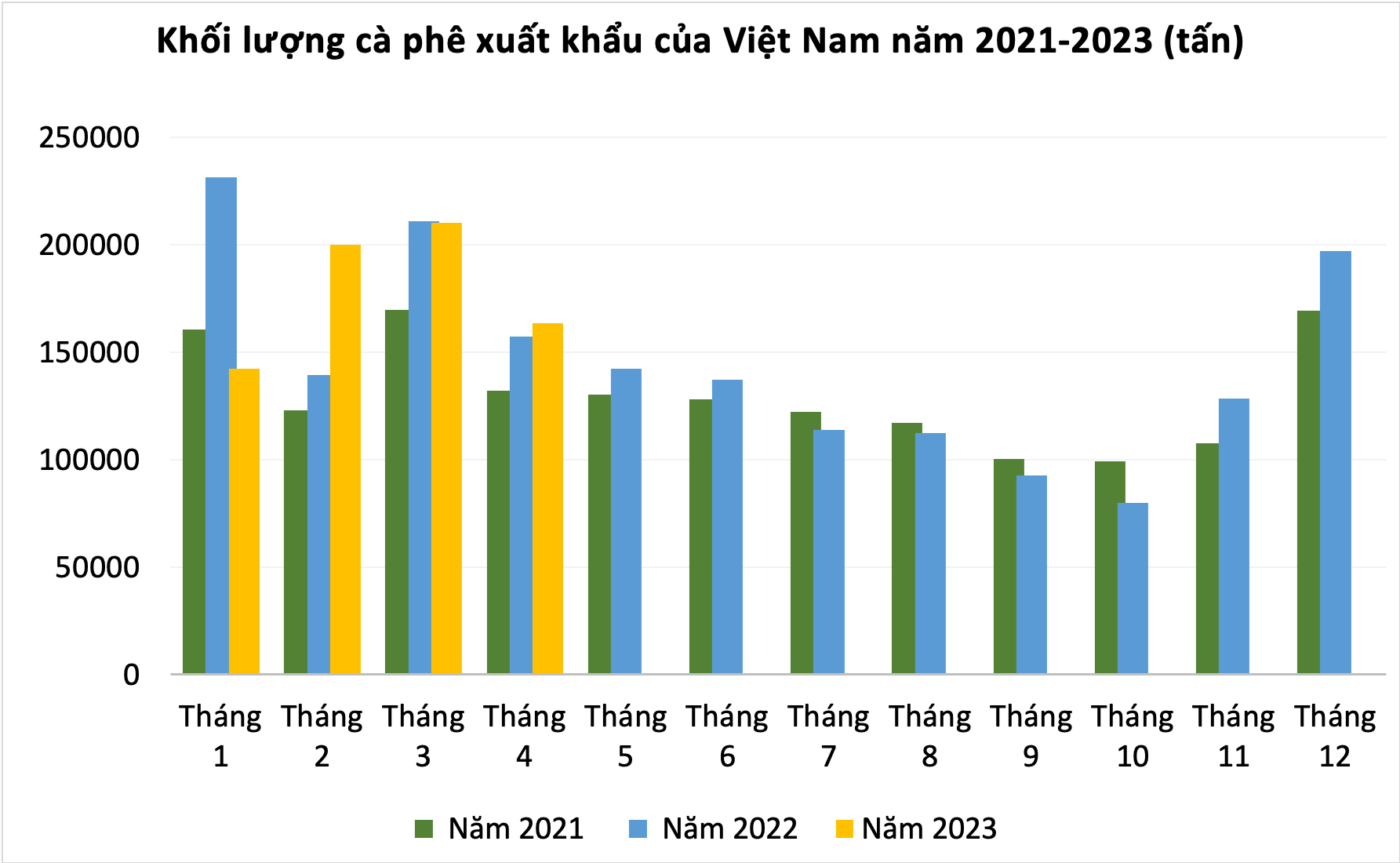

According to data from the General Department of Customs, in the first 7 months of the 2022-2023 crop year (from October 2022 to April 2023), Vietnam exported 1.12 million tons.

