The game is in the hands of the big guys with money.

As reflected in the article ' Coffee price reaching a record of 64,000 VND/kg is something that no export enterprise can imagine' , since the beginning of the year, domestic and world robusta coffee prices have continuously set new records due to high demand while supply is gradually depleting.

However, in reality, not all coffee market participants are benefiting from this price increase.

Sharing with the writer, Mr. Thai Nhu Hiep, Chairman of the Board of Directors, Director of Vinh Hiep Company Limited, and Vice Chairman of the Vietnam Coffee - Cocoa Association (VICOFA), said that according to the practice, coffee exporting companies start buying stock from the end of last year and gradually sell it during the year.

However, in the 2022-2023 crop year (from October 1, 2022 to September 31, 2023), many domestic coffee exporting enterprises cannot purchase goods due to "capital shortage" when banks tighten credit and interest rates are too high.

Therefore, many domestic coffee exporting enterprises have to stay out, leaving the playing field to big companies with strong capital, especially FDI enterprises.

“FDI enterprises and funds started to buy goods from the end of last year, so the supply of goods from people ran out very quickly. Domestic export enterprises also knew that, but because of credit tightening, they did not have enough money to buy coffee. Normally, we start buying a large amount of goods from October of the previous year to February of the following year to sell sporadically during the crop. However, this year, the supply from households ran out very early,” said Mr. Hiep.

According to him, when the price reached its old peak of 52,000 VND/kg at the beginning of the year, people sold a lot. Therefore, currently, although the coffee price has reached 64,000 VND/kg, the remaining inventory is not much. The inventory of people in the 2022-2023 crop year is currently about 100,000 tons. Adding 100,000 tons of inventory from the 2021-2022 crop year, the remaining inventory is only about 200,000 tons.

“Many businesses with strong capital have been buying goods since the end of last year. When the price of coffee rose to around 52,000 VND/kg, people sold very strongly, buying as much as they sold. Now the price has been pushed up to 64,000 and I think the price can be pushed up to 70,000 VND/kg,” said Mr. Hiep.

