Stocks on November 2 accelerate in the Asian and European markets

Last night, the US Federal Reserve (FED) announced that it would continue to keep USD interest rates unchanged. This information made the global stock market flourish.

Asian markets rose sharply, led by South Korea, as investors cheered the Fed's decision and digested inflation and trade data from across the region.

The Fed on Wednesday again held interest rates steady amid signs of economic growth, while labor market conditions and inflation remained above the central bank’s target. The decision also included an upgrade of the Fed’s overall assessment of the economy.

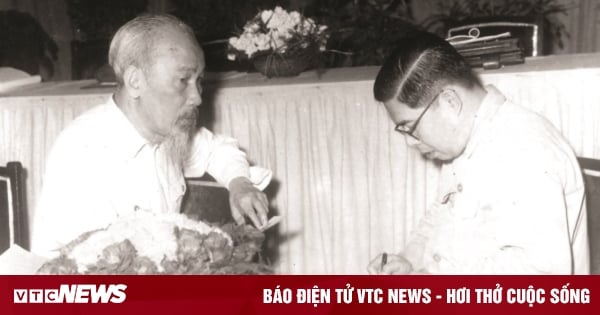

The stock market on November 2 was "hot" after the FED announced not to increase the USD interest rate. However, the VN-Index still showed its outstanding strength. Illustrative photo

Data from South Korea showed consumer prices accelerated for a third straight month in October, with the CPI rising 3.8% from a year earlier. Economists polled by Reuters had expected a 3.6% increase.

Australia's goods trade surplus narrowed to a 32-month low in September, official data showed.

Japan's Nikkei 225 rose 1.1% to end at 31,949.89, extending gains from Wednesday. The Topix rose 0.51% to 2,322.39, hitting a fresh three-week high and snapping a three-day winning streak.

South Korea's Kospi rose 1.81%, leading gains in Asia to close at 2,343.12 while the Kosdaq rose 4.55%, marking its biggest one-day gain since June 24, 2022.

Hong Kong's Hang Seng Index rose 0.78% in its final hour of trading, while China's CSI 300 closed down 0.47% at 3,554.19, the only major benchmark in negative territory.

Taiwan's Taiex rose 2.23% to 16,396.85, posting its best one-day percentage gain in more than nine months.

In Australia, the S&P/ASX 200 index rose 0.9% to close at 6,899.7, approaching its highest level in nearly two weeks.

European markets opened higher on Thursday as investors reacted positively to the US Federal Reserve's decision to keep interest rates steady.

The Stoxx 600 rose 1.3% in morning trade, with all sectors in positive territory. Technology stocks led the gains, rising 2.4%, while mining stocks rose 2%.

The Bank of England will announce its latest monetary policy decision on Thursday. The central bank is widely expected to follow the European Central Bank and the Federal Reserve in keeping interest rates unchanged this month.

Corporate earnings also remain a key driver of stock prices in Europe, with Novo Nordisk and Shell.

VN-Index increases strongly, liquidity remains weak

VN-Index opened with an increase from the beginning of the session with green spreading across most industry groups. After more than 1 hour of trading, active buying liquidity reached 85% of the total liquidity of the market, helping the general index regain its balance at the 1050 area. According to VCBS Securities Company, securities and chemical stocks were the two industry groups that attracted the best cash flow with an increase of approximately 2.7%. The afternoon session continued to record positivity when active buying liquidity was well maintained, helping the general index maintain its green color.

In contrast to domestic cash flow, foreign investors net sold with liquidity of 156 billion, focusing on selling MWG, VHM, HDB.

At the end of the stock market session on November 2, VN Index increased by 35.81 points, equivalent to 3.44% to 1,075.47 points; VN30-Index increased by 35.85 points, equivalent to 3.41% to 1,087.50 points.

One of the notable points of the stock market on November 2 is that although the index increased sharply, liquidity improved very slowly and at a low level. The entire Ho Chi Minh City Stock Exchange only had 772 million shares, equivalent to 14,637 billion VND, successfully traded. The VN30 group had 212 million shares, equivalent to 5,818 billion VND transferred.

The entire Ho Chi Minh City Stock Exchange had 512 stocks increasing in price (82 stocks hitting the ceiling), 26 stocks remaining unchanged and only 32 stocks decreasing in price. The VN30 group recorded all stocks increasing, including 2 stocks hitting the ceiling. The 2 blue-chips that closed the stock market session on November 2 in purple were GVR and SAB. GVR increased by 1,200 VND/share to 18,500 VND/share, SAB increased by 4,000 VND/share to 61,400 VND/share.

On the Hanoi Stock Exchange, the indices also rose strongly. At the close of the stock market session on November 2, the HNX-Index increased by 8.32 points, equivalent to 3.97%, to 217.97 points; the HNX30-Index increased by 27.60 points, equivalent to 6.58%, to 447.09 points.

Source

![[Photo] 2nd Conference of the Party Executive Committee of Central Party Agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8f85b88962b34701ac511682b09b1e0d)

![[Photo] Speeding up construction of Ring Road 3 and Bien Hoa-Vung Tau Expressway](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/f1431fbe7d604caba041f84a718ccef7)

![[Photo] Prime Minister Pham Minh Chinh receives delegation of leaders of US universities](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/8be7f6be90624512b385fd1690124eaa)

![[Photo] General Secretary To Lam receives US Ambassador to Vietnam Marc E. Knapper](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/31/5ee45ded5fd548a685618a0b67c42970)

![[REVIEW OCOP] An Lanh Huong Vet Yen Cat](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/c25032328e9a47be9991d5be7c0cad8c)

Comment (0)