“Domestic consumption is about 250,000 tons. Therefore, the current inventory of people is about 100,000 tons. Adding 100,000 tons of inventory from the 2021-2022 crop year, the remaining quantity is only about 200,000 tons. Meanwhile, the world's average monthly import demand for Vietnamese robusta coffee is 100,000 tons, and we still have 5 months until the new crop year. Therefore, the supply shortage will continue in the coming time,” said Mr. Hiep.

Figures from the General Department of Customs also showed that coffee exports in April decreased by 22% compared to March to 163,000 tons.

According to Mr. Hiep, this is a sign of a shortage of supply: “Last year, the shortage did not occur until August, but this year, the goods were sold out as early as March. When the price reached its old peak of 52,000 VND/kg at the beginning of the year, people sold a lot of them.”

Data from the General Department of Customs (compiled by H.Mị)

Mr. Duong Khanh Toan, Director of International Business Development, Import and Export of Me Trang Coffee JSC, said that one of the factors pushing up coffee prices recently was due to the increase in input costs such as fertilizer, labor, gasoline, and electricity.

In addition, speculative factors also contribute to the scarcity of supply. When seeing negative weather conditions, large buyers will accumulate goods, pushing up purchase prices, reducing available supply for farmers.

"Small and medium roasters like us have only about 100 tons of reserves per month, which cannot compare to large buyers, especially FDI enterprises with purchasing power of up to tens of thousands of tons of reserves. They collect goods and then push up prices. Currently, goods are concentrated in FDI enterprises and intermediary agents, a few are among the people.

Households that still have coffee are waiting for prices to increase further before selling while demand for coffee is still high. This pushes prices up even further,” said Mr. Toan.