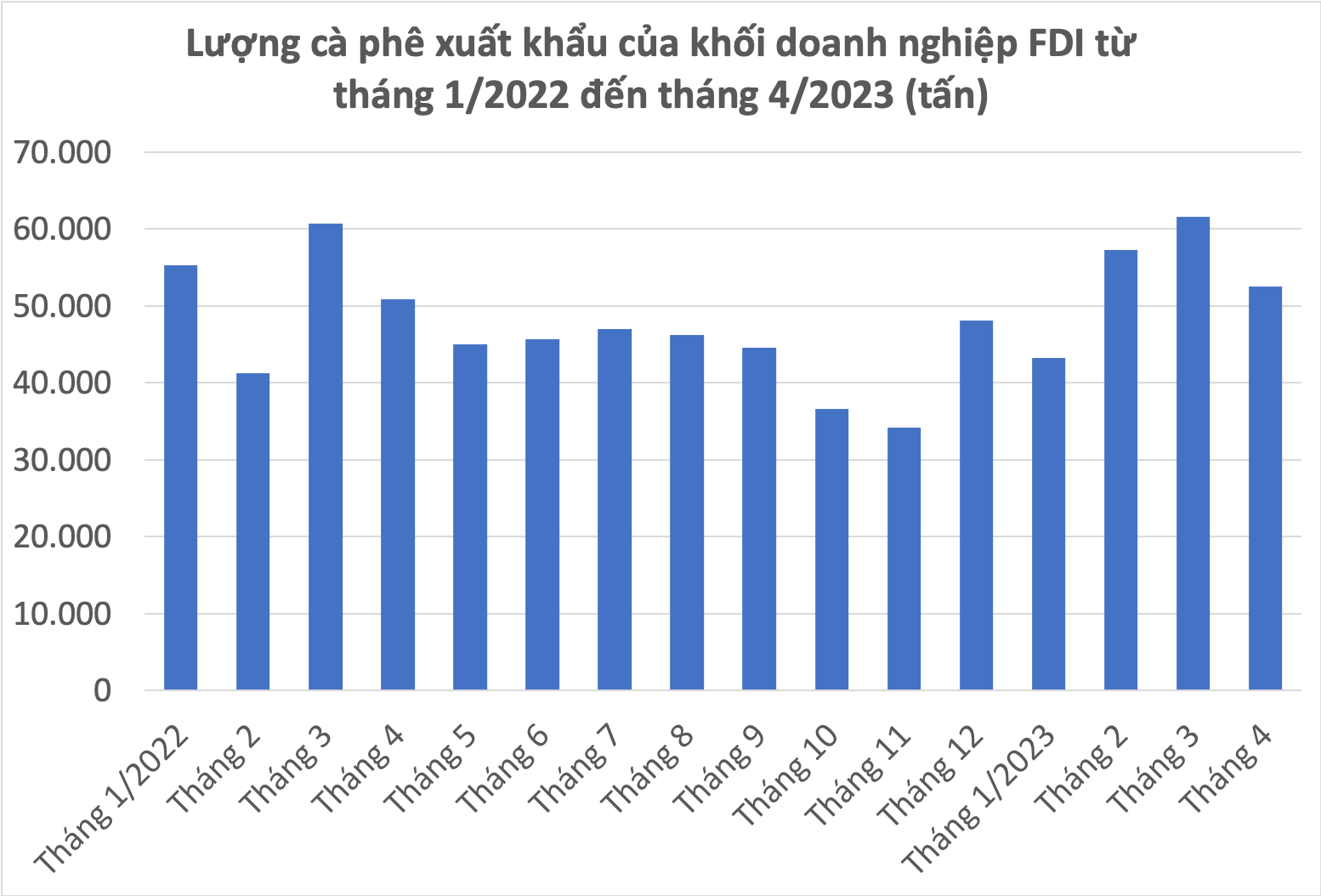

According to data from the General Department of Customs, the volume of coffee exports by FDI enterprises has continuously grown over the months of the 2022-2023 crop year, especially concentrated in February and March.

Data: General Department of Customs (compiled by H.M.)

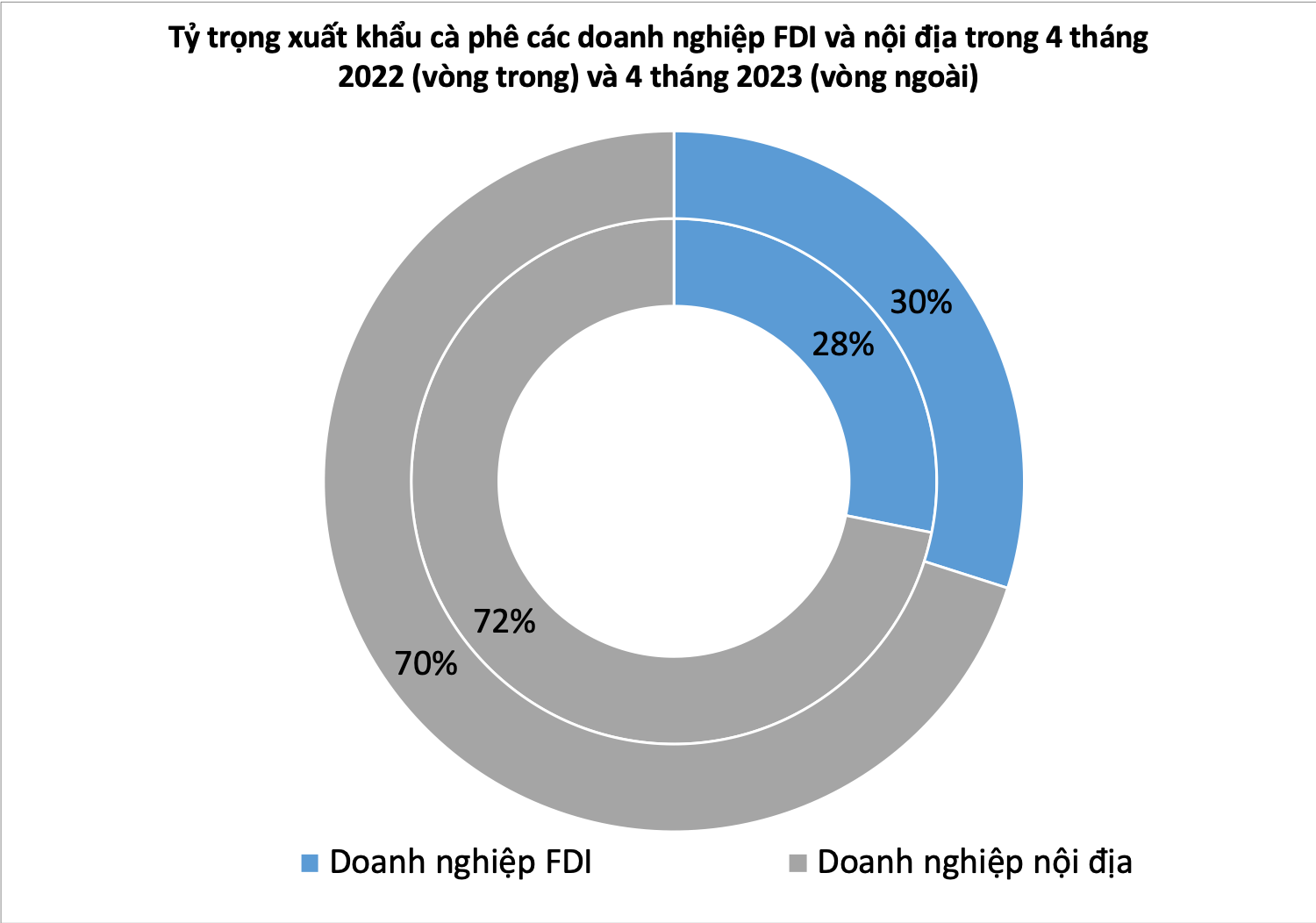

The proportion of coffee export volume of FDI enterprises in the first 4 months of this year also increased to 30%, up 2 percentage points over the same period last year.

Data: General Department of Customs (compiled by H.M.)

“The bulk of the goods are now in foreign companies and big companies with strong capital. Buying coffee at this time is harder than buying gold. Everyone buys at their own price, selling at the same price. The current price is too unreasonable, no longer reflecting the real value,” said Mr. Hiep.