Big funds are focusing on buying robusta coffee

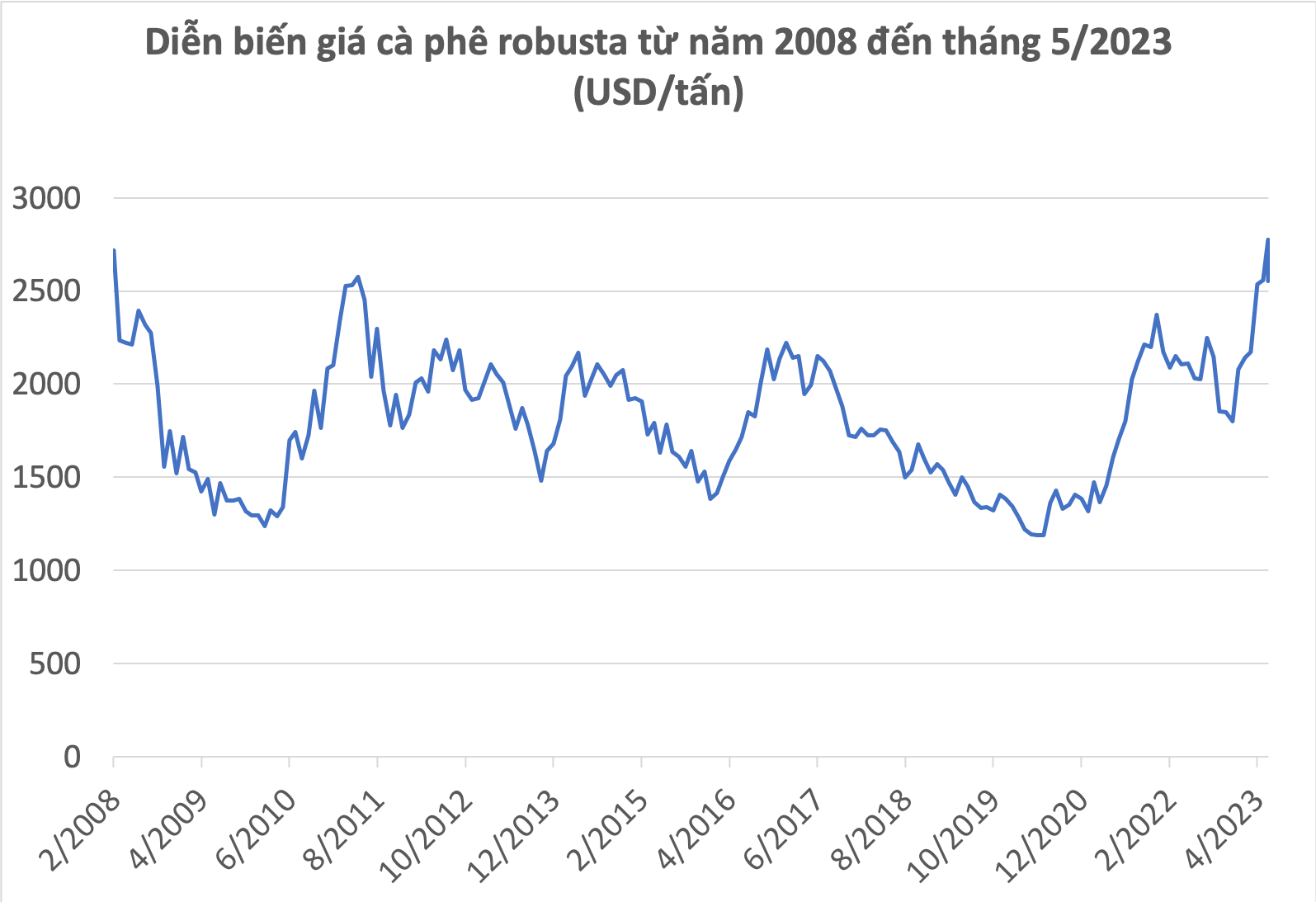

In the coffee derivatives market, robusta coffee prices are also at a 12-year high of $2,572 per ton, up 40% from the beginning of the year. Previously, on May 22, coffee prices reached $2,777 per ton, the highest level since 2008, but then adjusted down due to profit-taking pressure.

Data: Investing (US synthesis)

“Many traders realized that the current coffee price was unreasonable and they sold short. But funds around the world, with financial potential, were ready to buy goods right from the end of last year and the beginning of this year because they knew that the supply was seriously lacking. Investment funds were ready to squeeze other traders dry. They just waited for the short sellers to close their positions and the funds would “dump” the goods because there were still 5 months left until the end of the season while the global supply was no longer available,” said Mr. Hiep.

In contrast to robusta, the arabica market seems to be more subdued. Although prices are still rising, the increase is not as “sharp” as robusta beans. As of May 24, arabica coffee prices were trading at 189 US cents/pound, up 14% from the beginning of the year.

In a recently released report, the International Coffee Organization (ICO) said that the global coffee supply in the 2022-2023 crop year is about 171.3 million bags while consumption is at 178.5 million bags. With this forecast, the world coffee market could have a deficit of 7.3 million bags in the current crop year.

Domestic coffee prices will set a new level

Mr. Hiep commented that after this period of strong fluctuations, coffee prices could establish a new level of around 50,000 VND/kg after a long period of maintaining around 30,000 - 40,000 VND/kg due to oversupply.

Because, in the current context, the supply-demand balance has gradually shifted to a deficit as people switch to growing fruit trees, causing the coffee area to shrink. Meanwhile, input costs such as fertilizer, electricity and labor have all increased. Currently, the cost for 1 hectare of coffee with an output of 3 tons is about 100 million VND.

Illustration: H.My

"If the price remains around 40,000 VND/kg, the revenue of the people is 120 million VND/ha, profit 20 million. This amount divided by 12 months is not worth it. At the minimum price of 50,000 VND/kg, the people will earn 50 million VND, then they will return to coffee trees. Actually, 50,000 VND/kg is not too high when fully calculated in the production chain, because currently consumers are willing to spend 50,000 - 100,000 VND for a cup of coffee," said Mr. Hiep.

Source

Comment (0)