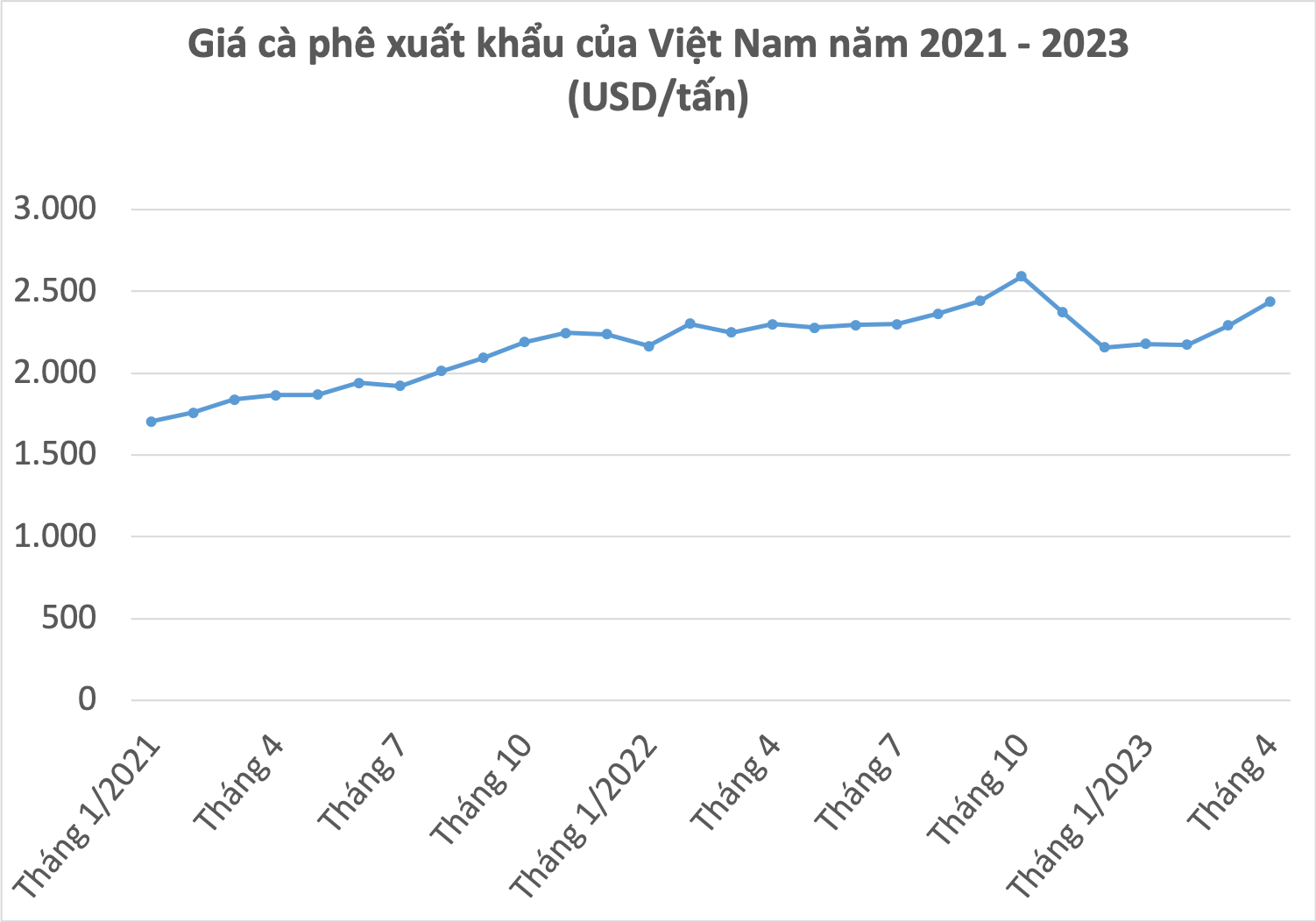

Although domestic prices increased sharply, export coffee prices did not increase proportionally.

Accordingly, since the beginning of the year, domestic coffee prices have increased by about 40%, however, export prices as of April reached 2,437 USD/ton, up 12% compared to January.

Data: General Department of Customs (compiled by H.M.)

This makes many people worry that the scenario of export businesses having to buy at high prices but sell at low prices like last year will repeat itself.

However, some businesses said the landscape this year is different from last year.

Accordingly, last year, many businesses signed long-term contracts, and by the time of delivery around the third quarter of 2022, coffee prices fluctuated sharply because there was not much inventory left in households. Therefore, businesses were forced to buy at high prices, peaking in August 2022 when it first reached 52,000 VND/kg, to have goods to deliver to partners to avoid contract penalties.

This year, businesses have had difficulty purchasing goods since the beginning of the season, so signing long-term contracts is also limited.

"Currently, there is no buying high and selling low because businesses do not have money and do not dare to import goods to sell," said Mr. Hiep.

How do listed coffee businesses do business?

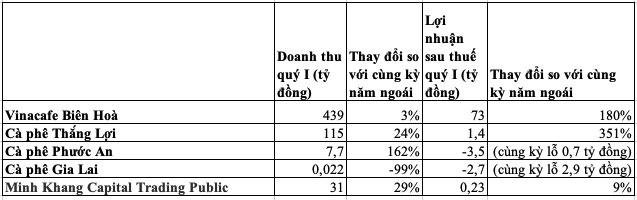

By the end of April 2023, businesses trading and listed on the stock exchange have announced their revenue results for the first quarter of 2023. Some businesses recorded unsatisfactory business results.

Typically, Phuoc An Coffee JSC (Code: CPA) recorded a 162% increase in net revenue in the first quarter of 2023 to VND 7.7 billion. Operating below cost price caused the company to record a negative gross profit of VND 450 million, while in the same period it made a profit of VND 745 million. After deducting expenses, the company lost VND 3.5 billion after tax, in the same period it lost VND 670 million. By the end of the first quarter, the company had an accumulated loss of more than VND 166 billion. This loss has eroded the company's equity to VND 70 billion.

According to the company's explanation, revenue in the first quarter increased sharply compared to the same period last year, but the cost of goods sold increased by 73%, leading to a 265% decrease in gross profit from sales. In addition, financial expenses and business management expenses in the quarter increased sharply by 43% and 64%, respectively. Therefore, the company recorded a loss in the first quarter.

As of March 31, the company's total assets decreased by 6% compared to the beginning of the year to VND129 billion, mainly due to inventory remaining at VND19 billion. The amount of cash held by Phuoc An Coffee was less than VND500 million compared to VND8.5 billion at the beginning of the year. Meanwhile, the company is borrowing VND46 billion, accounting for 78% of total liabilities.

In the case of Gia Lai Coffee JSC (Code: FGL), revenue in the first quarter only reached 22 million VND compared to 4.3 billion VND in the same period, down more than 99%. According to the explanation, revenue comes entirely from business cooperation, not from coffee trading. After deducting expenses, the company lost 2.7 billion VND after tax. By the end of March, this enterprise had accumulated losses of more than 77 billion VND, leaving less than 70 billion VND in equity.

Meanwhile, some other companies with larger assets and cash recorded strong business growth.

Accordingly, in the first quarter of 2023, Vinacafe Bien Hoa's net revenue (Code: VCF) reached VND 439 billion, an increase of 3% over the same period last year.

The company said that its revenue from financial activities increased by 118% to 13.5 billion due to optimizing cash flow and no longer generating provisions for subsidiaries (83 billion). As a result, the company's profit after tax was 73 billion VND, 2.8 times higher than in the first quarter of 2022.

At the end of the first quarter of 2023, Vinacafe Bien Hoa's total assets stood at VND2,083 billion, almost unchanged from the beginning of the year. Cash, cash equivalents and bank deposits stood at VND320 billion. In the first three months of the year, the company received more than VND16 billion in interest from bank deposits.

Or in the case of Thang Loi Coffee JSC (Code: CFV), the first quarter recorded a 24% increase in revenue compared to the same period to VND115 billion, mainly due to increased export output and increased selling prices. The company's gross profit was VND5 billion. Thanks to cost reductions, the company's after-tax profit was nearly VND1.4 billion, an increase of 351% compared to the same period.

Business results of some coffee exporting enterprises in the first quarter of 2023 (compiled by H.My)

When will coffee prices adjust?

That is the question that market participants are asking right now. Talking to us, Mr. Duong Khanh Toan, Director of International Business Development, Import and Export of Me Trang Coffee JSC, said that currently the goods are in the warehouses of the big guys and they will definitely have to change the crop.

Mr. Duong Khanh Toan, Director of International Business Development, Import and Export of Me Trang Coffee JSC (Photo: H.My)

Prices will continue to rise until the forecast of the new crop (starting in October 2023) begins. At that time, market participants will monitor the output of major producing countries such as Brazil, Vietnam, Ethiopia, etc. Vietnam's coffee output itself is currently affected by weather factors.

“Robusta beans can be kept in storage longer than arabica, but traders and businesses will definitely have to switch crops and sell their inventory to buy new coffee crops because storage capacity is limited. At that time, coffee prices will have to decrease due to profit-taking pressure. For now, we need to consider how high prices will go,” said Mr. Toan.

The International Coffee Organization (ICO) recently forecast global coffee production in the 2022-2023 crop year at around 171.3 million bags while consumption is at 178.5 million bags, which could lead to a market deficit of 7.3 million bags in the current crop year. Of which, robusta production is expected to decrease by 2.1% to 72.7 million bags.

Not only Vietnam, coffee output of Indonesia - one of the other leading robusta coffee producing countries is forecasted to be 20%-30% lower than last year.

ICO data shows that global coffee exports in the first 6 months of the 2022-2023 crop year (October 20, 2022 to March 20, 2023) decreased by 6.4%, equivalent to 4.2 million bags compared to the same period last year to 62.3 million bags.

Source

Comment (0)